EXCLUSIVE REPORT | Top 12 Investment Trends in Fashion and Lifestyle in China 2019

April 15,2020

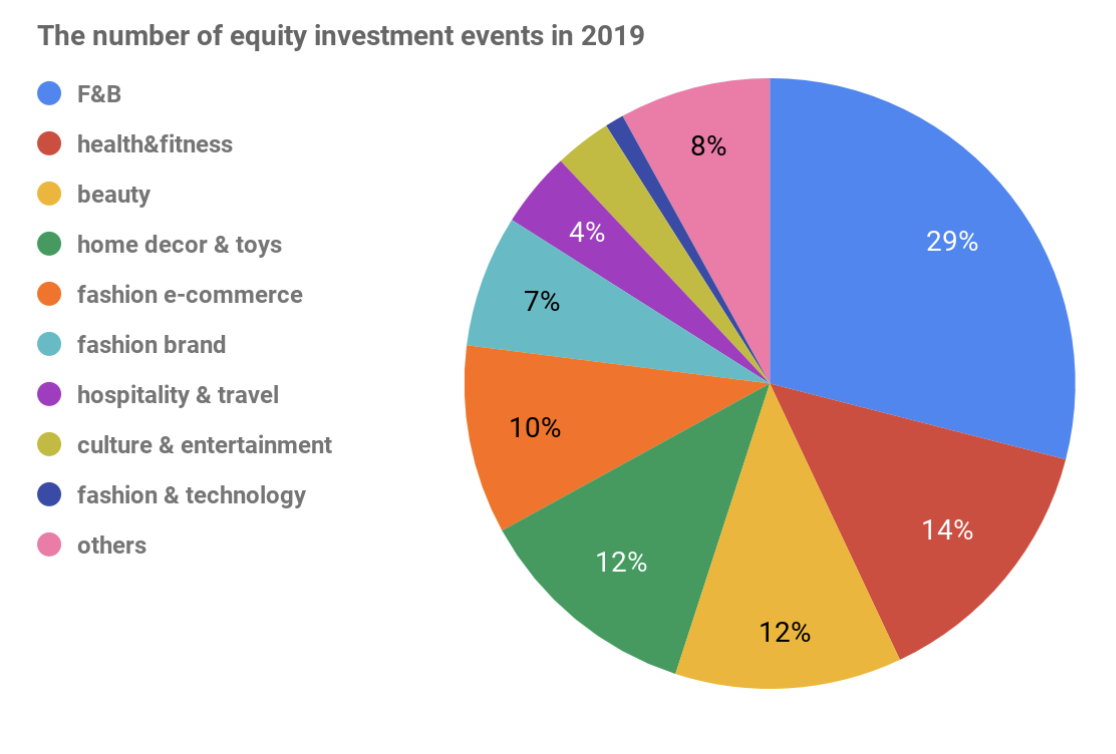

Since 2016, Luxe.CO has regularly compiled investment and financing case studies of the fashion and lifestyle industries in China, including fashion brands, fashion e-commerce, beauty, F&B, health & fitness, hospitality & travel, home decor & toys, culture & entertainment, and fashion & technology, etc., as well as following entrepreneurial projects that aimed to meet the demand of a new generation of consumers.

Over the past four years, Luxe.CO has published a total of 196 issues of China Investment Weekly, which coveredТ 1,115Т investment and financing projects. We published ourТ Annual Exclusive Report on Fashion and Lifestyle Trends in China based on this data. The evolution of fashion consumption trends could clearly be seen by observing the start-up projects that were funded over the past four years. Entrepreneurs and investors are more widely distributed and segmented, reflecting a refinement and differentiation of the needs of a new generation of fashion consumers: for example, Т creative toys (garage kits), innovative tea beverages, and pet products are now moving from the niche to the mainstream market.

