Analysis | Will Speciality Coffee Prosper in China?

June 7,2017

The speciality coffee market in China continues to expand. StarbucksТ will soon open itsТ firstТ internationalТ Roastery and Reserve Tasting Room in Shanghai. However, Shanghaiтs speciality coffees have already set trends of their own: Rumors Coffee, Essence CafУЉ, Mellower Coffee, Seesaw, Ashidaya and other independent coffee brands have gradually shifted from serving a niche audience to joining the mainstream by opening outlets in various, heavy-traffic parts of the central business districts. Funded by large capital investors, SEngine Coffee and Greybox Coffee made high-profile entrances into the speciality coffee market in Beijing and Shanghai at the beginning of 2017.

At the same time, instant coffee still retains a large share of the market. Many consumers still purchase instant coffee, which only costs few yuan per pack, in their local supermarket; in most large cities, coffee shops start business after nine in the morning. Despite this, more and more Chinese consumers are getting used to the once foreign coffee culture, gradually accepting the high price and complicated taste of the products served in speciality coffee shops.

However, does this mean that speciality coffee has reached the tipping point in the Chinese market?

The Growing Chinese Coffee Market

Ever since UBC Coffee entered Hainan and Guangdong in 1990, the Chinese coffee market has gradually expanded, nurtured by Starbucks, Costa Coffee, Pacific Coffee and other foreign brands. Though Chinaтs annual coffee consumption only forms 2% of the global market, demand is growing rapidly, with the annual consumption growth rate as high as 15% to 20%. According to data from the US Department of Agriculture, Chinaтs coffee consumption has tripled in the past four years, with its growth rate ranking first in the world.

тI wouldn't be surprised if one day we have more stores in China than we do in the US,т said Starbucks CEO Howard Schultz in an interview last year.

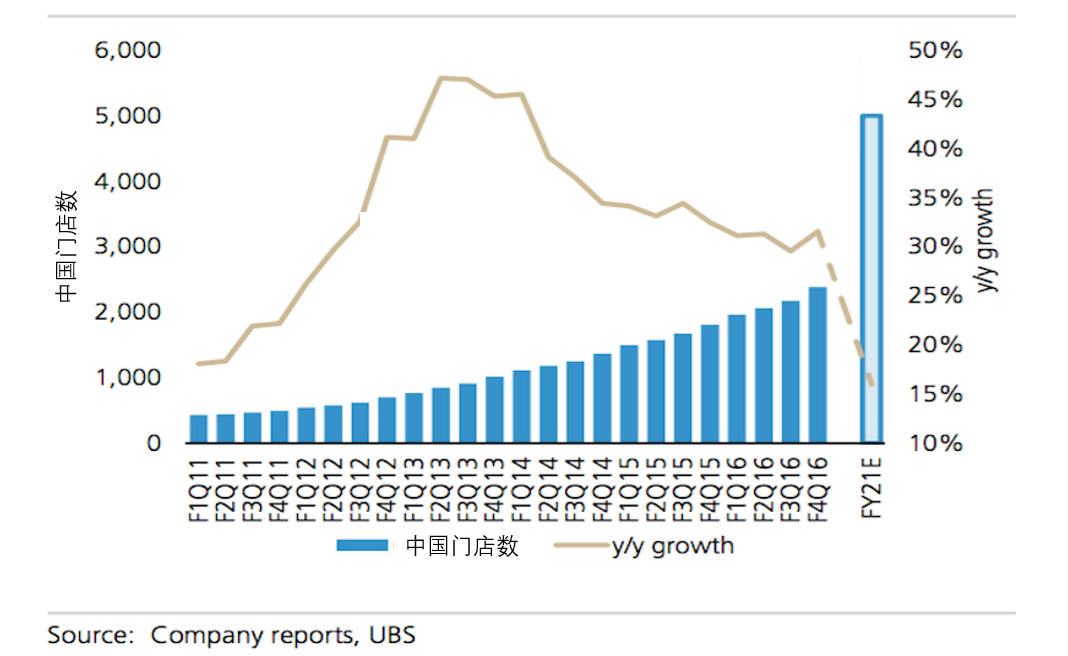

According to public data from the Union Bank of Switzerland (UBS), as of the first quarter of the 2017 financial year, Starbucks already has 2,543 locations in China. China is no doubt the most important overseas market for the company. Starbucks plans to open 500 new locations in China in the next five years, reaching the goal of over 5,000 stores in the Chinese mainland. In the meantime, the main rival of Starbucks in North America, Dunkinт Donuts, has also announced that it will open 1,400 stores in China, one hundred times the current number of stores, in the next two decades.

