Luxe.Co China Investment Weekly 2017/08/12~08/18

August 22,2017

Luxe.Co launched тLuxe.Co China Investment Weeklyт in 2016, reporting weekly updates on investment and financing in the China fashion and lifestyle industries. The updates cover fashion, beauty care, food and beverage, sports and fitness, hotel and travel, household products, culture and creativity, and other related fields.

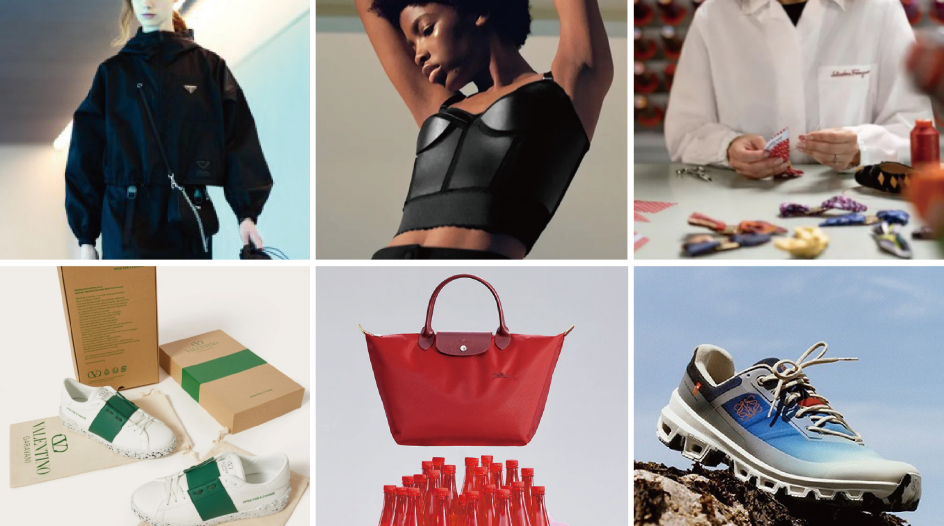

Fashion Brands

- Т Fast Fashion Company UR (Urban Revivo) Obtained a Strategic Investment of 100 Million Yuan from Heilan Home

Heilan Home signed an agreement with UR on August 14th to apply their own fund to raise capital for UR. The first investment arrangement is no more than 10% of URтs shares. According to the agreement, UR will receive an investment prepayment of 100 million yuan from Heilan. URтs main business is the fast fashion brand Urban Revivo, covering womenswear, menswear, kidswear and accessories. UR positions itself as a fast fashion brand in the market and its target customers are urban office ladies from 20 to 40 years old. UR has more than 160 outlets in China and overseas currently, with an annual turnover of around 2 billion yuan in 2016.