Although "consumption upgrade" is a hot topic now, the data shows that domestic fashion and lifestyle investment has decreased over the past four years. In the years 2016, 2017, 2018, 2019, it decreased by 385, 278, 273 and 179 respectively, and it was even worse in 2019, with a 34% drop from 2018, especially for "fashion brands", "fashion e-commerce", "hospitality & travel" and "culture & entertainment" (which dropped by 61%, 63%, 64% and 58% respectively from 2018)! Meanwhile, "F&B" has remained active, followed by "health & fitness". It is worth mentioning that "beauty care" and "home decor & toys" bucked the trend in 2019, and the number of investment projects even surpassed 2018 and 2017.

In terms of investment rounds in 2019, investment in fashion and lifestyle sectors were still concentrated across round A, Angel round, Pre-A/A/A+, and Pre-B/B/B+, which together accounted for more than 80% of investments. Early and mid-stage investments were still the most common choices for capital in fashion and lifestyle. The 12 trends detailed below were Т identified based on the latest layout of capital in China's fashion and lifestyle sectors in 2019.

1. Beauty Industry Chain Expansion

Beauty was the best-performing category in 2019, with 21 projects being funded. PERFECT DIARY may have been the most popular domestic beauty brand in 2019. After a new round of financing led by the Hillhouse Capital Group, followed by Sequoia Capital China and China Media Capital in September 2019, PERFECT DIARY was valued at more than US$1 billion, helping its parent company, Yatsen Global, to become a unicorn. PERFECT DIARY has more than 700 products, which cover the full range of makeup. It has achieved rapid growth by launching KOL on RED (Xiaohongshu), and creating hot styles, etc. PERFECT DIARY became the first Chinese brand to reach the top of the makeup list on Singles' Day, 2019. In addition, Cordmagic (хЏшПЊчІОчО), which was founded in 2018, completed the Angel round and Pre-A round of financing in 2019. Cordmagic is committed to the research and development of anti-aging functional skincare products through biotechnology. MixX laboratory, which was also founded in 2018, is dedicated to meeting the needs of young women between the ages of 18 and 25 with different skin types.

Besides makeup, skincare brands and other beauty projects also gained relative favor in terms of capital, including the high-end beauty collection store, HARMAY. Other examples were Shawya, a cosmetics group that owns several skincare, beauty and cosmeceutical brands; Golong, a beauty brand equity management company that incubates overseas emerging brands; DOCO, an intelligent sonic cleanser brand; and trytry, which provides users with AI skin measurement and customized skincare solutions.

2. Meeting "Personalized Needs" Is The Key To Success For Fashion Brands

The amount of funding for fashion projects in 2019 declined sharply from previous years. However, those that were successful in raising investment suggest that meeting the more specific and "personalized needs" of the new generation of consumers is the key to distinguishing fashion brands.

In October 2019, "NEIWAI", which has built considerable brand recognition and loyalty, completed a Series C financing of 150 million yuan, with a valuation of more than 1 billion yuan. Founded in 2012, it entered the underwear market with unwired underwear, advocating that women "pursue themselves" and "please themselves", and being committed to making underwear that frees people physically and mentally.

In June 2019, the high-end designer sports brand, Particle Fever, completed a Round B financing of nearly 100 million yuan. Founded in 2015, it is committed to designing all kinds of sportswear with an unconventional experimental attitude. Not only does it pay attention to the fashionable sense of the products, but also the technological content and functionality.

In December 2019, the lingerie brand, Berrymelon, received a Pre-A round of investment of 10 million yuan. This brand offers consumers suitable lingerie products that are based on their underwear measurement and a matching system.

In September 2019, the heel brand, 7 or 9, received millions of yuan in the Angel Round of investment. The brand mainly focuses on 7 and 9cm-high heels, and its products are more suited to Asian women's feet, with high elastic air foam added to reduce the footstep burden.