Speciality Coffee is Still Only a Spark in China

The global CEO of Illy CaffУЈ, Andrew Illy, once commented that it is interesting how coffee culture has become popular before its consumption has pervaded China. However, he also made the prediction that sooner or later, consumption would catch on; if coffee becomes an essential part of Chinese peopleтs daily lives, coffee consumption will certainly rise.

The commonly referred to тspeciality coffeesт in the market are mostly those produced by brands influenced by the тThird Wave of Coffeeт. The Chinese name for speciality coffee (чВОхххЁяМliterally тhigh-quality coffeeт) places emphasis on its premium price which is endowed by the distinctive quality of the product.

The concept of тspeciality coffeeт was first used by Erna Knutsen in 1974, from which the non-profit organisation promoting special coffee worldwide, the Specialty Coffee Association of America (SCAA) was founded. The emphasis with speciality coffee is on the provenance of the coffee beans and the extent to which they are roasted to accentuate their tastes and complexity. In the making of the beverage, тpour overт and тdripт are commonly used methods, with the aim being to maintain and maximise the coffeeтs original flavours. This has evolved to be the тThird Wave of Coffeeттafter the rise of instant coffee and freshly ground coffee chains, a group of consumers began to seek coffee with an even better taste.

To compare coffee to producing wine, the earliest classic examples of producers of the тThird Wave of Coffeeт are Intelligentsia Coffee, Stumptown and Counter Culture Coffee. But the best-known one is Blue Bottle. Sought-after by Silicon Valley venture capitalists, it has received total funding in the region of $120 million.

The industry generally regards 2012 as marking the start of the rise of speciality coffee in the Chinese market, when the number of coffee shops in China exceeded 30,000 for the first time.

According to UBSтs latest analysis, 78% of Chinese coffee drinkers buy freshly brewed coffee at least once every two weeks. In comparison, only 61% of American coffee drinkers buy it with the same frequency. However there are far fewer coffee drinkers in China than in the US.

Compared to the degree of acceptance of speciality coffee in the US, Chinese speciality coffee consumption is just beginning. According to data gathered from dianping.com in CBN Weeklyтs тEmerging First-tier Citiesт feature, there are currently 5,296 coffee shops in Shanghai, of which 3,257 are independent coffee shops. Many market themselves as тspeciality coffee shopsт. Since 2012, the domestic speciality coffee market has moved from scattered, independent boutique shops into the second phase of large-scale development, driven by capital. With the rising cost of the integrated operation of physical stores, the prime option for foreign and domestic speciality coffee brands wanting to enter the market is still chain operation.

Are speciality coffee shops a тhigh cost, low profitт business?

Behind every cup of speciality coffee is a complete industry supply chain consisting of cultivation, trading, roasting, stores, related fast-moving consumer goods and other links. The successful operation of a speciality coffee shop brand requires maximizing its uniqueness; therefore, coffee shops are windows in which to showcase the coffee beansт background, processing technique and, most important of all, the interaction between baristas and customers. Generally speaking, as long as the coffee shop provides high-quality, fresh, commonly accepted, competitive coffee beverages, it can be regarded as a speciality coffee shop. However, opening a speciality coffee shop is not as easy as it seems.

What Costs are Involved in a Speciality Coffee Shop?

- Having coffee beans with a story is only the first step

Traceability ensures the uniqueness of speciality coffee. There is a theory called т4321т that applies to speciality coffee, which means that the quality of a cup of speciality coffee is distributed as follows: 40% resides in the plant variety and its cultivation and harvest; 30% resides in its roasting; 20% resides in the brewing equipment; and 10% resides in the baristaтs technique.