Fashion Online Platform

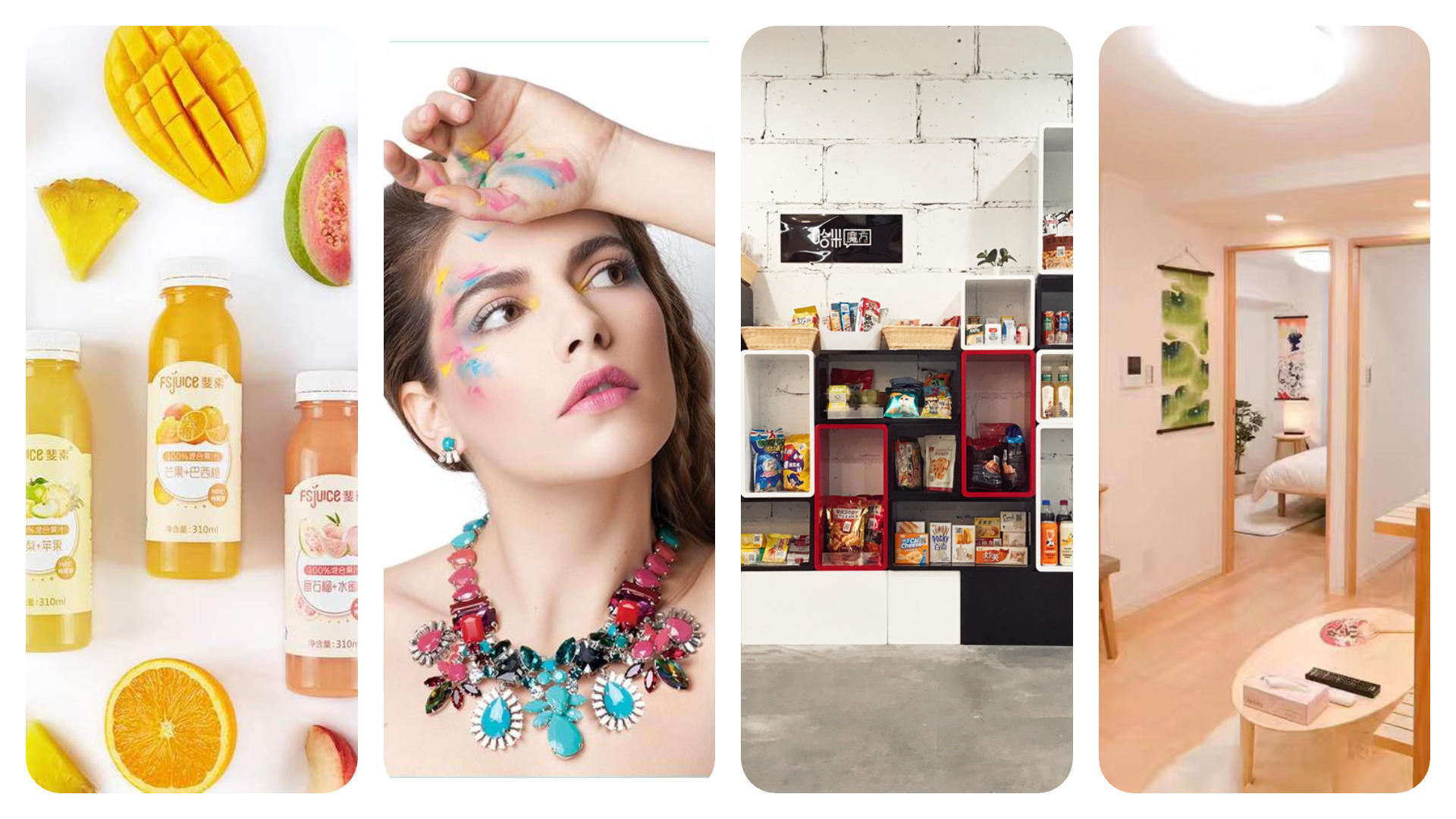

- Fashion Accessories Online Platform AZLOOK (Aizhi in Chinese) Obtained 22 Million Yuan Angel Investment

Fashion accessories online platform AZLOOK announced on August 18th that they obtained 22 million yuan angel investment. Investors were Shenzhen Capital Group, Guangzhou U-Sys Consulting and Information Technology, Beijing Tiangong Innovation Investment Center and Puxin Capital. The online platform features "experiential consumption". With aТ fixed amount service fee, usersТ have unlimited access to accessories within a certain price range in one to two years. AZLOOK is the agent for more than ten international accessory brands, including Philippe Ferrandis, Michael Michaud, Gas Bijoux and Reminiscence, in which they are exclusive agents for six of them in China.

Food and Beverage

- Not-From-Concentrate (NFC) Juice Brand FSJuice Obtained Millions of USD Series A Investment

NFC Juice brand FSJuice announced on August 14th that they obtained millions of US dollar Series A investment from Chengwei Capital. The investment will be mainly used on product line expansion and geographical expansion. FSJuice positions itself as a high-end fruit and vegetable juice brand, featuring a mixture of at least three types of fruits in every bottle. They have two product lines currently. One highlights diet and detoxification, with cold pressing technology and 3-day shelf life. It prices at 28 yuan per bottle. The other highlights daily nutrition supplement, with NFC technology and a price of 17.8 yuan per bottle. The third product line is still under development and will manage the price range per bottle to 10 yuan and less. FSJuice isТ sold at more than two thousand convenient stores and supermarket outlets, and through online platforms including Tmall, JD, Xiaohongshu, Global Scanner and Hema Fresh.

- Internet-Popular Food Brand Songge Braised Prawns Obtained Nearly 100 Million Yuan Series A Investment

Internet-popular Shenzhen crayfish brand, Songge Braised Prawns, announced on August 15th that they obtained nearly 100 million yuan Series A investment. The investment arrangement is led by Tiantu Capital, and followed by Zhizhuo Capital. The investment amount will be mainly used on geographic and store expansion. Songge expects 50 additional stores this year. Songge Braised Prawns was established in November 2015, focusing on oil-braised prawns and crayfish with both dine-in and takeaway business models. At present, Songqe has 16 stores in southern China with a monthly turnover of over 30 million yuan.Т Т

- Crayfish Chain Brand Duoluo Prawns Obtained Series A Investment from Tiantu Capital

Crayfish chain brand Duoluo Prawns announced on August 18th that they obtained Series A investment from Tiantu Capital. The detailed amount was not disclosed. Duoluo Prawns obtained 10 million yuan Series Pre-A investment in October 2016. Duoluo Prawns was established in 2015 with 300 direct-managed stores (with 10-30 square meters each) in seven cities including Beijing, Shanghai, Chengdu and Shenzhen. In addition, Duoluo Prawns supplies to more than 5,000 restaurants. They have crayfish breeding farms in two areas, Tai Lake and Dongting Lake, with a size of 150,000 Mu and an annual production of 2.5 million kilograms. Duoluo Prawnsт monthly turnover has reached 15 million yuan, and they have been profitable since 2016.

