IN-DEPTH | What We Can Learn From Louis Vuitton and Nikeтs First Live Streaming Experience In China?

March 31,2020

At 8pm on March 26, Louis Vuitton and Nike launched live streams on Little Red Book and Taobao, respectively. It is reported that more than 15,000 people watched Louis Vuitton's live stream, and fans of the brands on Little Red Book increased by 10% after the broadcast. More than 2.78 million people watched Nike Air Max Day live.

The emergence of these two leading brands on the live streaming platform has refreshed people's imagination of the traditional live streaming industry -- it is expected that traditional e-commerce platforms, content e-commerce platforms or MCN agencies will continue to accelerate their bets on the live streaming industry. These two benchmark brands in the field of luxury and sports fashion have dared to be the first to test the water and set an example for more fashion brands.

Before the Covid-19 outbreak, the public impression of live streaming e-commerce (as in the cases of Austin Li and Viyaaa) was built around exclusive limited-time discounts. After the outbreak of the epidemic, as the brand types participating in live streaming became more diverse, the functions of live streaming were no longer limited to promoting or recommending products and influencing potential buyers. The audience also shifted from extremely price-sensitive consumers to those who can afford higher unit prices.

In this paper, we will discuss the application and prospects of live streaming for luxury and fashion brands through brand case studies across four categories: international luxury brands, international sports brands, major Chinese fashion brands, and Chinese independent designer brands.

International Luxury Brands:

- Offline: Mainly physical stores, limited in number.

- Online: With self-owned e-commerce as the main channel, traditional e-commerce as the auxiliary.

- Live streaming content: Mainly show activities, focusing on the brand image display.

- Live streaming channels: Weibo live stream, Little Red Book live stream.

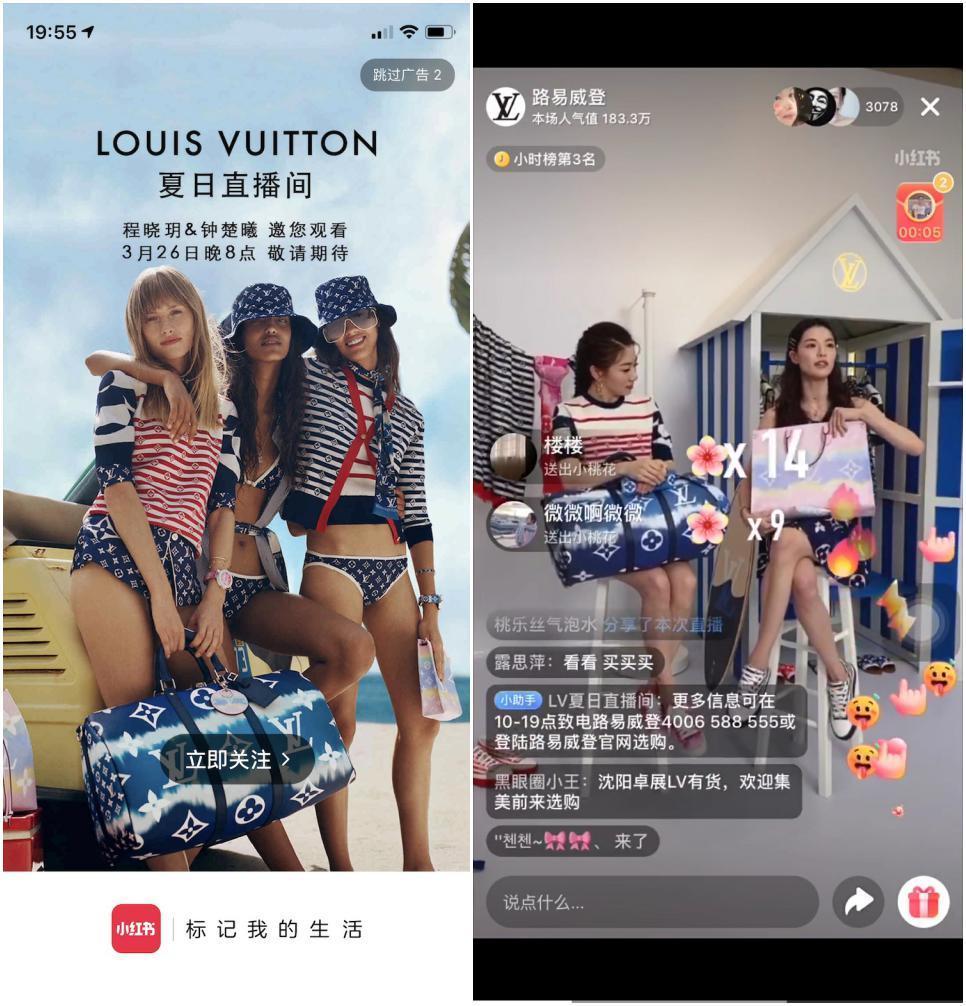

Brand Case Study: LOUIS VUITTON

Key Question: How Do We Transfer Brand Focus to Product Focus Properly, Without Damaging Brand Image?