Therefore, most baristas who own their own brands seek coffee beans with distinctive market-friendly flavours from coffee bean plantations across the world, and set up cooperation with them. Speciality coffee beans form 2% to 3% of global coffee production and this percentage is growing. It has been reported that Starbucksт first single-origin Chinese coffee beans, Starbucks Yunnan coffee, are to hit Chinese Starbucks stores this year.

The price of coffee beans runs from $10 to a few hundred dollars per kilogram (the international futures prices of coffee beans constantly fluctuate; one must refer to the real time prices to determine the actual price). With transportation and importation costs, the actual price of speciality coffee beans is often above 100 RMB per kilogram.

A fine single-origin coffee requires not only high quality beans, but also meticulous processing, roasting and filtering; each stage needs special techniques and skill. The production of speciality coffee beans is not as stable as that of commercial coffee beans. Beans from different areas and harvested in different seasons require different processing methods, which adds to the difficulty of processing and emphasises the baristasт critical role.

The frequency with which domestic speciality coffee shops purchase beans is influenced by their limited sales (a speciality coffee shops on average sells less than 100 cups per day), and because they are unable to purchase beans every week, this affects the freshness of the coffee beans in stock.

- Roasting is the key to competitive difference and a cost-heavy area

When it comes to speciality coffee, thereтs a certain flexibility to its roasting. Different roasting levels generate fine flavours across a spectrum, thus satisfying customersт increasingly individualised demands.

Commercial coffee is usually dark roasted in large quantities using large roasters. Dark roasting can extend the best before date for longer storage: with the occasional use of preservatives, such beans can last for one to two years. Light- to medium-roast beans have a shorter shelf life, but the much-cherished bright acidity and clean fruity fragrance are more easily noticeable. Such speciality coffees need to be freshly baked, ground and brewed. Coffee beans that have been roasted less than a month ago are ideal. Therefore, while retailers of commercial coffee often purchase coffee beans from roasters, speciality coffee shops usually purchase raw beans and roast them themselves.

Roasters are increasingly being seen in speciality coffee shops, but are not necessarily the standard. The price of a roaster can run from tens of thousands of RMB (thousands of pounds) to more than 200,000 RMB (approximately ТЃ20,000). The capacity of roasters varies from between 200 to 300 grams to a hundred kilograms. However, a normal coffee shop often only needs to roast one to two kilograms of beans at a time. The roasting of single-origin beans is relatively easy to master though trial and error, while blends require higher standards from both the machine and the person processing the beans. Compared to in-house roasting, professional roasters are better value and more able to perform consistently.

Above: Hu CafУЉ & Bakery, which currently has three locations, purchases coffee beans from Barista King, roasted by renowned barista Zhou Yungui.

- Celebrity Barista, or Fresh Face in the Coffee Industry?

Like many other industries, Chinaтs speciality coffee industry is constrained by talentтa shortage of baristas and mid-level management staff. Suffice it to say that the existing speciality coffee chains are all staffed by champion baristas of all levels of domestic and international competition in coffee roasting, brewing and latte art. Celebrity barista teams can both ensure quality control and attract attention and bring in traffic.

However, celebrities can move. Essence CafУЉ, which once sold pour over coffee for 1,010 RMB (approximately ТЃ101) a cup, changed its strategy when it came to developing franchises, in order to reduce the brandтs reliance on individuals after the departure of their chief barista, Chinaтs first international judge in the Cup of Excellence competition, Huang Junhao.

- Bar equipment competition

Inside the coffee shop, the central area is the bar where the baristas brew coffee. Operators should be prepared to invest in bar equipment. Aside from the technique of the barista, a speciality coffee shop is expected to invest around 100,000 RMB (approximately ТЃ10,000) in coffee machines and grinders.