3. Keywords For Food: Single, Taste

Single people have become a group of consumers who cannot be ignored, and their demand has become an important indicator of changes in consumption trends. The new generation of single people are seeking not only speed and convenience, but also health and taste.Т WANGBAOBAO, which was established in 2018, completed the Angel Round, Pre-A round and A round of financing in 2019. Its investors include Source Code Capital, Vertex Venture Holdings, Decent Capital, etc., and its sales are expected to reach 300 million yuan in 2019. The brand mainly focuses on instant cereal. Sales of single cereal, which targets single people, have exceeded 200 million yuan since the product was launched two years ago. While providing products, the brand pays attention to building a Single Culture by including "single" topics in copywriting, posters, advertisements and other publicity. In addition, a number of seasoning brands also received investment in 2019, including the spicy beef sauce brand, ERHE JIAJIA (фКххЋхЋ), and 56 Foods, which has two famous internet sub-brands, "Important Sauce" and "PU XIANGXIANG".

4. Sneaker Culture Is Rapidly Spreading In China, And Sneaker Platforms See Success With Youth

The sneaker culture has developed rapidly in China in recent years, leading to a boom for overseas sneaker online marketplace platforms such as Stadium Goods, Goat and Stockx.Т цЏApp, an online sneaker marketplace incubated in HUPU BBS (a sports forum), has become the leading app in the field of sneakers in China, valued at US $1 billion after a new round of investment from Digital Sky Technologies in April 2019, making it a unicorn. цЏApp mainly provides services such as authentic identification and trading services.

Another sneaker marketplace, Nice, received tens of millions of US dollars in its D-Round investment in June 2019. Nice had transformed itself into a C2C sneaker marketplace platform in 2018 to provide shoe identification services. About 90% of its users were born after 1995. DoNew, a fashion e-commerce platform, received a Round A investment of nearly US$10 million in May 2019.

5. More New Players Enter Baking Industry

The baking industry has grown rapidly in recent years and is now a market worth over 100 billion yuan. In addition, more and more capital has entered the baking industry with its high gross profit rate. More than five major bakery brands were invested in each year in 2018 and 2019, which exceeded the number and amount of investment in 2016 and 2017. The growing love of bread and bakery products among the new generation of consumers has also become an industry norm.

Founded in 2018, the new traditional Chinese pastry brand, Yu XIAOGUO (фКхАш), has received an investment of 20 million yuan for two consecutive years, with a current value of more than 100 million yuan. In 2019, Matrix Partners China invested US $3 million in round A of Man Man Yuan Qi Zao Gao, which also focuses on Chinese pastry.

As well as Chinese bakery brands, western pastry brands are recognized by consumers and have received capital attention. MORANCA XIAOBAI XINLIRUAN, a maker of yogurt buns, had sales worth more than 400 million yuan in 2018. XUANMA, whose core products are egg yolk crisps, had sales of around 200 million yuan in 2018. XIONGMAODANGAO, which sells and delivers birthday cakes, now has nearly 5 million users and a monthly revenue of more than 30 million yuan. The A1 Snacks Research Institute, a snack brand that creates salty egg yolk pastry and cloud cake, also received a Round B investment of 100 million yuan in 2019.

6. Tea And Liquor That Caters To Youth PreferencesТ

New high-end tea brands with premium raw materials (fresh milk, high-quality tea leaves) and upgraded decor of spaces have been favored with capital since 2016. Besides new teas, liquor and alcoholic beverages have become a dark horse in the beverage industry, with eight brands invested in 2019. Is this popularity due to young peopleтs growing need for emotional catharsis?

Craft beer is the most popular subcategory of liquor and alcoholic beverages. Founded in 2013, Panda Craft received over 30 million yuan of Pre-B round investment in 2019, and 119 million yuan of A round investment in 2018.Т In addition, a whole-malt brew, Whale Brew (щВИхАщ ) and Songrendan (цфККш) which focuses on events such as music festivals, also completed new rounds of funding in 2019. In addition to beer, other subcategories have also received capital attention, such as the new Chinese baijiu brand Kaishan (хМхББ), the whisky brand VETO, Erguotou brand Xiaoniujiu (хАчщ ), and green plum wine brand PUTIAN COOL DRINK (хчАхАщ), etc.

