China Fashion and Lifestyle Investment NewsяМFashion resale e-commerce, Textile B2B platform, Island Travel Services, Smart Homewear, and self-serve retail services

September 6,2018

Luxe.Co has launched тLuxe.Co China Investment Weeklyт since 2016, reporting weekly updates on investment and financing in the China fashion and lifestyle industries. The updates cover fashion, beauty care, food and dining, sports and fitness, hotel and travel, household products, culture and creativity, fashion technology and other related fields.

Fashion e-commerce

- Fashion resale e-commerce platform PLUM raised tens of millions of US dollars in Series B funding

Fashion resale e-commerce platform Plum announced on August 27th that they raised tens of millions of US dollars in Series B funding. Matrix Partners was the lead investor. Previous shareholders including Qiming Capital, IDG Capital, Unity Ventures and K2VC also participated in the investment. Previously, Plum raised Series A funding in September 2017. The new funding will be mainly used on product category expansion, store opening and supply chain optimization. Providing fashion resale services, Plum went online in February 2017 with the business model of C2B2C. The platform charges service commission as income. Currently, platform users with both buyer and seller identities reached 40% with monthly GMV over 10 million yuan.

- Textile B2B platform Baibu (чОхИ) raised 30 million US dollars in Series C1 funding

Textile B2B platform Baibu announced on August 29th that they raised 30 million US dollars in Series C1 funding. The lead investor was Bull Capital Partners. Yunqi Capital, Chengwei Capital and Source Code Capital also participated in the investment. Previously, Baibu raised 165 million yuan in Series B+ funding in August 2017. The new funding will be mainly used to improve supply chain system and expand business scale. Founded in April 2014, Baibu has two APP including Baibu Yimai Easy Buy for buyers and Baibu Easy Sell for suppliers. Currently, Baibu has built in-dept cooperation with more than 1000 first-tiered suppliers. Also, Baibu built fabric information database with millions of SKUs covering most of the fabric in the China market.

Sports & Fitness

- Home smart fitness service provider Kuaigan (хПЋц) received strategic investment

Home smart fitness service provider Kuaigan announced on August 30th that they received strategic investment from Roots Capital and blockchain investment institutions including ACapital, Biwei and AChain. The detailed amount was not disclosed. Kuaiganтs main products include Kuaigan cycling machines with smart upgrades developed by Kuaigan. The cycling machines can be placed in home and offices. Kuaigan applies professional classes, music and visual images to help users obtain the experience of spinning gym. Classes feature a variety of themes including fat burning and body sculpturing with daily updates. The cycling machines are also equipped with internal sensors, monitoring fitness data and reflecting energy consumption.

Hotel & Travel

- Island travel service provider Hainiaowo (цЕЗщИчЊ) raised tens of millions of yuan in Series A+ funding

Island travel service provider Hainiaowo announced on August 31st that they raised tens of millions of yuan from Ant Financial in Series A+ funding. Previously Hainiaowo raised 15 million yuan in Series A funding in January 2017 with Yihua Capital as the lead investor. The new funding will be mainly used to expand leasing categories and service outlets and models. Established in early 2010, Hainiaowo offers more than 200 SKUs, featuring travel equipment leasing and related product sales, such as diving equipment, underwater cameras, travel planning and diving services.

Household Products

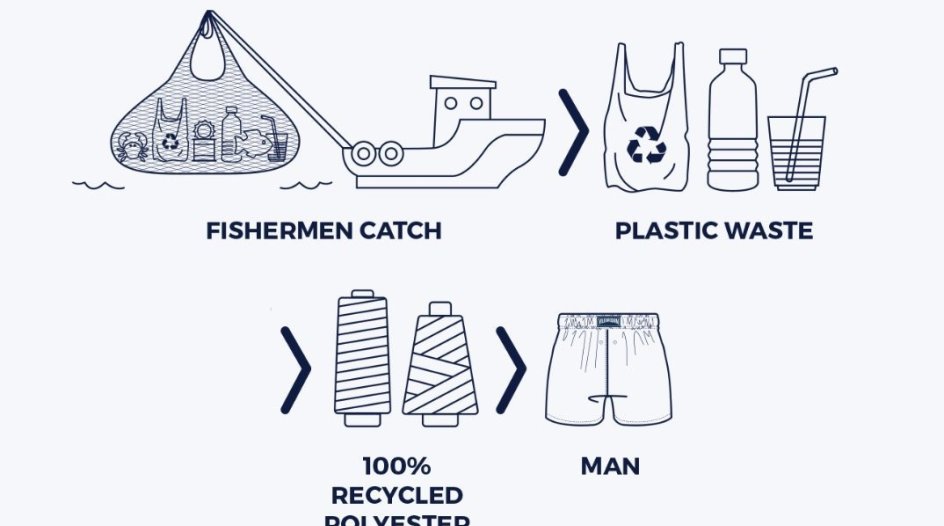

- Smart homewear R&D provider Homi Technology raised hundreds of millions of yuan in Series A+ funding

Smart homewear R&D provider Homi Technology announced on August 30th that they raised hundreds of millions of yuan strategic investment in Series A+ funding. Lead investors include Shenzhen Hongjinwen and Detao Capital. Previously, Homi raised 21 million yuan in Series A funding in January 2017. Lead investors include LB and Zehou Capital. Established in 2015, Homi targets business-ends at its early stage. In 2016, Homi launched ROOME targeting customer-ends with smart family lighting products in bedroom and living room scenarios. Currently Homi offers 5 collections and 12 SKUs featuring smart algorithm based on home scenarios and habits.

Others

- Self-serve retail service company Bianli 24 (фОПхЉ24) raised tens of millions of US dollars in Series A funding

Self-serve retail service company Bianli 24 announced on August 27th that they raised tens of millions of US dollars in Series A funding. Sky Chee Amiba Venture Capital was the lead investor. Previously Bianli 24 raised nearly ten million US dollars in Series Pre-A funding led by Sequoia Capital in February 2018. Established in 2017, Bianli 24 started in smart convenient stores, and then entered the field of smart vending machines. Currently Bianli 24 has set up over 2000 outlets in 23 cities.

The above information is based on the company announcement and/or online news. Luxe.Co makes reasonable efforts to obtain reliable content from third parties. Luxe.Co does not guarantee the accuracy of or endorse the views or opinions given by any third-party content provider.

| Chinese reporter: Jiaqi Wang

Marketing and Business Cooperation, please email to contact@hualizhi.com

Comments