Even in the world of speciality coffee, the truth is тa cent for a centsт worth of product, tuppence for a tuppennyтs worth of product, while three RMB will get you three RMBsт worth of productт, that is, the larger the investment the higher the quality. As quality goes up, differences narrow, but costs rise. Founder and CEO of SEngine Coffee, Wang Juntao has said that the companyтs coffee shop in Shanghai New World cost around 900,000 RMB (approximately ТЃ90,000) just for the bar area, which includes Chinaтs first limited-edition embedded Mavam coffee machine, a Slayer espresso machine with pre-soaking function and an EK43 grinder, regarded as тthe king of pour over coffeeт.

Speciality Coffee brands are making an effort to increase returns

In the field of speciality coffee, an area that might be easily neglected by the operators is how to convey their ideas and information to the customers. Many operators and baristas have prepared themselves with extensive research and practice, but because coffee is still regarded as a newly emerging foreign culture, customersт demands are often about more than the product itself. Therefore, patient promotion and marketing campaigns are required. The sharing of knowledge and experiences can educate customers and add interest to their consumption experience. To rely solely on the product itself for dissemination would be slow and ineffective, but a speciality coffee shop can display the culture and value behind a cup of coffee through the design of table cards and menus, through tasting events, and by providing details on the coffeeтs plantation, processing and roasting.

1) Enter the retail channel and break into a younger market

At the beginning of this year, Stumptown Coffee, a representative of the тThird Wave of Coffeeт released a brand new product lineтa canned sparkling cold brew in three different flavours: original, ginger citrus and honey lemon. The modern packaging is designed to appeal to more customers. These canned products are not only available from Stumptown outlets, but, in limited numbers, will also enter retail channels and be sold around the US. This move was inspired by Blue Bottleтs New Orleans Iced Coffee, a ready-to-drink coffee in cartons, made from organic coffee beans that have undergone a 12-hour cold brew process.

Above: Blue Bottleтs New Orleans Iced Coffee, sold through various retail outlets.

In a similar case in 2015, Never Coffee broke into the Chinese speciality coffee market by releasing its canned speciality coffee via online channels at the low price of 9.9 RMB (approximately ТЃ1). Last year, the brand ventured into offline outlets with three ready-to-drink products: Cold Brew Black Coffee, Cold Brew Coffee Lemonade, and Cold Brew Latte, with respective prices of 12.8 RMB (approximately ТЃ1.28), 12.8 RMB (approximately ТЃ1.28), Т and 14.8 RMB (approximately ТЃ1.48). Cold Brew Black Coffee, the most popular, has since raised its price by 2.9 RMB (approximately ТЃ0.2).

2) Coffee shop design: emphasise interactivity and accentuate the theme

In late December 2016, Greybox Coffeeтs first store opened on the first floor of the Beijing Kerry Centre near China World Towers. Its founder, Perry Pu, is the successful creator of the high-end rose and jewellery brand тroseonlyт. In the coffee shop, which is less than 80 square metres in size, rough-hewn wood and metal textures have created a minimalist industrial style, reminiscent of the working spaces of the Silicon Valley geeks who are constantly driving the tides of coffee culture forward. Perry Pu told Luxe.CO that Greyboxтs benchmarking brands are TWG, a high-end tea brand founded in Singapore, and Cova in Milan, a classic Italian coffee shop with over 200 years of history. Therefore, the brandтs very first shop is at an upmarket shopping centre in a desirable location, in keeping with the origins of many luxury brands. With its founderтs experience of running roseonly, the boutique Greybox coffee shop is likely to be a success.

Above: Greybox, Beijing Kerry Centre store

Seesaw Coffee, which aims to тmake the most authentic Australian speciality coffeeт, had two main design requirements when opening its first shop at Yuyuan Garden, Shanghai. First, the bar area had to be as open as possible, allowing customers to view the whole coffee-making process clearly and to communicate with the staff at any time. Second, the bar area had to resemble a stage. With the height difference between the seating area and the bar area, customers have to be able to view the тperformanceт of the barista while they are seated.

