Luxe.CO Exclusive: т2017 Chinese Fashion Consumer Reportт

July 10,2017

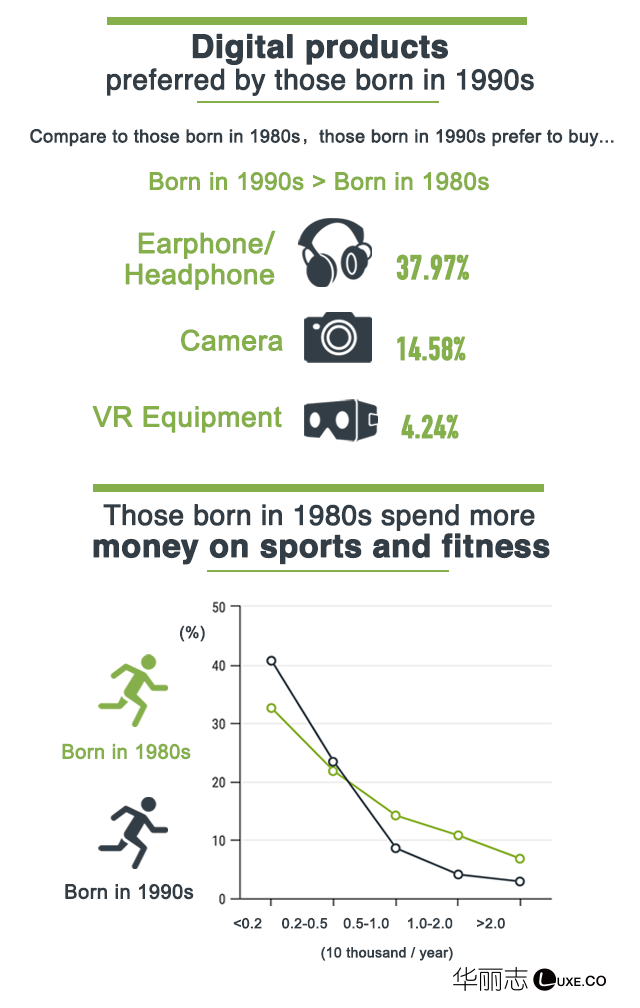

Globalization and digitalization are major unstoppable trends for any industry, and luxury and fashion retail are no exception. In China, young and curious consumers born in the 1980s and 1990s are the first to embrace and enjoy these trends.

As Chinaтs most authentic and influential fashion business media, Luxe.CO has an accurate grasp of middle to high-end consumers in China based on extensive research. TowardsТ the end of 2015, Luxe.CO released the first тChinese Fashion Consumer Reportт. This professional report, with its extensiveТ and accurateТ data set, was well received within the fashion industry.

This year,Т Luxe.COтs exclusive report т2017 Chinese Fashion Consumer Reportт is available in both Chinese and English for the reference of global industry insiders. The report provides an comprehensive understanding of the behaviours and preferences of middle to high-end consumers in China, the demographic that is key to grasping the opportunity of Chinaтs growing fashion market.

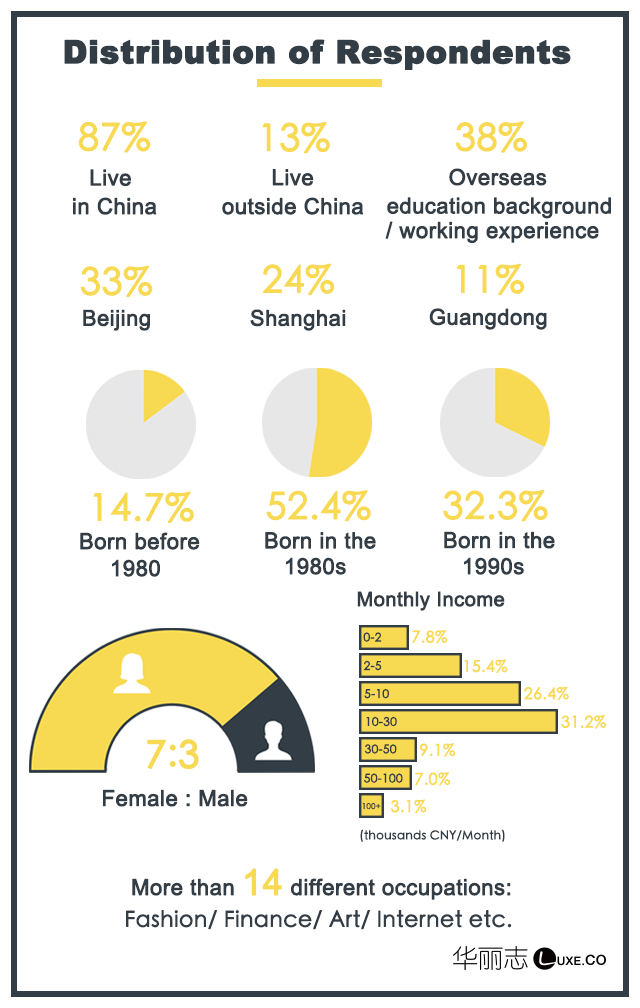

The survey underlying the report was conducted over the Internet with questionnaires, using controlled node distribution. TotalТ 1816 respondents have participated in this survey.

A wide range of respondents are covered, including first and second-tier city residents and overseas Chinese, with the high income 1980s generation as the main body.

With the rise of the Internet, young Chinese consumers receive global fashion news and brandТ information more and faster than ever before. Benefiting from Chinaтs advanced e-commerce and delivery network, Chinese consumers are practicing almost every day in the way of "get to know a brand"-"buy new brand", more and more global luxury andТ fashion brand and their productsТ are becoming visible and readily available. The aesthetics of mid and high income consumers in China, their awareness of global trends, identification with brand names, and taste are changing quickly and becoming elevated.

Fashion Consumption Returning to Rationality

According to Luxe.COтs report, consumer attitudes in the 1980s and 1990s generations of medium to high-income consumers are growing more rational.