On March 26, LOUIS VUITTON hosted its first official live stream on Little Red Book. This was the brandтs first live stream on a Chinese social media platform, and the first luxury brand to do so on the Little Red Book platform.

The LOUIS VUITTON live stream invited Chinese actress Elane Zhong (Zhong Chuxi) and Chinese artist Yvonne Ching to display the Summer Collection at their flagship store at Shanghaiтs Plaza 66.. Elane Zhong and Yvonne Ching have 197,000 and 1,022,900 fans respectively on Т Little Red Book.

The use of celebrities as live streaming anchors has attracted many fans, and some fans record the live streams to send to more social media. More than 15,000 people watched the live streaming that night, with an interaction rate reaching 33%, and the popularity value exceeding six million. The whole live stream stayed in the top three of the live streaming list, and occupied first place many times.

LOUIS VUITTON opened its Little Red Book account in May 2019, the first luxury brand to enter the platform, and has more than 130,000 fans. It is reported that after this live stream, the brand will cooperate with the fashion KOL of Little Red Book, Chen Baiyang, on April 1.

Brand Case Study: TAG Heuer

Key Point: To Test Whether Live Streaming is Suitable for High-End Brands, Especially for Those Products Demanding a High Level of Knowledge.

On March 24, TAG Heuer, a high-end watch brand owned by LVMH Group, launched a new Connected smartwatch through two online platforms, Tencent Kandian live stream platform and Taobao Live.

Geneva Watches & Wonders and Baselworld Watch And Jewelry Show were canceled due to the Coronavirus outbreak. Although instances of luxury brands using live streaming have become very common, the idea of high-end watch brands using live streaming to release new products is still very new.

The whole live stream event on Tencent Kandian lasted about an hour. For the first half-hour, a promotional video for the new Connected smartwatch was played on loop. In the last half hour of the event, the anchor demonstrated and explained the product features, functions, design and details for the camera.

The whole Taobao live streaming lasted about two hours. In the first 15 minutes, the new Connected smartwatch promotional video was also repeatedly played. In addition to the detailed display of product functions, the brand anchor and the influencer also introduced the brandтs background, culture, product design, function and characteristics to the audience. There were about 100,000 people watching this Taobao live stream.

Compared with a clothing live stream, the audience who watched the TAG Heuer live stream were more technically-minded. Anchors answered a lot of user questions about the difficulty of choosing a watch, including questions on whether a smartwatch is suitable for formal business occasions. Anchors also taught the audience how to set the dial display mode, to better meet the needs of different occasions.

From this point of view, high precision products such as watches do need to come with Т professional meticulous guidance and explanation to make it easier for consumers to understand and ultimately make the purchase. Live streaming does not necessarily mean that clientsт technical queries will be answered without visting offline physical stores. However, for such products with higher unit prices, many viewers said they expected to be able to try them on in offline stores.

International Sports Brands:

- Offline: Mainly physical stores, with the number of such stores more widely distributed.

- Online: With traditional e-commerce as the driving force , self-own e-commerce in a support role .

- Live streaming content: Mainly to launch new products as an opportunity to promote sales

- Live streaming channels: Taobao Live, Tencent Kandian Live, TikTok.

Brand Case Study: Nike

Key Question: How to Exceed User Expectations When Buying Products or Connecting Т with Brand Culture

Nike has pushed the following contents in different live stream platforms: Taobao live--new product release; Tencent Kandian Live -- fitness live classes; TikTok -- fitness live classes.

On March 26, Nike hosted its Nike Air Max Day event with an impressive lineup, content, and format. The live stream lasted three and a half hours. In the first half, there were three talks and interactions with more than ten Т special guests, including talk-show actors, fashion influencers, and musicians. It is clear that Nike had considered the viewing needs of different types of users by inviting celebrities, bloggers, media, sneaker collectors, stylists and so on.

A number of games were set up in the event, such as the Air Max shoe quiz, blind box guess, voting interactive session -- indeed, it seemed at times that the audience was watching a variety show! In the middle of the broadcast, the brand invited star Wang Yibo to complete the unpacking of new products. However, the three-and-a-half-hour live stream still challenged the patience of many users: from ten o'clock, a large number of netizens were too sleepy, and gradually lost patience. Even so, under the huge influence of the Nike brand, the live stream attracted 2.786 million views, with some netizens commenting: "In order to watch the live stream, I specially downloaded the Taobao app."

