Investor TalkяНPermiraяМEvery Brand Should Have a Clear Chinese Market Strategy

July 9,2017

Permira is a renowned private equity investment company based in Europe, with businesses across the globe. Founded in 1985, Permira has invested in over 200 business cases in the past three decades, with committed capital of тЌ25bn and more than 240 staff in 14 offices around the world.

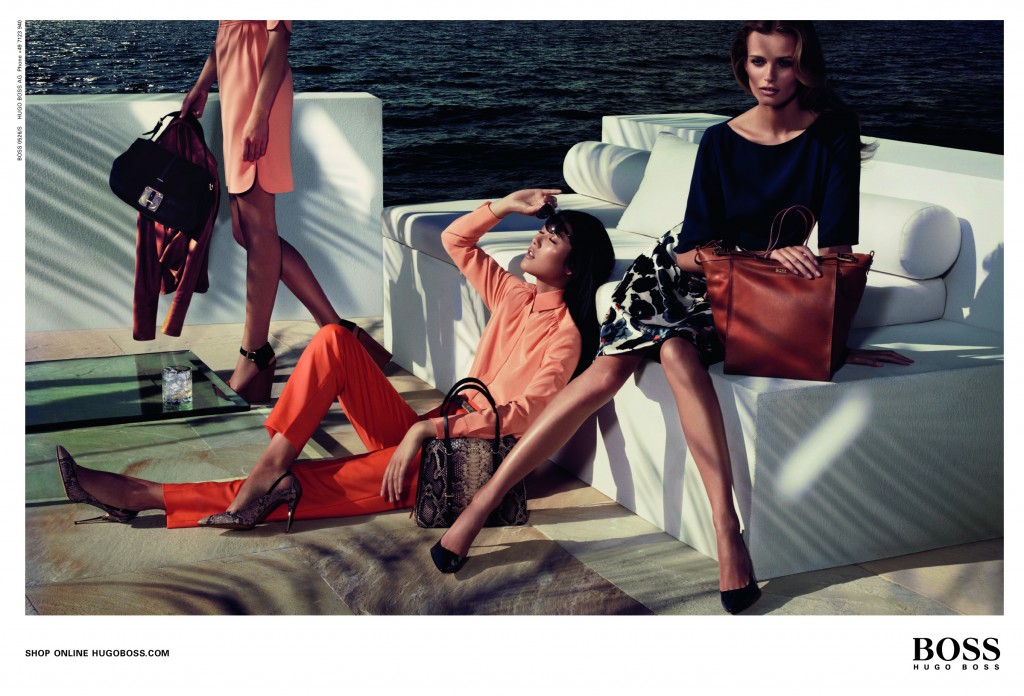

Permira has always been active in investing in the fashion and consumer sector, and is known for its serious-sized investments. It has stakes in Valentino, Hugo Boss, British high-street brand New Look and Dr Martens, among others.

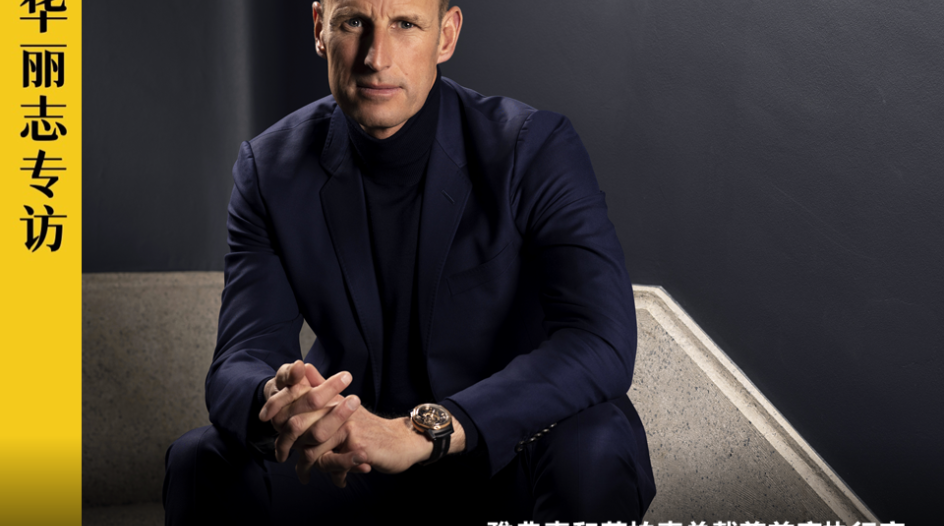

Luxe.CO enjoyed an exclusive interview with Fabrizio Carretti and Martin Wechwerth, partners at Permira.