- 55% of respondents are willing to try niche or new brands

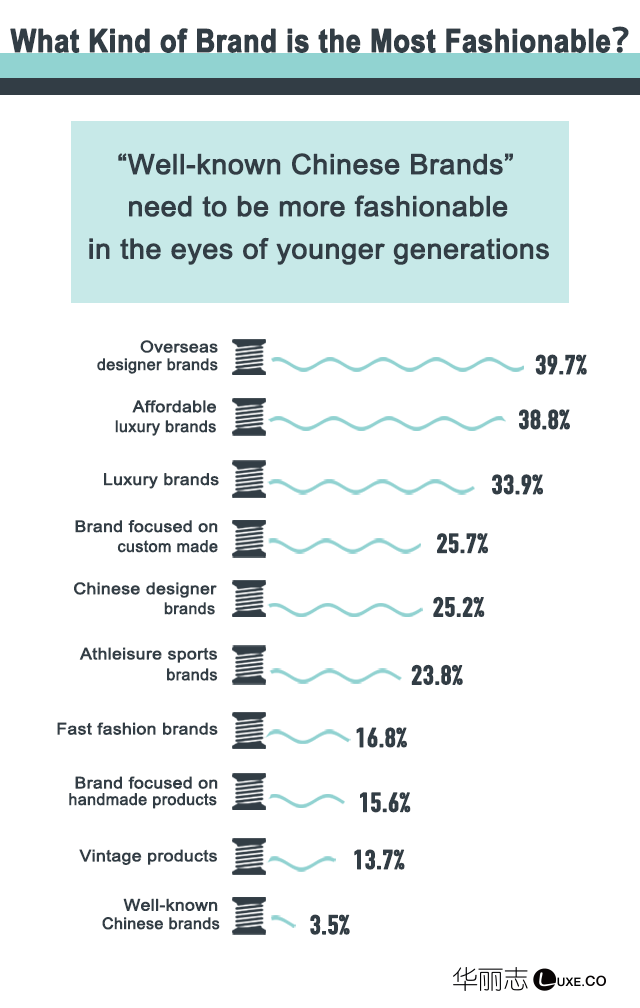

- тOverseas designer brandsт are perceived as the most fashionable brand category, especially to the post-80s generation

- 43% of respondents among the 90s generation deem тaffordable luxuryт more fashionable

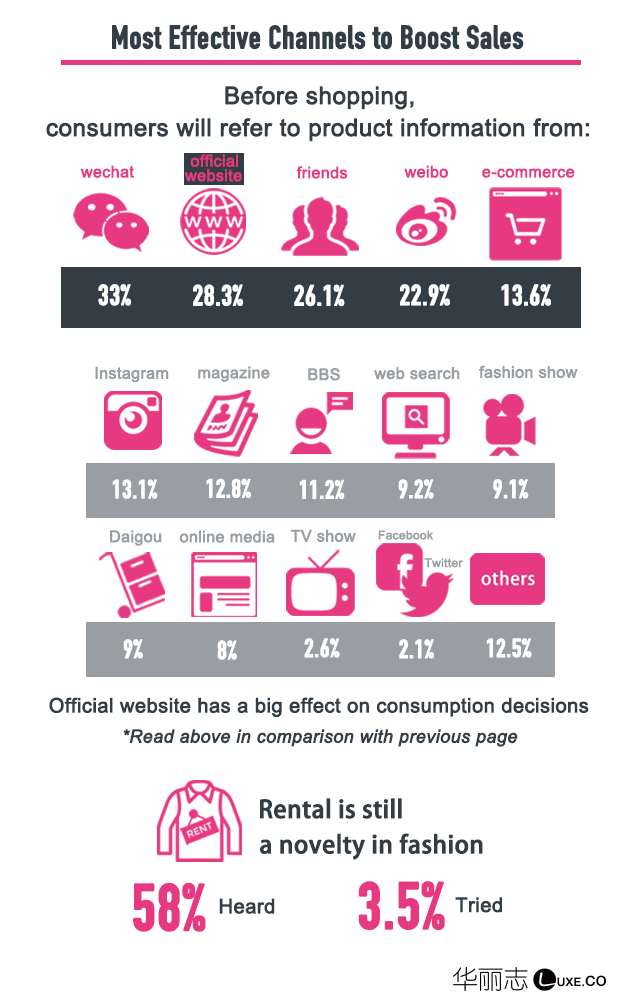

- 58% respondents begin to learn about тfashion rentalт

In China, consumers are actively or passively learning numbers of new native and overseas fashion brands on a daily basis. Various forces are behind the new brandsт promotion, for instance, celebrity or key opinion leadersт personal choice, professional buyers or Showroomтs effort, Chinese capitalтs acquisition, sales via e-commerce platforms of all scales and purchase agents, coverage by fashion media, and fast spread on various social media.

Young consumersт understanding of fashion and their purchase behaviour are going global. With Chinese consumers now choosing products for personal taste, not simply because theyтre expensive or prominent, there is a window of opportunity for overseas brands to enter China. At the same time, consumersт ability to distinguish new brands is growing stronger. The report shows that more and more consumers learn about fashion brands through their official websites.