Nike has chosen to focus on fitness classes on TikTok and Tencent Kandian Live to build its brand image and enhance user communication. For example, there are 70,000 fans following Nike on TikTok, and the latest live stream of a "special basketball game" has been upvoted 45,800 times. The content is an online tournament between basketball masters, providing tips for home training. The brand cooperated with Tencent Kandian Live to launch live fitness courses, so that users can enjoy the fitness guidance of professional coaches at home during the epidemic period.It received a wave of positive comments.

Major Chinese Fashion Brands

- Offline: Mainly physical stores, more widely distributed.

- Online: With traditional e-commerce as the driving force , self-own e-commerce is rare.

- Live streaming content: Retail store sales self-run live stream, fashion show and new product launch to build brand image.

- Live streaming channels: Complete coverage.

Brand Case Study: Peacebird

Key Point: The Relationship Between Manpower and Products in Live Streams and Т Т Physical Stores.

Peacebird began to test the waters of Taobao Live in 2016. In 2018, it released its own shopping app, and in 2019, it released the WeChat Mini Program store. When the outbreak came, Peacebird quickly adjusted by dividing into four new teams: the "attracting fans group", "promoting group", "sales group" and "support group". Nearly 10,000 Peacebird stylists and shopping guide staff participated.

Taking the "Queen's Day" from March 5 to 8 as an example, Peacebird live streamed more than 40 times, reaching nearly 1.8 million consumers, with total sales of 246 million yuan. The sales of women's clothing alone exceeded 100 million yuan, and half of the sales came from the WeChat Mini Program, social media platforms, live stream e-commerce, and other new retail methods.

Brand Case Study: Ellasay

Key Question: How to Deliver More Practical Information and Services to Users Through Live Broadcasting (Such as Styling or One-to-One eExclusive Customer Service)

On March 18, Ellasay held a live stream with the theme of "what flower print suits you?", hosted by a brand stylist with two fashion designers as guests. The event lasted about two Т hours. The brand stylist recommended products and showed the audience how to wear them according to the two guestsт style, skin color, and figure.,. During the event, the anchor also encouraged the audience to follow the brand live stream channel, WeChat public account, and Little Red Book account.

In addition, at 8pm on March 23, Ellasay presented an " Online Fashion Show" on Т Tencent Kandian Live, combining offline reality shows with online virtual technology. While watching the fashion show, the audience was able to connect with fashion bloggers and designers, and get professional analysis and comments. Ellasay also provided customers with the opportunity to buy on the spot with one-to-one exclusive customer service. The show was viewed more than 60,000 times in half an hour.

Chinese Independent Designer Brands

- Offline: Physical stores (especially multi-brand boutiques) are the main focus, with a limited Т number of stores and regions..

- Online: Traditional e-commerce was dominant, but with relatively modest results .

- Live streaming content: To explain the product, design concept and brand story,

- Live streaming channels: Taobao Live, SECOO Live.

