In-DepthяНWhy Can't COVID-19 Stop Perfume Brands from Opening Stores in China?

July 8,2020

More and more independent stores are selling a single perfume brand in many high-end shopping malls. The opening of international perfume brands in China has not slowed down, even with the impact of COVID-19.

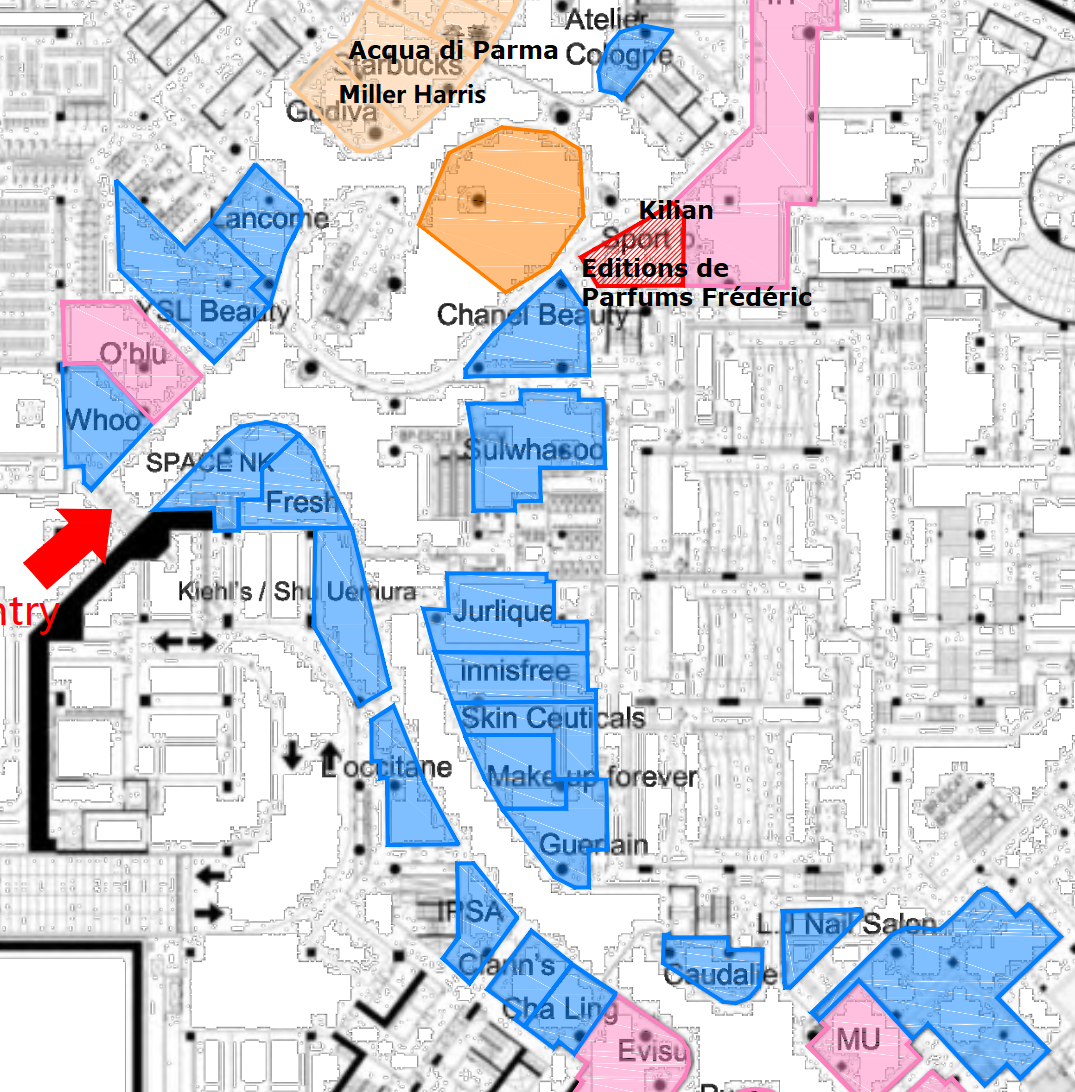

Luxe.CO recently visited the Shanghai International Finance Center (IFC), where a group of international high-end perfume brandsт independent stores has suddenly emerged in the atrium space on the second basement floor (blue area shown below). These include two major French high-end niche perfume brands, Kilian and Editions de Parfums FrУЉdУЉric Malle of the Estee Lauder Group, Miller Harris from London, and the boutique of the Italian niche perfume brand, Acqua di Parma of the LVMH Group.