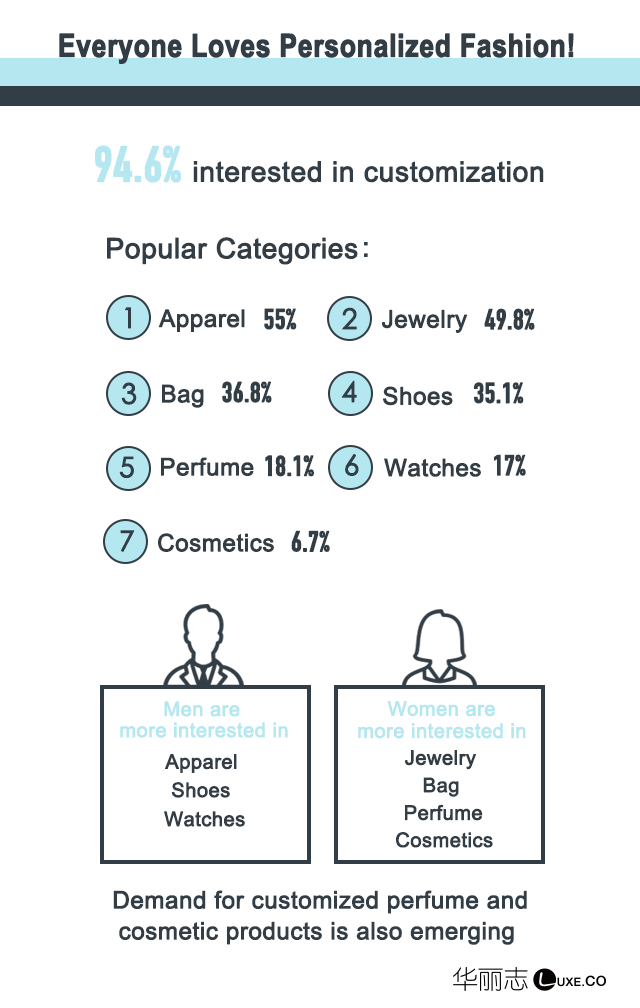

Everyone Loves Personalization with Demands of Customisation Fully Explode

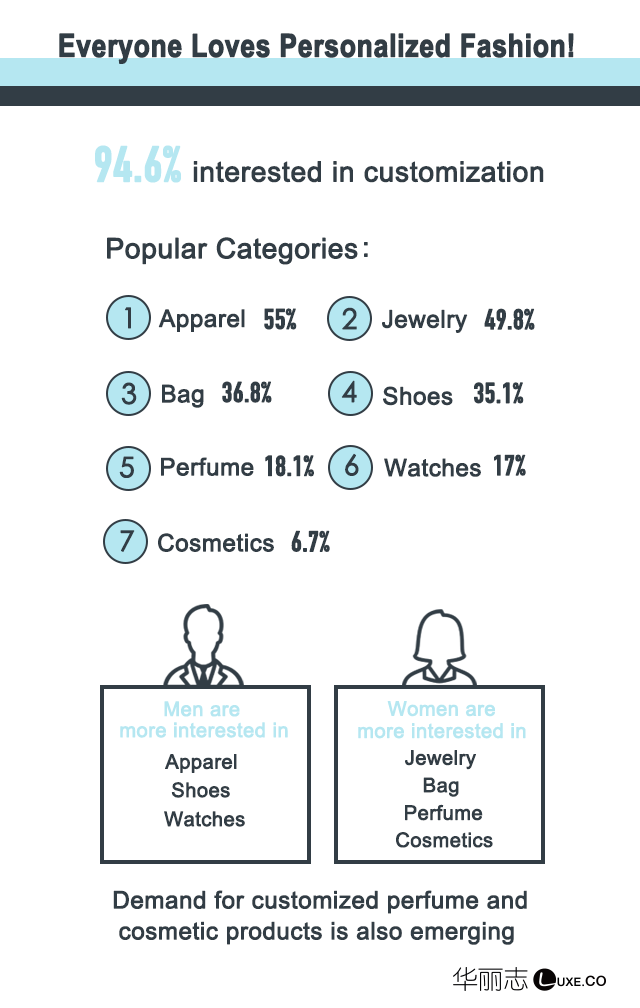

The report shows that nearly 95% of respondents expressed interest in customised fashion

- 55% of respondents are interested in customised fashion

- The percentage interested in customised jewellry, handbags and footwear are 50%, 37% and 35%, respectively

- There is also interest in customised fragrance and cosmetics, taking up 18% and 7%, respectively

From a global view, big brands are putting more and more effort into customised service: Swedenтs fast fashion brand H&M has invested in fashion brand Ivyreyel, who cooperated with Google in developing an app named Coded Couture, that can design clothes based on usersт lifestyle and preference; to cater to the demands in the field of cosmetics, in early this year, the US branch of Japanese cosmetics giant Shiseido announced the acquisition of California makeup startup company MATCHCo; at the same time, customisation has become another driving force of fragrance sales, especially in the luxury industry.

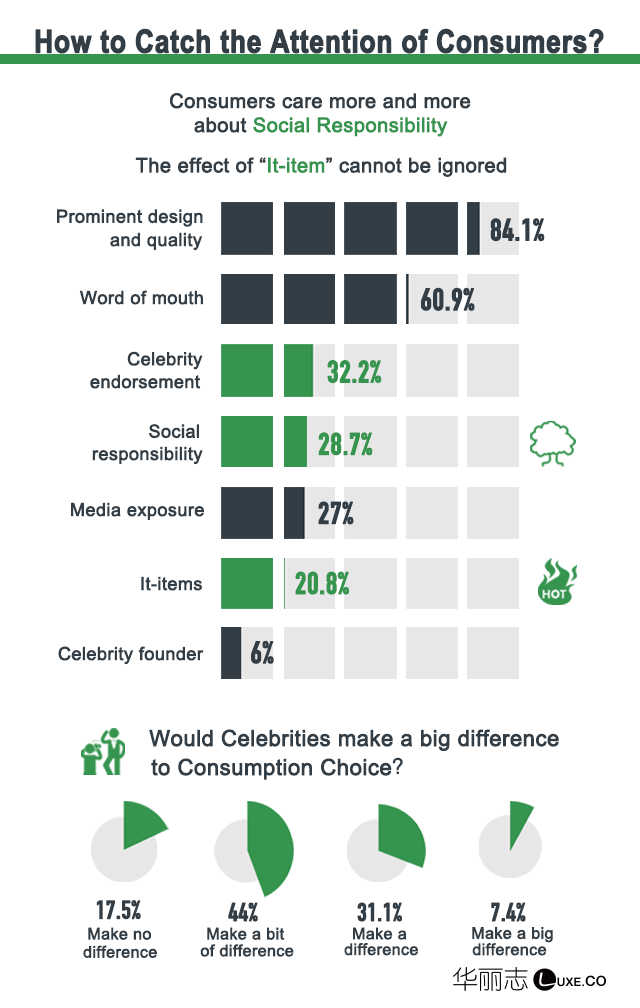

How luxury brands retain and recalled consumers?

