In-DepthяНWhy These Japanese Fashion Brands Retreated from China?

July 15,2020

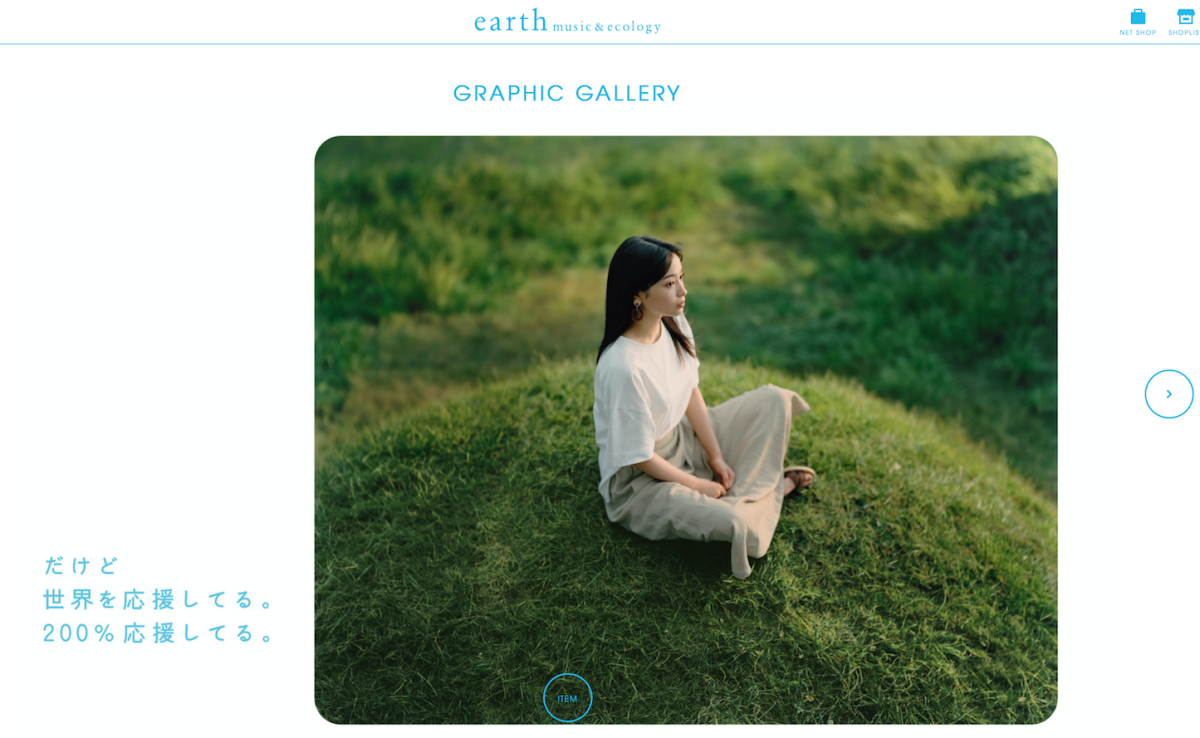

The Japanese fashion group, Stripe International, withdrew from the Chinese market on June 30, and all the online and offline sales channels of its seven brands, including Earth Music & Ecology, E Hyphen World Gallery, and Samansa Mos2, were closed.