7. A New Wave Of Healthy Diet

Healthy food has long been seen as "positive but not easily accepted by consumers", but YUANQISENLIN (х цАцЃЎц) has undoubtedly given a shot in the arm to healthy food entrepreneurs. The brand focuses on a sugar-free life. The company was valued 4 billion yuan after the new round of investment of 150 million yuan in October 2019. In addition to YUANQISENLIN (х цАцЃЎц), other healthy food brands that focus on functionality, reduction of fat and fitness have also won more capital recognition. For example,Т Yeshou Shenghuo (щх НчцДЛ) received investment by focusing on a low-carb, gluten-free, high-fat diet with bulletproof coffee as its flagship product, and MISS ZERO (шЖ чКЇщЖ), which advocates a sugar-free meal replacement, has been funded by focusing on weight loss among fitness groups.

8. Fitness Becomes Easier And Happier

The popularity of fitness clubs decreased in 2019 compared to 2018, but many gyms have received medium-term investment, including SunPig, Rockies Fitness, Hey Heroes, etc. In particular, SUPERMONKEY, a new fitness chain brand that started in Shenzhen in 2014, has now become the top fitness club. In February 2019, it completed the largest financing as a start-up company in China's fitness industry, a 360 million yuan D-Round financing.

In addition to private training, group exercises and other traditional forms of fitness, some new entertaining forms have also been recognized by capital. For example, 24KiCK, a combat fitness chain that both adults and children can join; SINOSTAGE, a fashion brand mainly engaged in Urban Dance; and Happy Cycle, a spinning bike fitness studio brand which includes music, games, video and social interaction in the classes. It is worth mentioning that the upstream content and tool suppliers of fitness, especially the service providers focusing on home fitness emerged rapidly in 2019 and further simplified the offering from тcompany-home-gymт to тhome is a small gymт. For example, brands such as Fiture and Mobi Fitness provide hardware products such as home treadmills and rowing machines, and brands such as SPAX, FireNow and TT Live Fit provide content for home hardware products.

9. Keeping Pet Cats And Dogs Are The Trend; Increased Capital Inflow Into The Pet Industry

Loneliness has become increasingly "normal" for the new generation of young people, and keeping pets has become a way for them to relieve their loneliness. More and more young people are seeking food and toys for pets. Pet consumption is surging, the pet industry chain is gradually improving, and capital is entering the ecosystem of pet food, pet supplies, pet services and so on. Pet food is getting the most attention from capital. Founded in 2014, Crazy Doggy completed a 300 million yuan B round in May 2019. The brand focuses on pet food research, development and manufacturing, and saw sales worth more than 600 million yuan in 2018. Fu Bei Pet, founded in 2002, also completed a 300 million yuan B round of financing in 2019. In addition, Babypet, which focuses on kitten food and puppy food, Vetreska, which represents overseas brands as well as operates its own, and the imported cat food e-commerce PetPlus, all received investment in 2019.

In terms of pet products, brands with new technology and creative designs are more likely to attract capital. PETKI entered the pet products market with smart accessories and other hardware. Currently, the brand has nearly 100 direct-sale stores in Shanghai, with an overall revenue of 220 million yuan in 2018. Furrytail, which provides smart hardware, such as smart feeders and creative cats, launched the IP XiaoXiao Cat in 2019 to gain fan recognition on social media. Kitten & Puppy, which built a blockbuster pet water dispenser, and Touchdog, which features pet leashes and pet backpacks, also received funding in 2019. In terms of the business model, subscription e-commerce is still common in the pet industry. "Mengchongxiaobaihe", a subscription-type pet goods e-commerce company which was launched in 2019, will deliver a box to users every month, including pet food, pet snacks, nutrition and health products, cleaning and care products, etc. MollyBox, an online subscription service for cat owners, allows users to choose a monthly, quarterly or annual subscription for a single box containing cat food, snacks and toys.