In recent years, China has been a key market in the strategy of global luxury brands. As Chinese consumers have matured, brands have entered a challenging new phase of growth.

Since the last half of 2016, the Chinese luxury fashion industry has shown signs of recovery. Various luxury brands have adjusted their pricing, updated their store image, while starting to target a younger audience with its products, marketing strategy and the expansion to e-commerce sales channels. All are timely responses based on accurate understanding of consumersт attitude and behavior. The direct results of these measures are an increased flow of luxury good to China from abroad.

According to the report:

- 17% of respondents have made more purchase of luxury goods

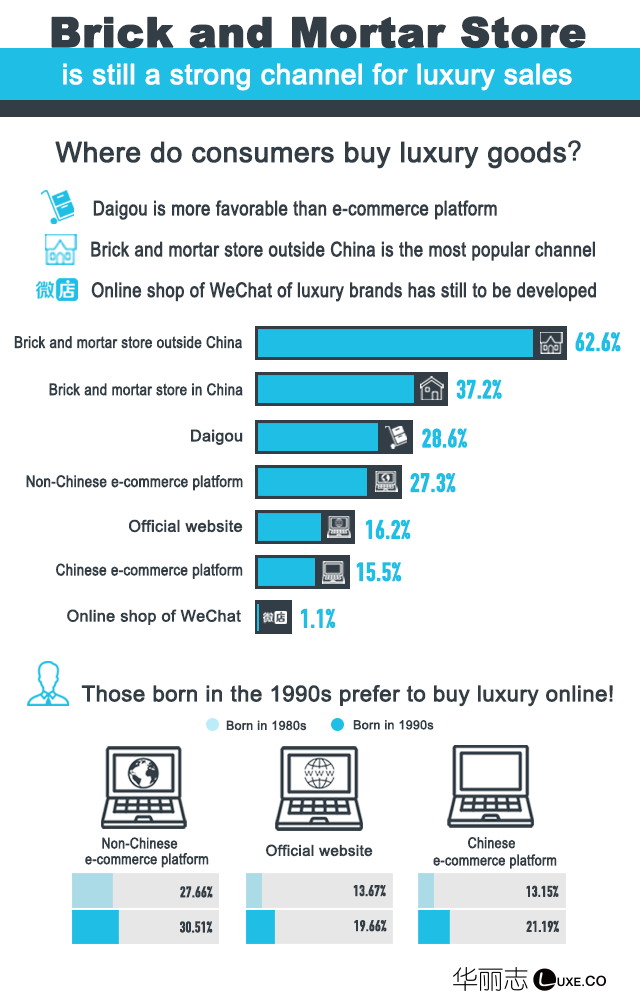

- 35% of respondents prefer physical stores (overseas and in China) when making a purchase of luxury goods; physical stores are still a strong retail channel for luxury products

- 1% of respondents purchase luxury goods through WeChat stores; compared with the 80s generation, the 90s generation prefers the online sales channel more

According to Luxe.CO analysis, the recovery of the luxury fashion market is not only the result of brandsт efforts, but also the choice of consumers who are increasingly rational. When the halo of worship faded, luxury goods become a normal part of mid- to high-income demographicsт daily consumption. Consumers focus more on the design and quality of the product, the brand culture and service. These rational consumers have raised the bar for brandsт product design, store service, integrity marketing, and retail channels.