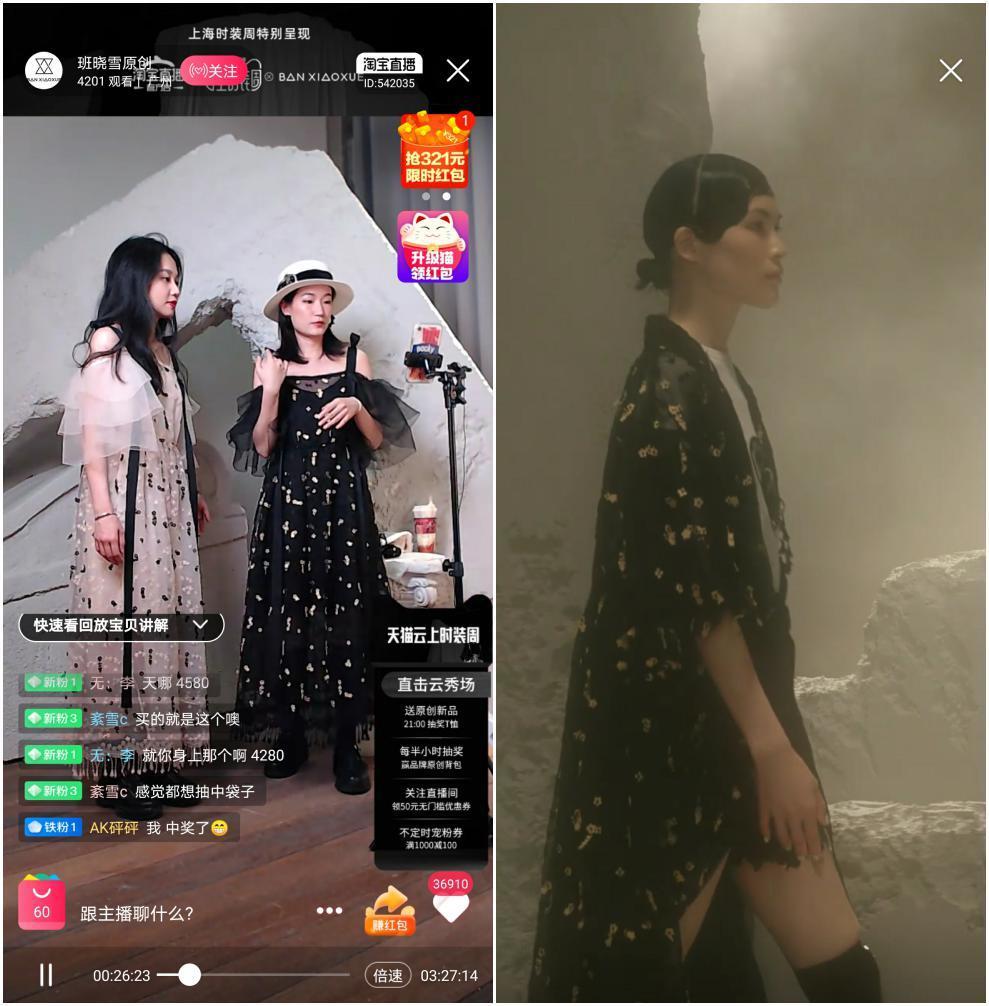

Brand Case Study: BAN XIAOXUE, YEтS BY YESIR

Key Question: How to Leverage Higher Aesthetic Standards and More Ingenious Ideas to Design and Create a Better Live Streaming User Experience

From March 24 to 30 Shanghai Fashion Week held the world's first "online fashion week" jointly with Tmall.. A number of local Chinese designer brands were showcased on Taobao Live.

The designer brand YE's BY YESIR live streamed on Taobao and Secoo.. Take Taobao Live as an example. As it was the first time for a niche designer brand to appear, the brand chose a super-long format that lasted from 10am to 10pm. The total number of users reached 1,980, including 1,452 new users and 528 old users. The longest viewing time among all users was Т three hours, and a total of 50 people made post-live stream purchases (split between new and existing Т customers in a ratio of 3:2). A total of 304 styles were displayed on Taobao Live, and 40 styles were successfully sold.

The biggest surprise of the YEтS BY YESIR live stream was the construction of the set. According to the brand, it was in the company's second-floor warehouse, with the stock of fabrics building a depth of field effect in the studio. The total cost of the set was about 10,000 yuan.

At present, the brandтs Taobao live stream is mainly focused on attracting new customers, increasing the number of visitors and attention to the store. For previous customers, each product will have a post-live stream replay, which they can also watch.

Designer brand BAN XIAOXUE showcased the brand's summer 2020 collection on Taobao Live. The three-and-a-half hour live stream on Taobao attracted 3,101 viewers. In the future, the brand may try TikTok.

As the live streaming continues to trend upward, many fashion brands have seized the opportunity to taste the benefits. Some beauty brands are even reportedly ready to set up their own influencer department. Live streaming has become a new sales channel for brands that sparks shoppersт enthusiasm, similar to traditional physical stores. Further, as live streaming has become a platform for brands to face users directly, it can also build awareness and deepen curiosity around brands.

Luxe.CO Thoughts:

- From the perspective of product design, live streaming enables us to observe more clearly that consumers have a strong desire to understand products and dressing styles.

- From the perspective of brand content, live streaming reminds us that we must pay attention to long-term accumulation of brand assets. Only more high-quality content can support the lasting output of the brand and leverage more users and sales. For example, whether one looks at fashion shows, design concepts, or brand story, the key is using live streaming to form a stronger brand stickiness for users.

- From the perspective of brand users, live streaming gives many brands more confidence as about such concerns as whether the brand should build its own app outside of various social media platforms, and what logic should be used to design the relationship between the private domain and public domain of the brand. When the Coronavirus outbreak forced Nike to temporarily close about 75 percent of its own stores and partner stores in China, the Nike Training Club App saw an astonishing increase in enrollment and participation in China. From the beginning of December through the end of February, the number of weekly active users on all of Nike's sports apps increased 80%.

| Photo Credit: Brands' WeChat Official Accounts & Live streaming

| Editor: LeZhi

Comments