(Fabrizio Carretti, partnerяМHead of the Milan office at PermiraяМ

(Martin Weckwerth, partner at PermiraяМ

LUXE.CO: As a global investor across multiple sectors, how much has Permira invested in the consumer sector? Will this change in the future?

Permira: Since 1985 we have advised private equity funds with a total committed capital of approximately тЌ25bn. We invest in market-leading businesses with strong growth potential, which is driven by solid underlying growth trends. We specialise in five sectors: consumer, industrial, financial services, technology and healthcare.

The consumer sector is one of our key sectors. Over 30% of our total investments have been in the consumer sector. Over the years, we have seen strong growth potential in this sector, especially in Asia, where sales growth in the region could potentially be the fastest over the next few years due to the growth of the regional economic powerhouses of India and China. We continue to actively look for the right investment opportunities in the sector.

Luxe.CO: What is the key growth trend you see in the global fashion industry? And how does Permira intend to capitalise on this trend?

Permira: The global retail landscape is evolving and nowhere is the pace of change faster than in Asia, where convergence and innovation in e-commerce and m-commerce have forced a rethink in the channel strategies of key retail players. Customers are more sophisticated nowadays. They demand the seamless integration of channels and look for a compelling combination of value and experience.

The rising fast-fashion trend has reshaped the global fashion industry and forced retailers to respond quickly to this change. With big data and digital marketing, companies need to experiment to figure out which strategies should be used to most effectively reflect their brand values, engage target customers and expand their most valuable customer relationships. Luxury brands are also placing high importance on these factors, including how the Internet has changed the habits of the luxury consumers, the rise of the Chinese as significant online shoppers and the digital knowledge of millennials. All of these factors indicate that the industry needs to embrace rapid change.

Permira has invested heavily in this sector across the globe, as demonstrated by the investments in Dr Martens, Hugo Boss, Valentino and Atrium. We have the experience to support leading global brands as they seize the new opportunities arising from these changes. We have invested in over 20 consumer companies since 1997, with a total investment of тЌ6.7 bn. We have a significant international presence which allows us to provide seamless global support to our portfolio of companies. More importantly, we have credibility as sparring partners for management and entrepreneurs.

Luxe.CO: Compared to previous investments, your investments in the past 5 years have shown a subtle shift from traditional luxury and fashion apparel companies to broader lifestyle-related brands, and a shift from being Europe-centric to a more global outlook. What are the considerations behind these changes?

Permira: We are consistently looking for broad investment opportunities in this sector in order to unlock value. Our consumer team specialises in four categories: apparel, footwear and accessories, health & wellness, leisure, and consumer/retail niche leaders.

We are particularly interested in companies with high growth potential and a strong, distinctive and clear brand positioning in the market.

яМImage aboveяМJapanese Sushi chain Akindo SushiroяМ

яМImage aboveяМSnack brand PopCorners owned by MedoraяМ

Luxe.CO: China is the biggest consumer market in the world. More and more overseas fashion brands are looking to China as their driver of growth. Does Permira have a specific China strategy? Will any of your companies be expanding into China? Would you consider investing in a Chinese company?

Permira: With the middle class expanding fast and the number of millionaires soaring, China has become the main target country for almost all fashion brands. Branded goods and sophisticated travel are high on many peopleтs wish lists. However, the Chinese are very price sensitive: they either shop online or shop outside of the country when travelling.