Besides the Shanghai IFC, the LтOrУЉal Group's French luxury beauty brand, YSL, also opened the world's first perfume flagship store recently in the Xintiandi Style Shopping Centre. The statistics in the picture below are of some niche and commercial perfume brands that opened their first store in Mainland China, collected by Luxe.CO.

Consumersт Attitude Toward Perfumes Has Changed Rapidly

Neo, general manager of Estee Lauder Group's Chinese fragrance department, told Luxe.CO that he is optimistic about the future development of the home and lifestyle categories represented by fragrance in the Chinese market after the epidemic. Neo believes that "People's desire for a better lifestyle has never changed and this mood will intensify after the epidemic."

Chinese consumers' attitude toward perfume brands has changed rapidly in recent years, from rarely using perfume, but buying famous brandsт products as gifts, to chasing well-known niche brands. Using fragrances at home, constantly exploring their favorite types of fragrance, and owning a few bottles of perfume have already become the norm for many of todayтs consumers.

In terms of price, as more brands enter the market at different price points, Chinese consumers have more and more choices. For example, in the local market, consumers can choose 50ml of commercial/mainstream perfume with an average price of about 500 yuan, to niche/independent perfumes with an average price of about 1,000 yuan, to high-end niche brands whose price has tripled and the average price is about 2,000 yuan.

As the perfume segment is favored by consumers, more overseas brands are eager to try and enter Chinese market.

The Chinese Market Still Has Much Room for Imagination

In the L'OrУЉal Group's annual report for the fiscal year 2019, the luxury product department used "A big year for fragrances" as the title to summarize the outstanding achievements of high-end perfume categories in the department. This highlighted the strong response to the international expansion strategy of the French cologne brand, Atelier Cologne, in the Asian market.

According to the perfume industry research report by WiseGuyReports, the value of the global perfume market is expected to grow at a compound annual growth rate of 6% to $64.6 billion by 2023. Emerging markets represented by China and the Middle East will be the main driving force of this growth.

According to the National Medical Products Administration, the number of domestic cosmetics filings fell sharply from January to April this year compared to the same period last year due to COVID-19, but the number of imported cosmetics filings has significantly increased. The year-on-year growth rate was 83% in February and 92% in March and, although it slowed down in April, it still reached 40%. As for the Luxe.CO publication, 6,955 cosmetics products with a Chinese name containing "perfume" have been imported, and 364 products have been filed since January 2020.

Physical Stores Have Become the Forefront of the Battlefield of Perfume Brands

Regardless of the establishment of the brand image or the characteristics of the product trial, the physical channel is the battlefield of perfume brands. From a global perspective, luxury brands were sensitive to the market demand at the very early stage, so they have successively opened independent stores selling only perfumes:

- Chanel opened an independent perfume store, Espace Parfum in Suria, KLCC shopping mall in Kuala Lumpur, Malaysia in 2014.

- HermУЈs opened a perfume museum in Lower Manhattan, New York, USA in 2015, with a focus on displaying all the brandтs perfumes, from classic to niche.

- Tiffany opened the world's first new concept retail store for perfumes in Covent Garden, London, England in 2018, with the introduction of a perfume vending machine. The brand's first independent perfume store was established in Joy City, Beijing in October of the same year.

- Dior opened the brand's first independent perfume boutique at Londonтs Heathrow Airport, UK in 2019.

- CELINE opened its first independent perfume boutique in Saint-HonorУЉ, Paris, France in 2019.

Some well-known niche perfume brands began to enter the Chinese market at about the same time:

- Italian niche perfume brand, Acqua di Parma of the LVMH Group, opened its first store in Mainland China at Nanjing Deji Plaza in 2013.

- French independent niche perfume brand, Diptyque, entered the Chinese market and opened first store in Hong Kong IFC in 2014. It opened its first store in mainland China in 2015 and currently has 8 retail outlets there. It also has plans to expand its online business this year.

