Swiss Sports Brand On: From Zero to USD 4 Billion in a Decade with Federer and Hillhouse as Shareholders

August 24,2021

Swiss sports brand On, which has a close relationship with tennis superstar Roger Federer, filed an application for an IPO with the US Securities and Exchange Commission on August 23. Its Class A ordinary shares are expected to be listed on the NYSE under the symbol тONONт in September.

According to a report of Reuters in April of this year, Onтs valuation already approached USD 2 billion in the last round of financing before the IPO. The IPO might be valued up to USD 4т6 billion.

Many people know of On because of tennis superstar Roger Federer, who joined this low-key Swiss brand as an investor and co-entrepreneur in July 2019.

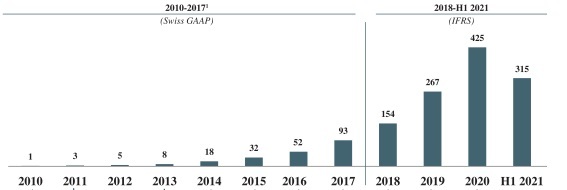

Though On is not yet a widely-known name, it is probably one of the fastest-growing athletic sports companies in terms of scale in the world in recent years, and has already become an influential high-performance sports footwear brand. In the ten years from its inception in 2010 until 2020, Onтs sales have grown by leaps and bounds (as shown in the diagram below) with a compound annual growth rate of 85%. Onтs growth has continued in the first half of 2021, with net sales having grown by 84.6% to CHF 315.5 million (1 CHF т 1 USD).

As an Ironman Champion, Olivier Bernhard devoted himself to creating a running shoe that would give him the perfect running sensation.

Together with his friends Caspar Coppetti and David Allemann, Olivier Bernhard formally established On in ZУМrich, Switzerland, in 2010. Early On prototypes equipped with their own developed anti-shock CloudTec technology won the ISPO Brand New Award. In the years that followed, On has developed a wide portfolio of proprietary technologies.

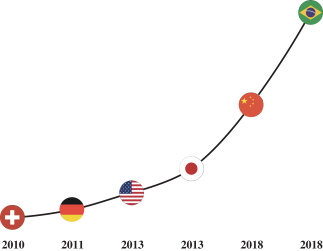

As a Swiss company with a small home market, On opted to expand globally from the very beginning. Today, the brand has a fast-growing presence across a number of international markets including, among others, Germany (first entered in 2011), the United States (2013), China (2018), and Brazil (2018). North America has become Onтs largest market and contributes more than 50% of Onтs revenue.

As Onтs popularity continues to increase globally, the company has set out to expand its direct-to-consumer (DTC) channel through its official website www.on-running.com, which is primarily comprised of its own e-commerce platform on its official website, its flagship store in New York City, four retail stores in China, and its platforms on Tmall and JD.com in China. DTC represented 37.7% and 36.6% of Onтs net sales for 2020 and the first half of 2021, respectively.

On has maintained good relationships with both professional and amateur runners. ItТ hosted 132 events for runners in 2019.

43% of Onтs customers own more than one pair of On shoes and 75% have recommended On to other people. 3.5% of Onтs consumers have posted their user experiences on Instagram. Onтs net promoter score of 66 is among the highest of all DTC brands surveyed.

It is worth noting that environmental protection and sustainable development are also core values of On.

In 2020, On announced Cyclon, its first 100% recyclable shoe, which is only available through a subscription model to ensure that the shoe materials can be recycled and reused.

According to the prospectus, On has two classes of shares: Class A ordinary shares (with a par value of CHF 0.1) and Class B voting rights shares (with a par value of CHF 0.01). Each Class B voting rights share has ten times the voting power of each Class A ordinary share. At present, Onтs issued Class B voting rights shares are owned by the five Partners that lead the company.

Through the previous rounds of financing, shareholders with 5% or more of the shares include: HH OAG Holdings HK Limited, Point Break Capital LP, Alex Perez, investment manager of Point Break Capital LP, entities associated with Stripes, and Kenneth A. Fox, investment manager of Stripes.

HH OAG Holdings HK Limited holds 6.1% of the Class A ordinary shares. It was established by Hillhouse Fund IV, LP in 2018 and managed by the same. Hillhouse Fund IV, LP focuses on investment in healthcare, consumers, technology and services, especially in the Asian market.

| Image source: On

| Writer: Jiaqi Wang

Comments