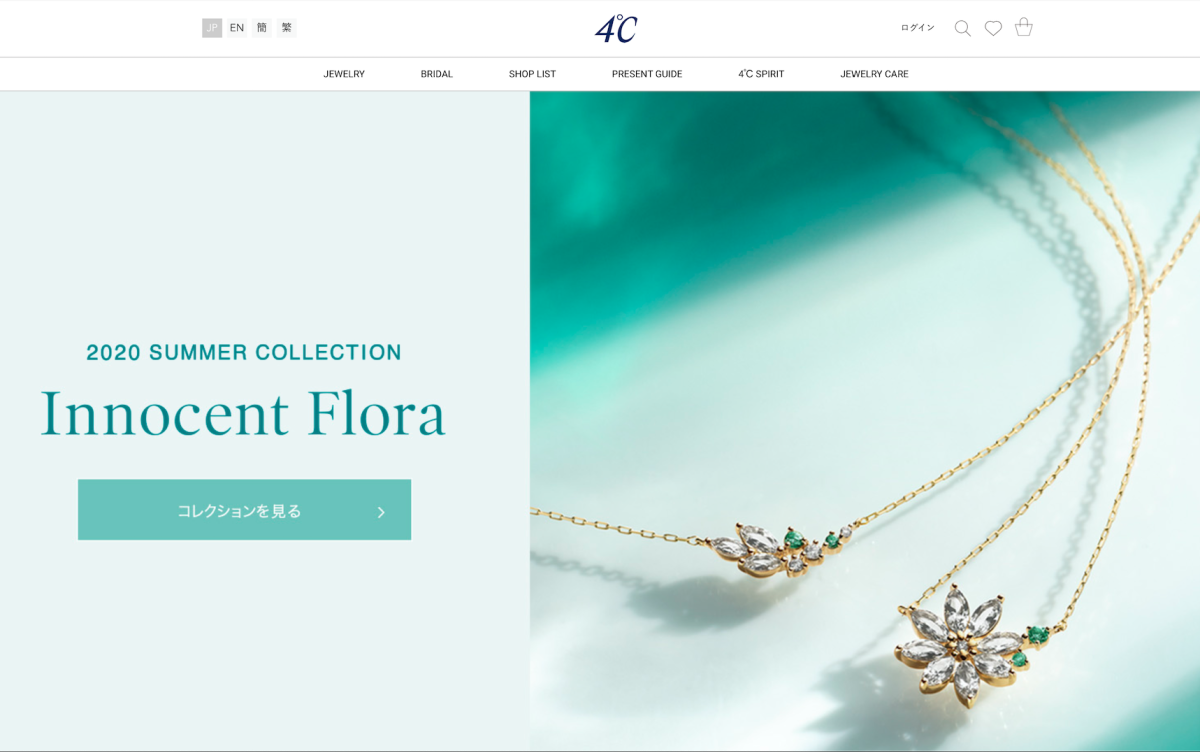

Earlier in April, 4ТАC Holdings, a jewelry group tipped to become the "Tiffany of Japan", announced that it would withdraw from the Chinese market and close three stores within the next year.

In the past three years, Japanese fashion brands and companies that have withdrawn from the Chinese market include fast-fashion brand, Honeys, department store brand, ITOKIN and its brands, and multi-brand clothing store тCollect Pointт under the fashion group ADASTRIA, etc.

At a time when major fashion brands around the world are making efforts to enter the Chinese market, why do Japanese brands that have always been popular with young people have little voice and action in the Chinese market, and are even steadily failing? Through research, Luxe.CO has discovered five major reasons why Japanese fashion brands are unaccustomed to the Chinese market:

- Vague and medium market positioning.

- Slow response to the rapidly-changing Chinese market.

- Over-reliance on traditional department stores and shopping centers.

- Slow digitalization process.

- Insufficient investment in brand building and communication.

Vague and Medium Market Positioning

The buying preferences of fashion consumers are leaning toward "two poles", either high-priced luxury goods or low-priced fast fashion. Brands positioned in the middle are in an embarrassing situation. This trend shows signs of accelerated evolution based on the effect of COVID-19.

For example, the main customers of the brand, Earth Music & Ecology, under the Stripe Group are young females in their teens to thirties, and the prices are higher than for fast fashion. It can be seen from China's social media that some consumers define it as a "fast fashion brand" and others think it is "a bit expensive" or even "becoming more and more expensive."

The prices of Japanese brands, Majestic Legon and W Closet, which still operate in the Chinese market, are similar to those of fast fashion brands. In the official Taobao stores of each brand, the most expensive price of these two brands after discount is about 600 yuan.Т Brands like Snidel and Lily Brown, which mainly target white-collar women, are priced slightly higher, with a discounted unit price of around 1,000 yuan.

As for 4ТАC Holdings, the Group began to implement a high-end brand strategy in the second half of 2018, dividing the fashion jewelry business into three parts: the first level of products is priced below 30,000 yen (about 1968 yuan), the second level between 30,000 to 70,000 yen (about 1968 т 4592 yuan), and the third level more than 70,000 yen (about RMB 4,592). Products are developed and sold according to these three price levels.

Even if the 4ТАC Holdings Group decides to take the high-end route, most Chinese consumers who know the brand still define it as a "fair price jewelry" brand.

Slow Response to the Rapidly-Changing Chinese Market

Many overseas brand executives who have been in contact with Luxe.CO have marveled at the "fast" speed in China. This is not only reflected in the evolution of consumer preferences and fashion trends, but also includes the entire process from the production plan to the launch. The average production cycle of fast fashion brands is 10 days, and new products are launched at least once a week.