- Jo Malone London, the niche perfume brand of the Estee Lauder Group, opened its first store in mainland China in Shin Kong Place, Beijing in 2015.

- French cologne brand, Atelier Cologne, was acquired by the LтOrУЉal Group, and began to expand at full speed in the Chinese market, opening its first boutique in HKRI Taikoo Hui, Shanghai in 2017.

- London niche perfume brand, Miller Harris, and Swedish salon perfume brand, BYREDO, entered Mainland China in 2019 and located their first stores in Shanghai.

- The first stores of French niche perfume brand, Kilian, and Editions de Parfums FrУЉdУЉric Malle in mainland China will be established in 2020, Т in IFC, Shanghai followed by SKP in Beijing.

The competition among perfume brands in the Chinese market has become increasingly fierce in recent years, and major brands have launched one after another exhibitions in China to deepen their awareness in consumers' minds. These exhibitions include the Editions de Parfums FrУЉdУЉric Malle limited-time perfume art exhibition in June this year, the Diptyque Smell Journey perfume art exhibition in April 2019, the Chanel NТА5 special exhibition in Shanghai in April 2019, and Jo Malone Londonтs тXun Xiangт theme exhibition in March 2018.

As the front line of the battlefield of major perfume brands, physical stores are constantly being upgraded and optimized, with store style, product packaging, and fragrance interaction becoming the competition priorities of major brands.

One of Three Keywords of Perfume Stores - Store Style

The niche perfume brands, Kilian and Editions de Parfums FrУЉdУЉric Malle, used completely different styles for their first stores in China. When stepping into the Kilian store, the luxurious ArtDeco style gave the first impression of the brand. Although founder, Kilian Hennessy, rarely promotes the brand as heir to the Hennessy family, the counters inspired by a bar top and perfume bottles inspired by wine bottles closely connect the brand with keywords like "brewing" culture and luxury.

The Editions de Parfums FrУЉdУЉric Malle store is simple and modern in style, and more like a private professional perfume laboratory, demonstrating brand founder, FrУЉdУЉric Malleтs idea that exploring perfume is a very personal experience.

The Miller Harris store has a modern feeling generated by the metallic luster of the store shelves and the decorative mirror. The green flowers hanging from the top of the head also add natural elements and create a dreamy, fragrant garden with a nostalgic atmosphere.

One of Three Keywords of Perfume Stores - Product Packaging

Perfume packaging, especially perfume bottles, is key to attracting consumers visually. For example, the outer packaging of each bottle of Editions de Parfums FrУЉdУЉric Malle perfume bears the name of the master perfumer. The Guerlain concept boutique also provides customers with a selection of colors and custom engraving services of classic bee-printed bottles to visualize personalized expression.

Besides, the handbags that brands like Miller Harris and Kilian match with their products have also been found to generate good results recently. The Kilian consultant told us that, immediately after the opening of the first store in China, some customers asked if they could purchase the brand's perfume packaging separately. At the same time, since this packaging is sustainable, customers can subsequently purchase perfume refills in the store for long-term use. On the other hand, Miller Harris gives laser-style handbags away when customers purchase a certain amount.

One of Three Keywords of Perfume Stores - Fragrance Test

A fragrance test is the biggest driving force for consumers to enter a physical store and buy a product. it is also the link that enables brands to interact with consumers, which makes it worthwhile for them to invest more. Editions de Parfums FrУЉdУЉric Malle has invested in an exclusive patent device called a Smelling Column for its first store in China. Each independent cabin is devoted to an independent perfume, and the natural essences used to make it are listed on the outside of the cabin door. The back tone of each perfume can be smelled when opening the door. This acts like a dressing mirror, enabling guests to experience the true taste of "wearing" perfume from a third-party perspective.

In this Shanghai IFC store, the brand is specially equipped with the world's first perfume interactive compass. Guided by a perfume consultant, customers can answer three questions to obtain the brand's recommended personalized perfume.

The Swedish niche fragrance brand, BYREDO, which entered Beijing SKP-S at the end of 2019, has established a special test scene in the store which simulates a human landing on Mars. At the entrance of the brand's store, there is a large glass cabin containing a huge "volcanic rock" filled with perfume. Customers need to open the glove on the door to take the test. This is a novel Т and interesting exploration process.

Comments