10. Art Toys Are Coming Into The Public Eye

Toys, especially art toys, have become one of the most expensive hobbies of the post-1995 generation. Art toys, also known as Designer toys, emerged in Japan and Hong Kong in the 1990s. This trend has been gaining momentum in China since 2015, driven by trendy toy retailers led by Pop Mart. In addition to the strong sense of design, art toys are often associated with IP, such as the hot style series created by Pop Mart around cartoon characters, such as Molly and Sonny Angel.

A number of IP product operation agencies received investment in 2019, and they are actively exploring offline channels while developing art toys. In March, 12Dong received a series B investment of nearly 100 million yuan from K2VC alone, with a total financing amount of nearly 200 million yuan. At the end of December 2017, the company launched claw machines, whose products include soft toys and garage kits, as well as bags, shoes and stationery. In March, the IP brand, 52TOYS, completed an A+ Round of financing of tens of millions of yuan. In March 2018, it also received an A round of investment of 100 million yuan, and launched more than 100 SKUs, including the MEGABOX series, original IP BEASTBOX series, blind CANDYBOX series and so on. In July, IP provider, Aimon, completed a new fundraising round worth tens of millions of yuan. With a focus on young people's offline entertainment consumption, it launched the retail brand, "IP Star" in 2017.

11. The Offline Space Is More Diversified, With Technology Permeating Consumption Scenarios

Commercial retail space is rapidly being upgraded with endless innovation to cope with the impact of the Internet. Visiting the zoo at the mall? In 2019, Mr. Zoo successfully completed five rounds of financing, including a Seed Round, Angel Round, Pre-A Round, A Round and A+ Round. Currently, Mr. Zoo has five venues with a size of 600 ~ 800 square meters, each of which has about 150 kinds of animals. Children can be accompanied by parents and teachers who provide science knowledge. With Zoo + Family + Shopping Mall,Т Mr. Zoo may be able to open up a new model.

Neobio, which focuses on family entertainment space, raised over RMB 100 million yuan in Round B financing in 2019. The store covers an area of 4,000 to 8,000 square meters and is divided into five main functional areas, including a book area, restaurant area, simulation city, playground area, and party classroom area. In addition, there are indoor rodeo parks, escape rooms, spas and so on, which also expand the content of the commercial retail space in different forms to create rich consumption scenes for the new generation of consumers.

It is worth noting that technology is also accelerating its penetration of commercial retail space. Eventec, an autonomous retail robot provider, received tens of millions of yuan in a pre-a round of investment in 2019. Its core product is "FANBOT", which can actively find target customers in the commercial space, promote and sell goods, and deliver goods in real time to help customers complete the purchase. East West Beauty, a beauty retail platform with smart retail terminals, enabling consumers to learn product information, core selling points, event information, product association, intelligent recommendations, etc., and purchase directly through the screen. INFIMIND, an artificial intelligence company, is committed to applying artificial intelligence technology to the fashion and retail industries, and using AI to improve the offline shopping experience.

12. Second-hand Marketplace Has Become A New Consumption Channel, Gathering Interest From The "Recycle-economy Group"

The second-hand industry has begun to show its great potential with the younger generation of consumers focusing on sustainability and eco-friendly fashion, and second-hand trading platforms have become a consumption channel that is gathering interest from the new generation "recycle economy group". The huge market potential has caught the eye of global investors, with more than $1.1 billion of venture capital pouring into the second-hand industry alone over the past few years, according to Bloomberg data.

Plum, founded in 2017, has now completed multiple rounds of financing, and US$20 million of B+ Round financing was completed in August 2019. Plum's business model is C2B2C, so it mainly makes a profit through service commission.

Goshare2.com, a second-hand trading platform, received tens of millions of US dollars in a round B financing in July 2019, and entered the second-hand clothing market in the mode of C2B2C, gradually extending to bags, shoes, accessories, beauty, home products, and then launched a C2C mode. In addition, the luxury maintenance service platform, Baodashi, and the second-hand luxury marketplace, TiAMOO, also received investment in 2019.

Comments