Earth Music & Ecology, which focuses on Mori Girl fashion, was established in 1999 as the creator and leader of this style. The main features of its products are simplicity and comfort. After the brand was born, the parent company, Stripe, continued to set new highs in its performance for more than a decade. According to statistics, the annual sales of Earth Music & Ecology reached 25.6 billion yen in 201, making it the number one women's wear brand in Japan.

Earth Music & Ecology is one of the Japanese-style enlightenment brands for many Chinese fashion consumers born in the 1980s. However, today's consumers love more diversified fashion styles, and are more inclined to choose sports and leisure, oversize, or more self-cultivation styles, and the style of Earth Music & Ecology has not changed much over the years. Although some Chinese consumers lamented its departure, they also said that it was just "the favorite of the high school era."

A similar phrase was used when consumers talked about Honeys, another Japanese enlightenment brand that has withdrawn from the Chinese market, when some of them said that it was "the favorite of the junior high school era."

In contrast, the Japanese brand, Jouetie, which entered the Chinese market in 2017, is based on street style and is good at mixing and matching various styles, such as rock, modern and girly, and has a unique personality that attracts current consumers.

Over-reliance on Traditional Department Stores and Shopping Centers

Compared to internationally-renowned fast fashion brands, Japanese fashion brands appear to be more traditional and cautious when laying out the offline market in China, and are more inclined to follow the strategy used in the Japanese market.

ITOKIN, which entered the Chinese market as early as 1995, is itself a department store operator, and its dependence on department store channels is self-evident.

Stripe began to expand its direct business in China and open single-brand stores in 2011 and the total number of Chinese stores exceeded 100 at its peak. However, most of its stores are in-store shops located in department stores or shopping malls, and there are very few large independent stores that can fully display the characteristics and concepts of a certain brand.

While Stripe is expanding its Chinese market, fast fashion brands such as Uniqlo, Zara, and H&M are also quietly being deployed. Unlike Stripe, which focuses on small stores, these fast fashion brands have invested heavily in building large stores in prime locations, such as Shanghaiтs Nanjing West Road, Sanlitun in Beijing, and so on.

Stripe only just began to adjust its store strategy in the Chinese market in 2017. Besides, the large-scale Earth Music & Ecology store, TOKYO, launched by Stripe is a collection of 51 brands. Although the store name is integrated into the brand name, the overall selection and product display weakens the existence of the main brand.

Honeys, which was mainly for students and young white-collar consumers, was one of the first Japanese fashion brands to enter the Chinese market in 2006. It also relied heavily on department stores in offline channels. Later, due to rising production costs and declining performance, the number of stores dropped from nearly 600 at its peak until it was completely withdrawn in 2018.

When another Japanese fashion group, ADASTRIA, entered the Chinese market, it chose a development model similar to that of the Stripe Group. In 2008, ADASTRIA introduced its multi-brand clothing collection store тCollect Pointт to China. At that time, the first store in mainland China was located in the Suzhou Aeon Mall, and the number of stores once expanded to more than 40, but the group decided to close all тCollect Pointт stores in China in mid-2019.

Т Slow Digitalization Process

The proportion of e-commerce in China's fashion retail industry is larger than that of Japan, and the competition is much fiercer. This is especially true for low-end and mid-end brands, especially youth fashion.

Although Honeys started its e-commerce business as early as 2009, its focus remained on offline channels, and e-commerce was handed to partners for entrusted sales. In 2010, Honeys opened a Tmall flagship store, but still handed the operation to a third party. It was not until 2014 that the company established an independent e-commerce department responsible for the self-operated business of online channels.

ITOKIN, which entered the Chinese market in 1995, did not open an online flagship store until 2011, but the online operation was handed to a third-party company. The group was unable to adjust its online business flexibly and closed it in 2012.

Earth Music & Ecology opened a flagship store in Tmall in 2015, but e-commerce only sells products exclusively online. It was not until 2018 that the parent company, Stripe, established a strategic partnership with Alibaba Japan and began to promote a new retail strategy based on integrating online and offline business models.

As of the end of June this year, Stripe International operates 7 brands in the Chinese market, including Earth Music & Ecology, E Hyphen World Gallery, Samansa Mos2, AMERICAN HOLIC, GREEN PARK, NiCORON, and YECCA VECCA. However, only Earth Music & Ecology, E Hyphen World Gallery, and Samansa Mos2 have opened online channels on JD.com and Tmall.