The theme of a speciality coffee shop can be flexible but must be focused. тOut of themeт tragedies often happen in catering, making it a relevant problem for many coffee shops. While the per person expenditure and table turnover rate of speciality coffee shops may not be as high as that of some restaurants, the cost of staff and rent is often comparable. To make sure that the theme is clear and accurate, one has to balance the services the shop provides as well as ensure the coordination of the overall design. For instance, through the dressing of plates and displaying the aesthetics of the food served, a wide variety of unrelated elements can be brought together in the space provided. Speciality coffee shops ensure every detail exemplifies the quality of its coffee, including tableware, flower arrangements, music, uniform and so on. Therefore, design is a deciding factor in the ultimate success of a speciality coffee shop.

3) Related product development and the creation of scene to induce consumption

Selling coffee alone may not cover the cost of staff and the rent of a coffee shop, therefore value added services should be another critical concern for speciality coffee shops. No matter how big or small the space is or the number of the customers, as long as thereтs a professional barista making coffee using high-end beans, it counts as a speciality coffee shop. In this flexible space, shops can sell coffee-related products, such as coffee machines, cups and saucers, or other items related to the particular space, such as clothing and jewellery. These are all methods to increase customer expenditure while optimising the consumption experience.

Baristas should also be promoters of these products. Wang Juntao believes that the reason why related products in coffee shops are often neglected is the lack of purchasing guidance. For example, a customer might see the barista grinding coffee beans as they enter the shop; the next step is a sample tasting: if the customer is satisfied with the taste, they may purchase coffee-making equipment.

4) Detailed division of labour and the seeking of suitable providers

The speciality coffee industry will become more and more finely divided as it grows more professional. Faced with the common obstacle of тthin profit and high costт, operators are putting more effort into running the shops and promoting sales, while outsourcing coffee bean purchasing, roasting, barista training, shop design and other jobs.

Currently, speciality coffee brands that feature roasting as part of their main service include Micro Coffee Roaster in Fuzhou, Ashidaya in Shanghai and Uncle Bean in Beijing.

5) Highly effective window shops with lower initial investment required and a shorter period of ROI may be the next opportunity

The next opportunity for speciality coffee in China is probably that to be found in smaller window shops serving takeaway coffee. In Melbourne, a takeaway speciality coffee shop only needs to sell 500 to 800 cups per day to easily make a profit. Last year, Manner CafУЉ, an independent speciality coffee shop, was included in the Shanghai Coffee Map, a book written by Huang Junhao. In an extremely small space, the shop sells small lattes for 15 RMB and large lattes for 20 RMB. Its sun-dried Yirga coffee is sold for the same price. In addition, a customer gets a five RMB discount if they bring their own coffee cup, and an 18 RMB discount if they bring their own jar for beans. The shop sells a thousand cups per day, double the number of an ordinary speciality coffee shop on a working day. However, from the perspective of branding, window shops are less than ideal in terms of promoting brand awareness.

6) Brand development on the basis of retaining oneтs capital

From Mellower Coffee, which has 17 shops, including two in Singapore, to the current SEngine Coffee, Wang Juntao constantly emphasises the importance of cost control. There are three main aspects to cost: materials, rent and staff. Based on cost, per-customer expenditure and daily traffic, one can roughly calculate whether the shop will operate at a profit or a loss. For chain brands though, the more locations that they open, the more they can share costs for branding and management.

In conclusion, speciality coffee shops require a refined operation, with their performance being assessed by certain standards and data, instead of by blindly pursuing the flavour of beans.

After all, for the ordinary consumer who just wants a cup of coffee, it seems overly complicated for them to have to refer to the spectrum on the flavour wheel for every cup of coffee. They would also have a hard time understanding Agtron numbers in relation to levels of roasting. Therefore, speciality coffee brands have to consider how to best serve the mass market to catch up with the wave of large-scale branding.

уChinaтs тnascent and growing coffee cultureт is a massive opportunity for Starbucks (SBUX)уяМhttp://markets.businessinsider.com/news/stocks/chinas-is-a-massive-opportunity-for-starbucks-2017-3-1001816087-1001816087

уThe Cost of a Cup of Coffee: Where Does the Money go?уяМhttp://www.scaa.org/chronicle/2014/09/15/the-cost-of-a-cup-of-coffee-where-does-the-money-go-2/

Comments