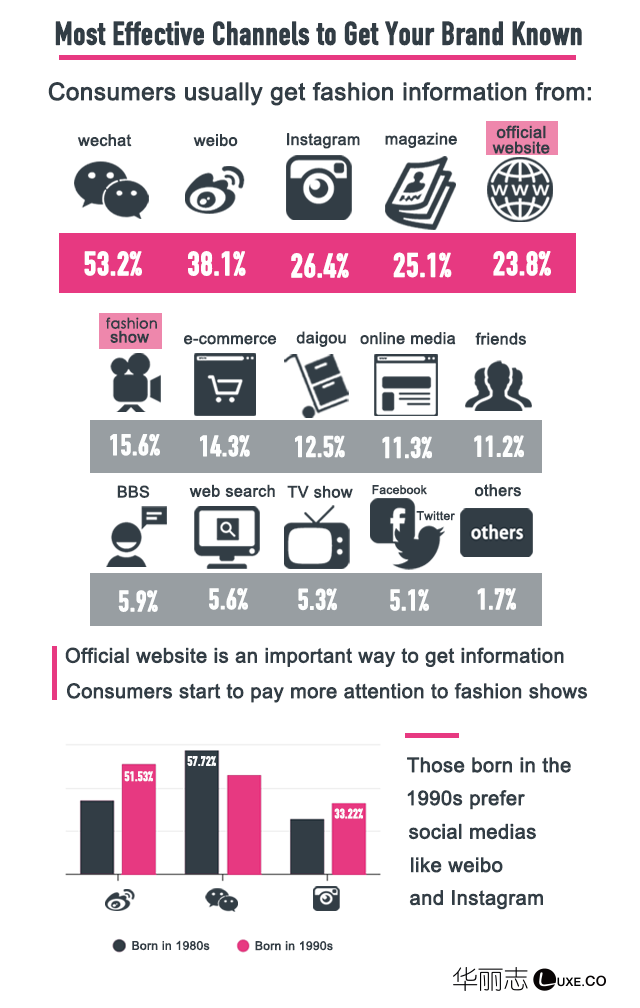

How to Advertise? The Importance of Official Websites &Т Instagram is Growing

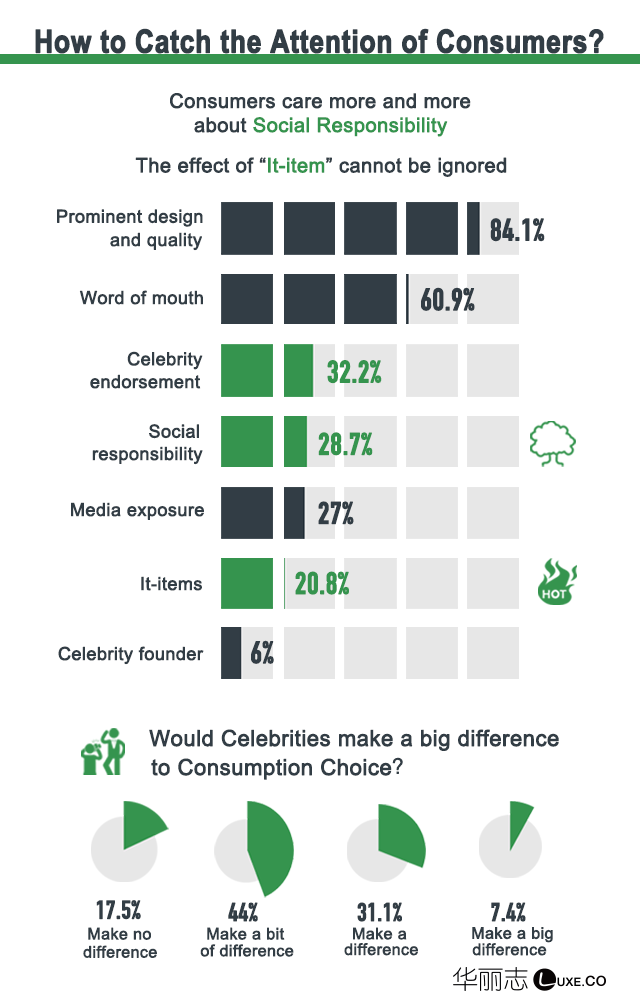

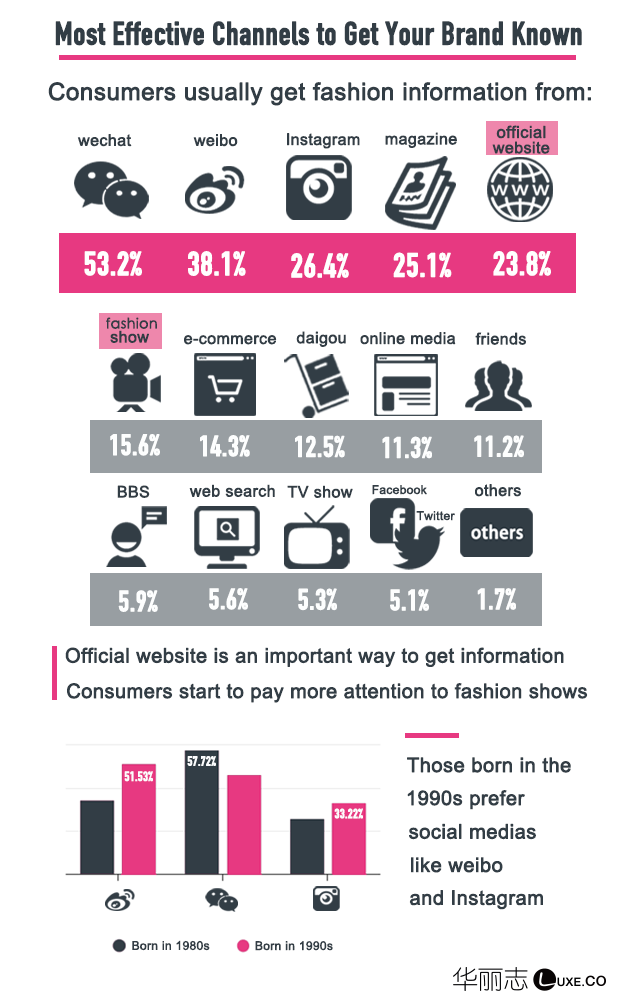

Faced with a rapidly changing media environment, and especially the fickle character of Chinaтs young consumers, fashion brands mostly have the same question: how to attract the young audience? Whatтs the effect of advertising? Whatтs the outcome? Are high priced celebrity endorsements really effective in attracting young consumers?

According to the report:

- 26% of respondents have frequently turned to Instagram to be informed about new trends; among the 90s generation, the percentage is 33%

- 3% of respondents have sifted brandsт official websites for information before making a purchase

It is now critical for fashion brands to build an official channel for communication and sales. For the brands that have not entered China, official channels are the best way for consumers to acquire information. At the same time, for luxury brands, official websites or online stores should be planned as soon as possible.

As Maro Bizzarri, CEO of Gucci, has stated, the luxury market has been difficult to break into because of the high cost of opening physical stores; now that has changed, many new competitors emerged with relatively strong competitive strength gained through their digital channels. Therefore, starting in 2015, Gucci started to update its US official website, followed by its European, Asian sites, and Mainland China sites starting this June. In 2016, Gucciтs online sales have increased by 20%. In 2017, Gucci planned to invest 35% of their entire marketing budget to digital communication, opening an online store for the Chinese mainland in particular.

Early this year, Hermes CEO Axel Dumas announced the brandтs plan to upgrade its official website.