As for withdrawing from the Chinese market, 4ТАC Holdings has not opened online channels in China yet.

Insufficient Investment in Brand Building and Communication

In the era of social media marketing explosion, how to reach a wider audience and improve brand recognition and recognition has become a major challenge for brands.

In 2011, Stripe opened Weibo and WeChat accounts for its Earth Music & Ecology brand and the brandтs Weibo has a total of 240,000 fans so far. However, the highest reading volume of WeChat headlines since the beginning of this year has been below 4000.

The content of the official Weibo of Earth Music & Ecology is mainly focused on new products, netizens reposting, product discounts, etc. The brand has also held several live broadcasts this year, but the overall interaction rate on social media is not high. Besides, the brand has not cooperated with celebrities and well-known big KOLs. Apart from the earlier joint name with Pac-Man, which caused a small wave of attention, the overall momentum is still insufficient.

4ТАC Holdings lacks a presence on social media in China, perhaps to ensure that the brand is cost-effective and it has insufficient budget for marketing. This means that most Chinese consumers do not even know the brand exists.

Although sadly, a large wave of Japanese brands has left, many Japanese fashion companies, such as Mark Styler held by ADASTRIA, Baroque Japan held by CITIC Capital, etc., are also adjusting their pace to expand the Chinese market more actively.

In 2017, Mark Styler introduced its young fashion brand, Jouetie, to the Chinese market and chose to open a flagship store on Tmall.

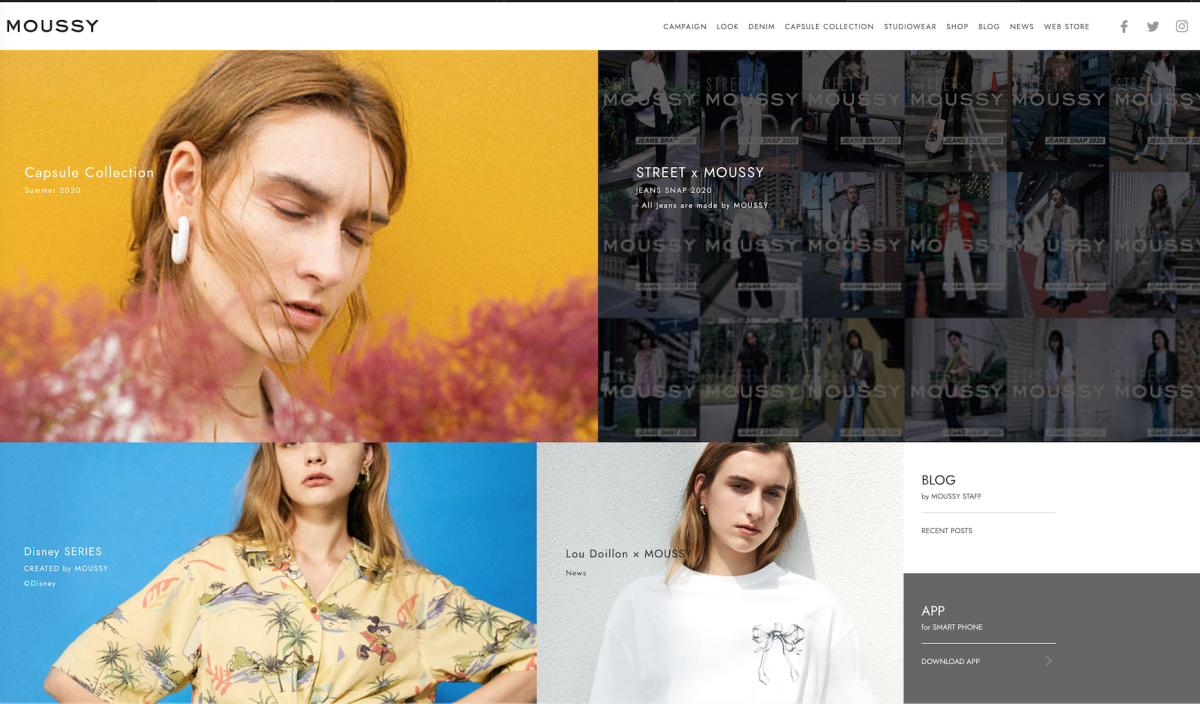

In addition to cooperating with KOLs, the social media content of Moussy, a brand under Baroque Japan, also shares product materials, provides advice on how to wear them, and interacts more closely with Chinese fashion consumers.

