Luxe.Co Founder Alicia Yu: 7 Trends Shaping China's Future Fashion and Lifestyle Industry

July 27,2017

As the financial world becomes ever more interested in the future of China'sТ fashion and lifestyle industry, over the past three months, Luxe.CO founder Alicia Yu Yan has been invited by Hua Chang Securities, Citibank and Everbright Securities to give a series of speechТ on the latest trends in the development of Chinaтs luxury goods, fashion and lifestyle industries.

According to Yu, тfragmentationт and тpersonalizationт are the two main trends that will determine the future of Chinaтs consumer fashion industry.

The characteristics and tastes of Chinese consumers are becoming increasingly diverse. From access to information, social activities, personal experiences and expanding horizons, to self-identification with opinion leaders, as well as the growing number of different shopping channels, many factors are causing fragmentation in the market.

Alicia Yu Yan, CFA, Founder of Luxe.Co |Т Fashion.VC | Orange Bay University

1) Access to Information

Abundant, easy-to-access global fashion and lifestyle news is available online. Knowledge of brands, products, prices and trends can be available at the tap of a finger. But when it comes to individuals, the ways in which they access information are extremely diverseтone-way media, such as news sites; vertical media such as film, video and the print media (which is still important); and two-way social media, such as WeChat, Weibo, live-streaming sites and various online communities, are interleaving and overlapping. Individuals can select from an infinite number of combinations of media outlets to meet their preferences.

Because of the fragmentation of the access to information, perceptions of brand also differ tremendously.

2) Social Activity

From what we have observed, WeChat dominates the adult and close social spheres, while Weibo dominates the teenager and open spheres. This is back up by Luxe.COтs consumer fashion report (click the link): of all the respondents in the study, 34.4% of the generation born in the 1980s or before use Weibo to access fashion information, a considerably lower percentage than amongst those born in the 1990s or more recently, where the figure is 51.5%. In contrast, the proportions for those using WeChat are reversed (57.7% vs. 46.3%).

The different means of social communication based on Internet usage have intensified fragmentation of the so-called тsocial sphereт, in which individuals live simultaneously in two тparallel worldsт, one open and one closed.

3) Personal Experience and Expanding Horizons

The popularisation of travelling abroad has given Chinese consumers broader, more global horizons and more diversified consumption choices.

On the one hand, Chinese travellersт destinations have become more diverse. Some make frequent round-trips to Hong Kong, South Korea, Japan and the South-East Asian countries for leisure; others are travelling to other continents and across oceans, from Europe to Africa, from the Pacific to Antarctica, journeying across the globe for fresh and exciting new experiences.

On the other hand, personal travel is no longer just for sight-seeing or shopping т sports trips, for skiing, scuba diving and marathon-running are becoming more and more common. Taking the opportunity to accompany children while they are studying abroad, to immigrate or to invest in property abroad, among other reasons for living outside of China, are also becoming more and more common.

With the expansion of the conception of the physical space that they are living in, modern consumersт perceptions and choices are becoming increasingly distinctive when it comes to consumer products.

4) Self-identification with key opinion leaders

Though there are few so-called superstars dominating web media platforms, top web celebrities and other such тpan-opinion leadersт have enormous exposure and there are also many тlong-tailт web celebrities and countless opinion leaders in small circles. For personalised brands and products, the latter are far more important.

тStarsт and тweb celebritiesт (key opinion leaders) have more influence among teenagers, young adults and people on mid-to-low incomes (the so-called тsocial followersт). Consumers with higher incomes are less influenced by these figures, relying more on personal experience, word-of-mouth and recommendations from their close social circle.

In this survey by Luxe.CO of consumers in the medium-to-high income bracket (click the link), among the decisive factors in making buying decisions, celebrity endorsement only accounted for 4% of responses, and ranked lowest on the list of factors.

5) Purchasing Channels

The above four fragmentation trends suggest that the trigger factors for purchasing decisions are becoming even more diverse. At the same time, actual buying activity is taking place via a wider and wider range shopping destinations: brand boutiques, multi-brand retailers (the rise of collective independent designer stores is especially worth noting), super e-commerce platforms (Taobao, Tmall, JD), vertical e-commerce platforms, content commerce, social commerce, videos with shopping content, individuals as shopping portals, and so on.

A member of the communications staff at a newly established pioneering Italian brand told Luxe.CO that they do not have any physical or online sales channels, but that, despite this, Chinese fashion lovers are still hearing about the brandтs most popular product via social media, and have contributed tens of millions of RMB in sales in a single season.

The current Chinese consumer fashion market is splitting into an infinite number of fragments.

Therefore, in order to have an objective, timely and accurate understanding of the new generation of consumers, one must abandon such тuniversalт general analyses and judgements and go deeper in order to observe and understand. This is especially important for fashion and lifestyle businesses whose major products and services are non-standard.