- Fine-Brewed Beer Comment APP Jiuhua Obtained Tens of Millions of Yuan Series A Investment

Jiuhua APP is similar to "Public Comment (Dianping in Chinese)", but features fine-brewed beer only. They announced on August 18th that they obtained tens of millions of yuan Series A investment. The investment arrangement was led by Sinovation Ventures, and followed by Kymco Capital, Tisiwi and Xiangcai Securities. Jiuhua obtained 15 million yuan Series Pre-A investment from Tisiwi in November 2016. The new investment will be mainly used on supply chain development, winery expansion, production capacity improvement and building fine-brewed beer shops. Jiuhua APP went live online officially in April 2016. The APP has three major functions, users to comment on fine-brewed beer, to search beer through bar-code, and to post information of searching or purchasing beer through an online forum / community.

- Office Self-Serve Snack Shelf Provider Hami Technology Obtained Tens of Millions of Yuan Investment

Hami Technology, a main office snack shelf provider, announced on August 17th that they obtained tens of millions of yuan Investment. Investors were Yunqi capital, Yuanjing Capital, Zhen Fund and Dianliang Fund. Hami was established in October 2016. They apply cube shelves providing snacks, beverages and meal supplements to companies. The quantities and colors of the combined shelves can be adjusted according to different office environment. Hami offers more than one thousand snack SKUs, of which 20% account to mass products (i.e., Master Kong or Coke), and the remaining 80% account to new products. Hami has settled in nearly one thousand companies in Beijing at present. From April till now, Hami has a cumulative transaction of 600,000 people and expects to exceed a daily transaction amount of 500,000 yuan this year.

Hotel and Travel

- Overseas Travel Platform RRUU.COM Obtained 35 Million Yuan Series A+ Investment

Overseas travel service provider RRUU.COM announced on August 17th that they obtained 35 million yuan Series A + investment. The investment arrangement was led by an investment fund under an A-share listed company, and followed by earlier investors Lenovo Venture Capital and Initial Capital.Т RRUU.COM obtained 15 million yuan Series A investment in June 2016. The new investment will be mainly used on integrating more suppliers and enhancing customer experience. RRUU.com was established in 2014.Т With the travel platform, users can schedule and purchase many products, including local entertainment, transportation, car rental, travel tickets, gourmet dining and so on. RRUU.com covers Australia, New Zealand, North America, Europe and Asia Pacific with cooperation from 10,000 destination suppliers.

- Bed and Breakfast (B&B) Platform Yiminsu (Easy B&B in English) Obtained 20 Million Yuan Series Pre-A Investment

TargetingТ international market, the B&B management platform Yiminsu (Easy B&B in English) announced on August 14th that they obtained 20 million yuan Series Pre-A investment. The investor was Haibei Investment, and the investment amount will be mainly used on the development of house sourcing. Yiminsu was established in February 2017, providing services to landlords from interior design and decoration, to distribution channels, operations and customer services. Yiminsu has consolidated more than 200 houses online from 8Т international cities including Tokyo, Bali, Phuket, Ho Chi Minh and so on.

Household Products

- Furniture Rental Platform Jujiajia Obtained Millions of Yuan Angel Investment

Furniture rental platform Jujiajia announced on August 15th that they obtained millions of yuan angel investment. The investors were not disclosed. The investment will be mainly used on supply chain construction, technology structure and team expansion. Jujiajia was established in 2017, providing furniture leasing solutions to customer ends (including landlords and tenants). The platform is inТ itsТ final stage of research and development currently. It is expected to be live online officially within half a month, available for both mobile device and desktop users. Jujiajia plans toТ make single-piece rentals as their main business. MonthlyТ rental will be under 100 yuan, with a minimum of 12 months rental period and aТ security deposit.

Others

- Baby Food Supplement Platform Mengzhu Obtained Millions of Yuan Angel Investment

Baby food supplement platform Mengzhu announced on August 15th that they obtained millions of yuan angel investment led by Haofang Venture Capital. Mengzhu was brought online in April 2016. The platform content consists of three parts, professionally generated content (PGC) by nutritionists, PGC by the platform and user generated content (UGC). In additional to third-party brand products, Mengzhu also launched joint brand products and their own brand products. They have 1.5 million users on APPТ and Wechat.

Note: The above information is based on the company announcement and/or online news. Luxe.Co makes reasonable efforts to obtain reliable content from third parties. Luxe.Co does not guarantee the accuracy of or endorse the views or opinions given by any third-party content provider.

яНChinese reporter: Wang Jiaqi

Comments