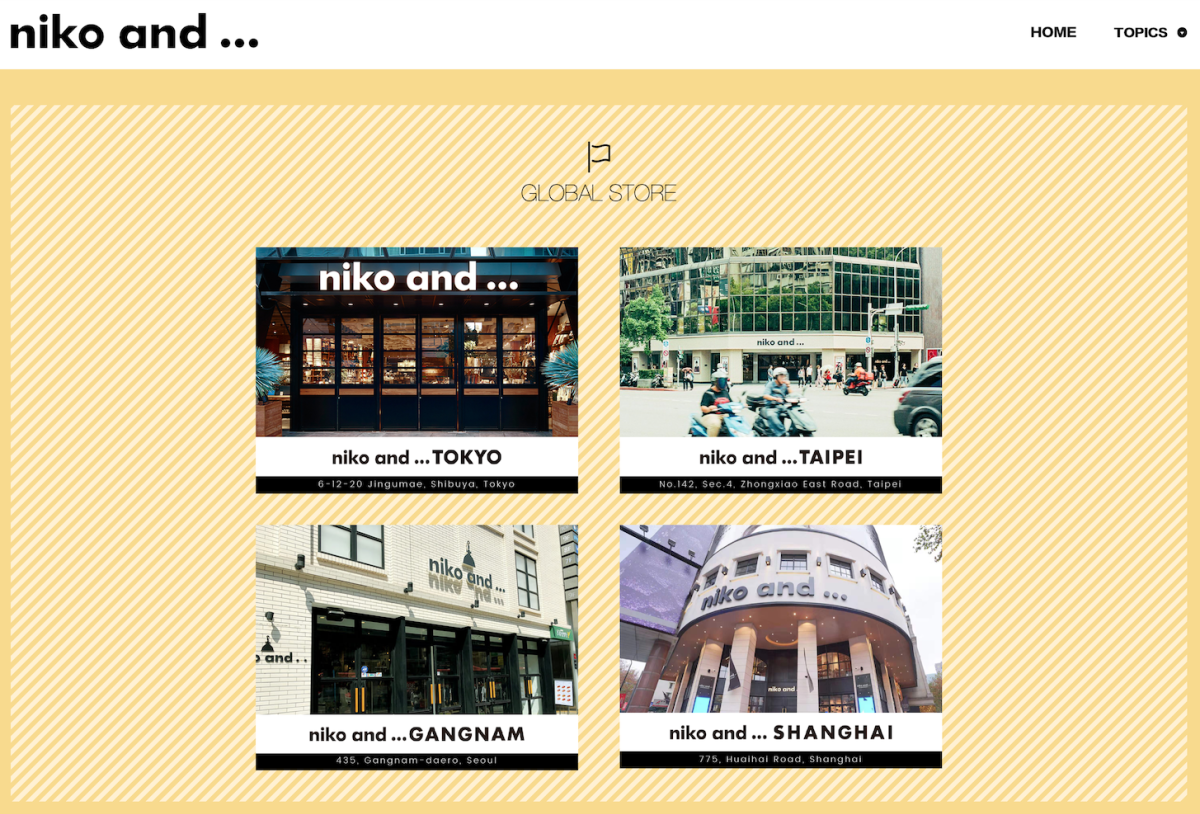

Although all its stores in the Chinese market were closed, the ADASTRIA group did not abandon the Chinese market. Instead, it chose to open the lifestyle brand тniko andтІт in the prime location of Huaihai Road in Shanghai and return to the global flagship store model. ADASTRIA Director and President of Sales Department, Yoshiaki Kitamura, bluntly said in an interview with Luxe.CO, тIf you can manage a store in the most expensive area in Shanghai, then the challenges in other places will be relatively small. Another reason is based on strategic considerations. Consumers are more willing to walk into the brandтs flagship store to explore, discover and feel the atmosphere. Regular products sold in ordinary stores can be ordered online."

In addition, тniko andтІт set out to prepare for online business in China at the same time as opening physical stores, but COVID-19 has caused them to launch WeChat mini program malls at a faster rate. Recently, they have also cooperated with Austin Li, the well-known anchor, on a live broadcast, and celebrities, such as Cheng Xiao, Wang Dalu, Zhu Yawen, etc.

Comments