Luxury goods companies have to cope with the challenge of cultural and purchasing power differences in China.Т Chinese consumers place more emphasis on social value brands than consumers in other countries. Chinese consumers are most influenced by word-of-mouth when buying new goods. Luxury goods are social tools used to increase individualsт distance from other social groups and to identify with peers of the same social status. However, personal cultural orientations can be influenced by age, social class, education and travel. We believe that Western luxury goods companies, when entering China, should take into consideration these important multidimensional Chinese cultural nuances. Furthermore, we are witnessing how quickly the Chinese consumer has become truly sophisticated. Consumers in China are much closer to understanding the significance of luxury brands than they were a few years ago.

Permira actively seeks investment opportunities among both foreign brands and domestic Chinese brands to assist them with growing internationally. Any project with a global ambition that we look at has to have a clear strategy to establish a strong connection with the Chinese consumer, from its brand values to its product offering, and from its distribution strategy to its approach to communication.

(Image aboveяМSpanish online travel agency Edreams Odigeo, in which Permira has invested)

Luxe.CO: Permira is an active operational and strategic partner to the companies in its portfolio. Could you use an example/examples to illustrate how you work with your invested companies to achieve growth?

Permira: Our investments in Hugo Boss and Valentino are perfect illustrations of how we identify companies with strong growth potential and support the management team to deliver on ambitious global expansion plans, while creating attractive returns for our investors. We fully withdrew our funds from Hugo Boss in 2015, after almost nine years, and from Valentino in 2012, after six years, in both cases, of very successful partnership. Over the years, we worked closely with both management teams on leveraging sector expertise and local knowledge, and contributed to implementing better corporate governance. For example, HB adopted a customer-centric retail model in order to respond faster to market developments. It also significantly invested in the expansion of its retail network and online stores, and optimised its operating processes with support from our funds.

HB has transformed from being a wholesale supplier into a fast-growing branded retailer. The Group is outstandingly positioned today to capture future growth opportunities, particularly as it continues to expand its own retail operations and its womenswear portfolio. It has established a strong position within the luxury segment and has achieved strong international growth, especially in Asia.

Since Permira invested in 2007, sales at Hugo Boss have increased by 60% to тЌ2.6 billion (2014), while EBITDA has more than doubled, from тЌ275 million (2007) to тЌ591 million (2014). The share price has also performed strongly, recently reaching an all-time high. At the same time, net debt has been reduced significantly. As a result of this positive business performance and in recognition of the strength of the brand, Hugo Boss received Germanyтs тBest Brands 2015т Award in the fashion category.

Other fashion companies in the portfolio have included British shoe brand Dr Martens, British fashion retailer New Look, and fashion company Cortefiel in Spain.

Luxe.CO: What are some of the challenges companies that Permira has invested in face when they are trying to expand into a new territory? Are there any best practices Permira can share to help companies overcome those challenges?

Permira: Our experience shows that successful international expansion requires a clear vision for the brand proposition as well as a detailed understanding of local consumer purchasing behaviour. It is also critical that a company has the right local management team and partners to deliver on the growth opportunity. More importantly, as demonstrated by the extraordinary work of the management and design team at Valentino, impeccable and consistent global execution is essential to appeal to the contemporary luxury consumer.

Luxe.CO: How has Permira performed overall in the consumer sector?

Permira: As one of the leading investors in the consumer sector, we have 30 successes under our belt. Our funds have returned approximately double their total investment in the sector since 1985.

Permiraтs investment record in the fashion industry:

Permira sold Valentino in 2012 toТ Qatar's royal family for over тЌ700 million. From 2011 it was cutting back its stock in Hugo Boss, and it sold the remainder of its share in the company in 2015. This investment had doubled in value in the previous eight years. In 2015, Permira also sold New Look to a South African billionaire. The fashion brands currently held by Permira are:

- Spanish clothing retailer Cortefiel Group (including three brands: Cortefiel, Springfield and Womenтs Secret)тacquired in 2005, along with private equity companies CVC and PAI.

- British iconic footwear brand Dr Martensтacquired in 2014

Permiraтs investments in the consumer sector are becoming more diverse. Permira acquired a Japanese sushi chain restaurant in 2012, the Canadian nutrition company Atrium Innovations in 2014, and also owns the American snack brands Medora and Ideal.

Comments