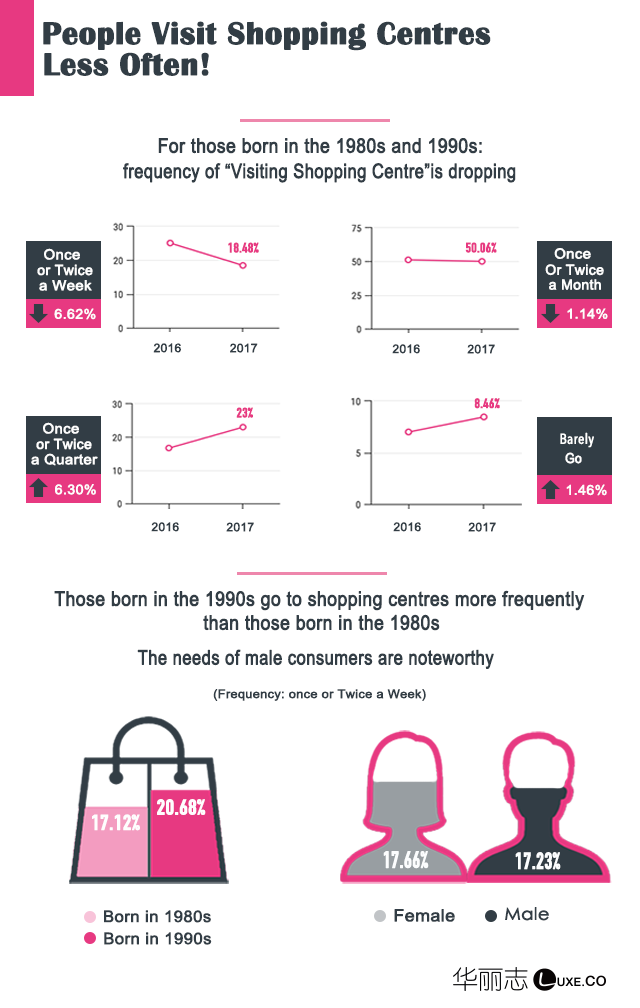

What are the pain points ignored by physical stores?

With the rapid growth of e-commerce, the retailers of China are trying to change. At the same time, retailers are striving to differentiate and explore consumersт interests that they have not yet touched, for instance, should they introduce more niche luxury brands and new brands? How to attract young people to the store and make a purchase? ...

According to the report:

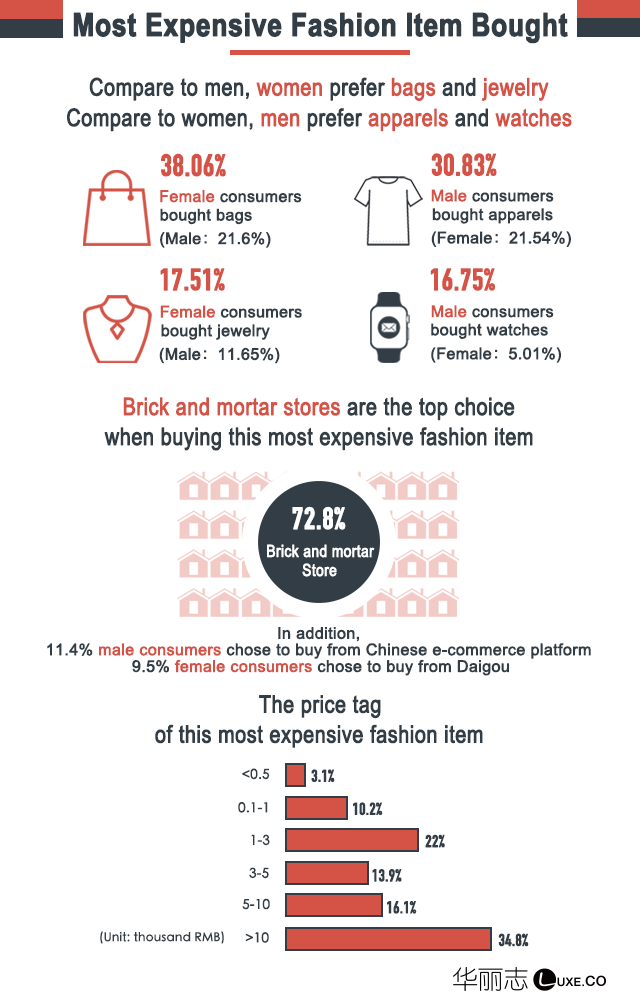

- 8% of respondents said the most expensive pieces of fashion acquired recently were bought in a physical store

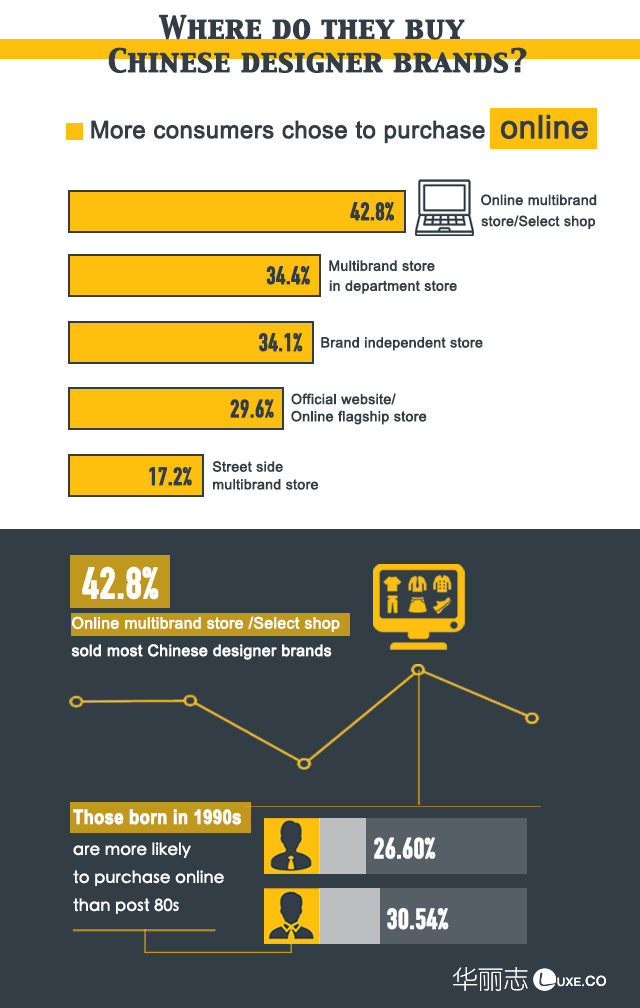

- 4% of respondents have made more purchases of Chinese designer brands in shopping malls than similar shops elsewhere (17.2%)