Fragmentation has led to increasingly complicated and personalised consumer preferences, meaning more uncertainty and bigger challenges for established brands and companies, which are used to production and sales on a scale targeted at the mass market. However, for the constantly emerging start-ups and innovative products and services, fragmentation offers great opportunities. It allows start-ups which have limited power and resources to focus on the highly personalised side of the market, and to compete for potential consumers with big companies, even winning over customers.

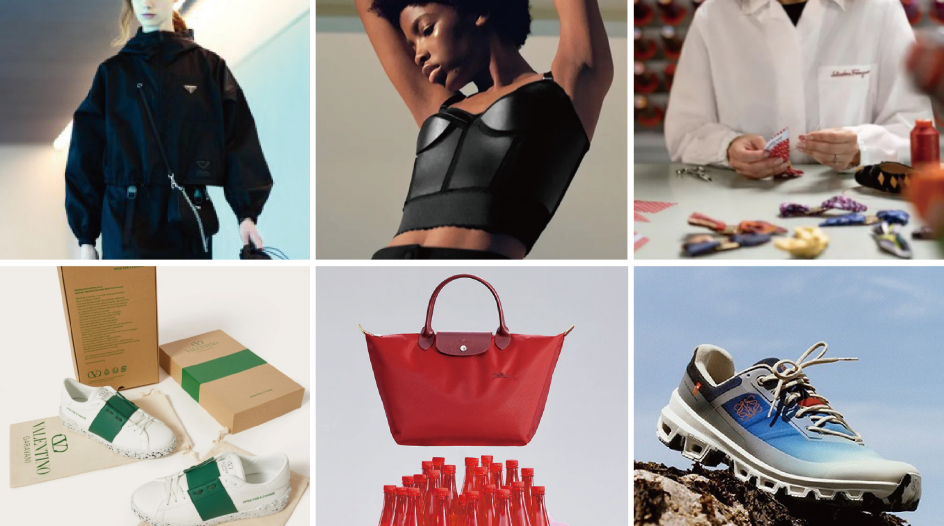

Alicia Yu has summarised the seven trends of personalization observed by Luxe.CO in Chinaтs fashion and lifestyle market from the perspective of branding and product evolution:

1) Mass consumer products have been upgraded to incorporate more fashion elements, as exemplified by the food and drink industryтcondiments, baijiu (a Chinese spirit), tea and other subcategories have seen an increasing number of trendy brands emerging.

2) Producers are taking advantage of China as the тworldтs factoryт, combining the next generation of branding, promotion and product design ideas with a vertically integrated supply chain in order to directly provide consumers with products that are better value and more recognisable.

3) More and more entrepreneurs from abroad are bringing aspects of the Western lifestyle to China for local adaptation. Start-ups are particularly numerous in the areas of fitness, healthy eating, speciality coffees and micro-brewing.

4) Entrepreneurs are able to discover and meet the unsatisfied needs of consumers through careful observation. From underwear and personal care products to every type of functional product, a whole group of new brands is ready to be launched.

5) More and more young designers are turning to tradition for inspiration, and are starting to interpret Chinese culture in a modern context by providing ranges of clothing, accessories and home products in a тnew Chinese styleт, which better fits the aesthetics and habits of the new generation of consumers.

6) Celebrities are no longer satisfied with simply sponsoring a product by appearing in few ads. Rather, they prefer to participate in creating the next generation of consumer brands by living the lifestyle promoted by the brands. From gourmet food to electronic products, with their popularity and their luxurious lifestyles, stars and celebrities are promoting brands continuously through their influence and enviable lives.

7) Western luxury brands will continue to enjoy a unique advantage because of their brand cultures and their origins. However, more consumers are purchasing luxury products for their own needs rather than for gifting or as a display of wealth as in the past. With the maturing of the consumer attitude, the fame of the brand is less and less important, with product design and quality becoming the main concern of the consumer when making purchases. Overseas niche brands are increasingly gaining popularity.

Over the past four years, Luxe.CO has followed the latest trends in the global luxury goods, fashion and lifestyle industries, while at the same time paying close attention to entrepreneurship and investment news in Chinaтs fashion and lifestyle industries. For the past three years, Luxe.CO has held the annual InnoBrand Fashion.VC Innovation Competition, published Luxe China Investment Weekly and produced timely financial news about the domestic fashion and lifestyle industries.

Based on our observations, there are a growing number of start-ups emerging in the areas of food, beauty, jewellery, fitness, travel, and home decoration, and a growing number of independent designer brands too. The development of the Internet and third-party services, as well as the interest from venture capitalists, has facilitated entrepreneurship in the consumer fashion industry. Start-ups that successfully promote sales through social media are able to achieve explosive development at a low cost.

However, new brands have to overcome obstacles such as product development, branding, supply chain management, and online and offline distribution channels on their way to success; thus continuous effort is needed to win the hearts of the next generation of consumers.

Comments