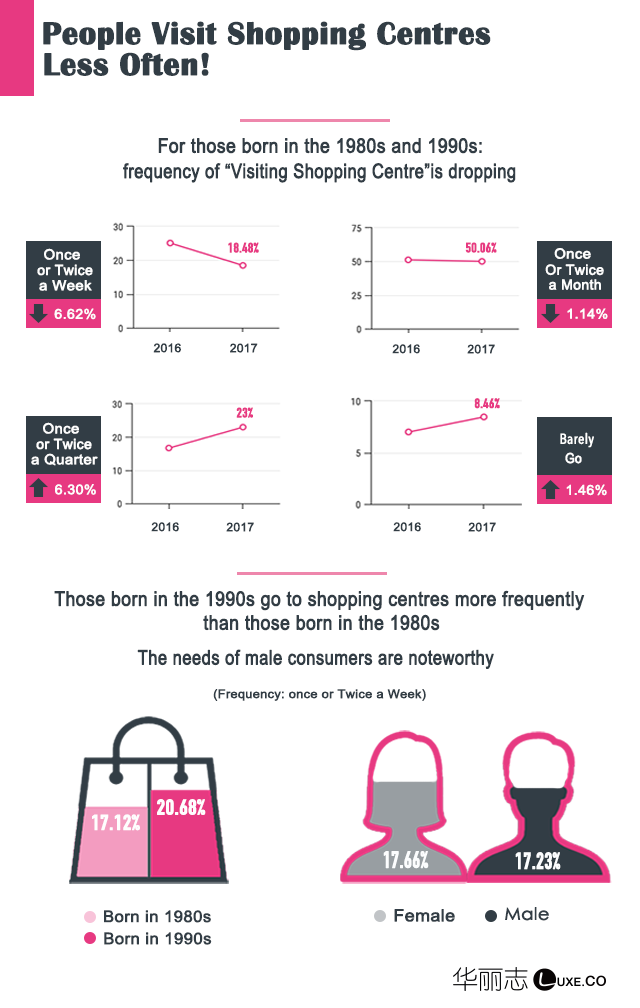

- However, the frequency of the 80s and 90s generation visiting physical stores has dropped. Compared to the report in late 2015, their weekly and monthly frequencies of store visits have all decreased. Many people visit stores once every month. The percentage of those who do not visit stores at all has also increased.

It is worth noticing that male consumers have the same shopping mall visiting frequency as female consumers, in addition, more male consumers prefer to purchase luxury goods in physical stores. Secondly, compared to other brands, young consumers showed a favour of niche overseas designer brands.

Good News and Bad News on Chinese Designer Brands

According to the report:

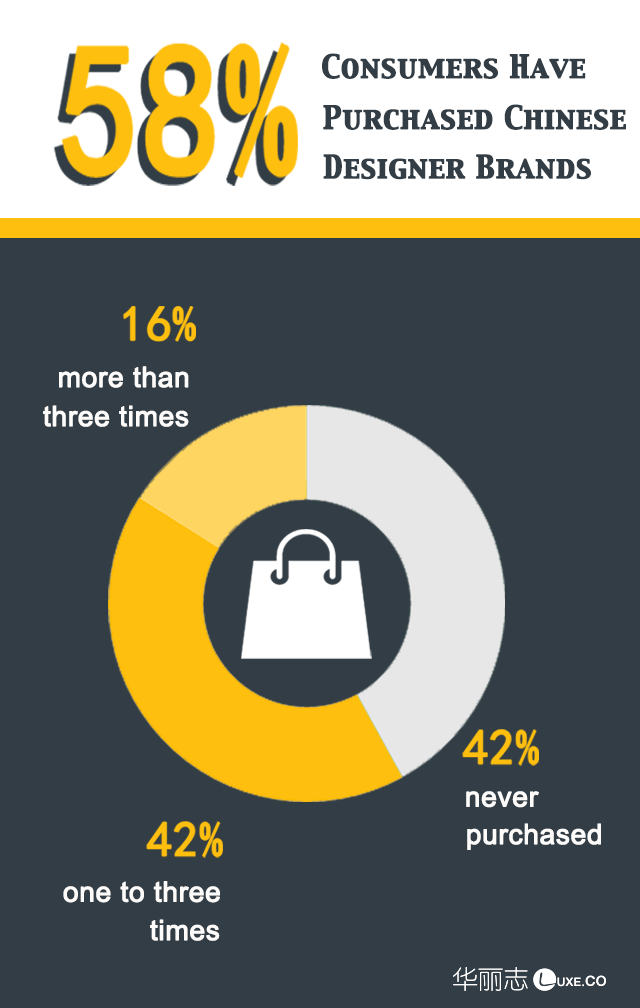

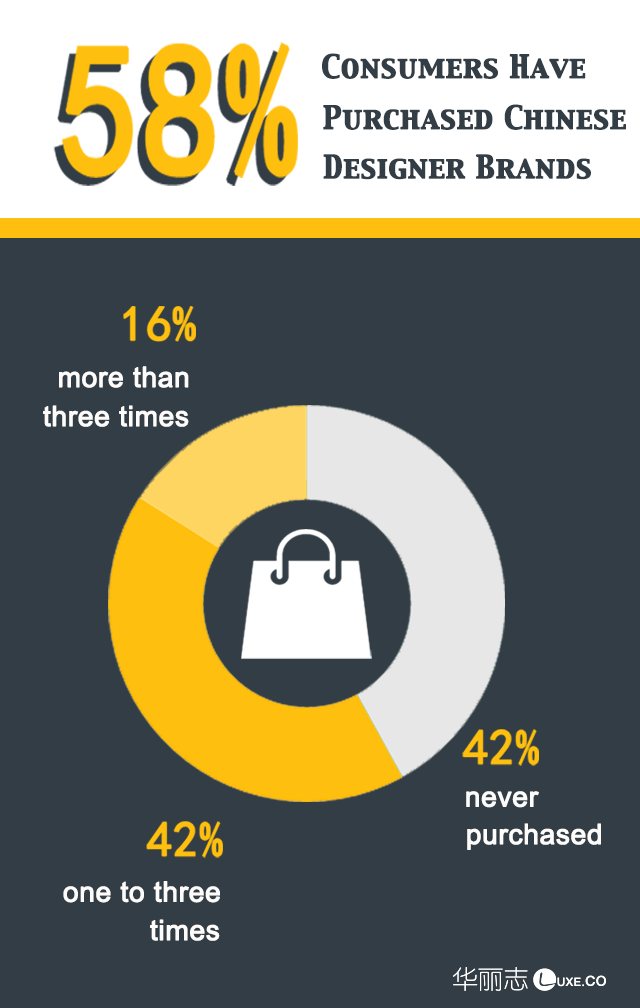

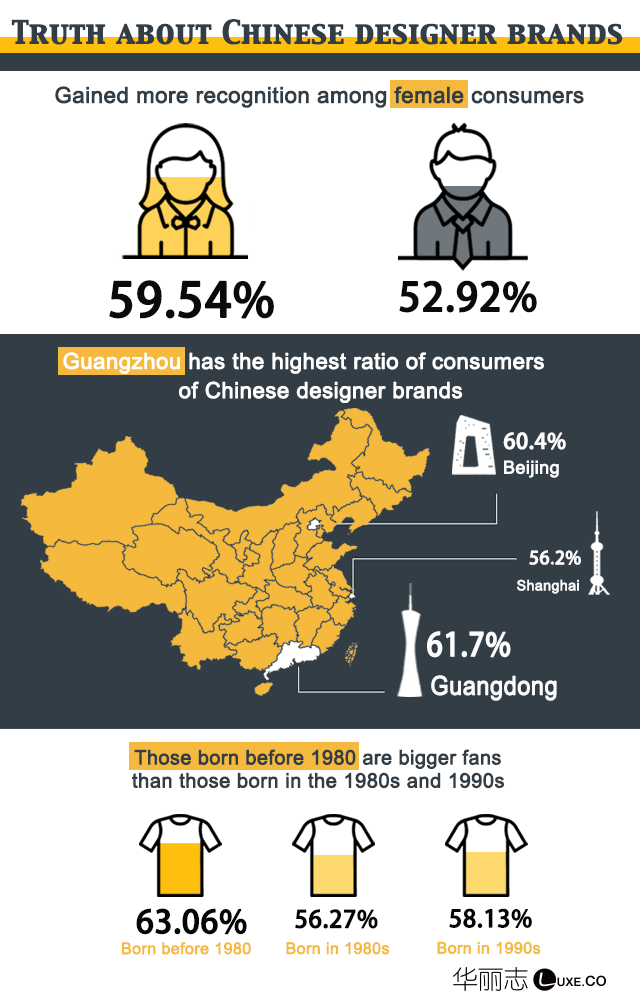

- 58% of respondents have purchased domestic designer brands

- Nearly 70% of respondents have purchased domestic designer brands through online channels

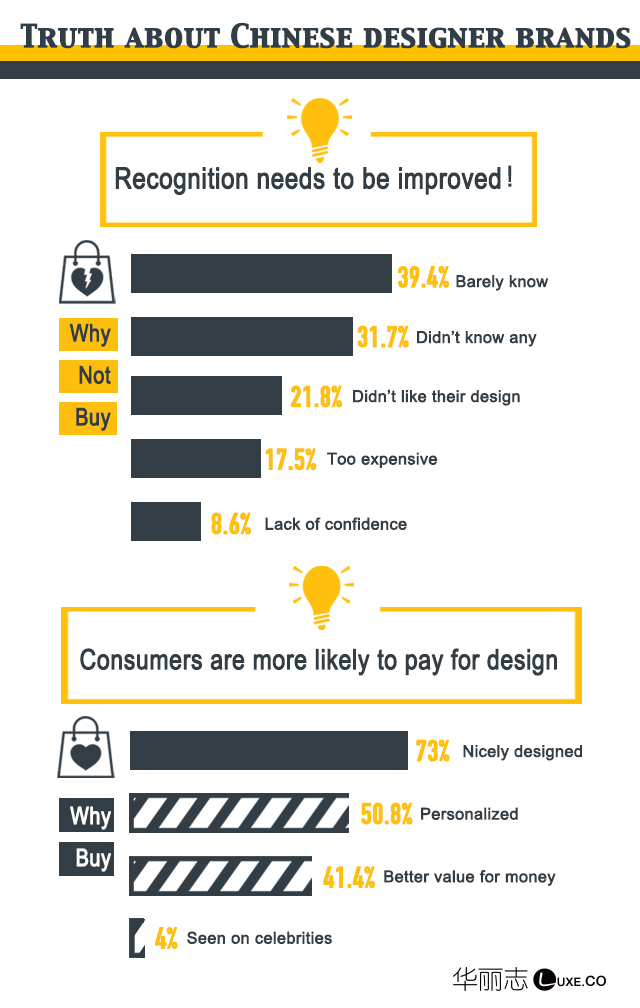

- Over 30% of respondents suggested that they donтt know any designer brands

70%Т percent of respondents are not familiar with Chinese designers, while 21.8% of respondents suggested that they do not like the product design, while 17.5% said their prices are too high. According to "Luxe.COТ China Designer Database"'sТ social media data: the total fans of the 651 designers in the database are only 30 million tillТ the end of 2016.

Most Chinese designer brands were established 3 to 5 years ago or less. They are at a critical moment in the survival or expansion of the brand. Every generation of designers has to learn faster, and with much of Chinaтs fashion industry still immature, they are able to explore with an open mindтexperimenting while receiving feedback from the market, and finding the target audience faster to realize sustained development.

The good news is that Chinese consumers are more open-minded when it comes to niche brands. They are more willing to try new things. Such attitudes are most obvious among the post 90s generation, which provides a firm base for Chinese designer brands to grow and expand.

The completeТ т2017 Chinese Fashion Consumer Reportт is as follows:

Comments