China Fashion and Lifestyle Investment News: Underwear, Cross-Border Retailer, Tea Drink, Healthy Drink, Lifestyle Retailer, Film Hotel, Shared Accommodation and Compounded Convenience Store

May 3,2018

Luxe.Co has launched тLuxe.Co China Investment Weeklyт since 2016, reporting weekly updates on investment and financing in the China fashion and lifestyle industries. The updates cover fashion, beauty care, food and dining, sports and fitness, hotel and travel, household products, culture and creativity, and other related fields.

Fashion Brands

- Underwear brand NEIWAI (х хЄ) raised 60 million yuan in Series B+ financing

The underwear brand NEIWAI announced on April 9th that they raised 60 million yuan from Huaqiang Capital in Series B+ financing. Previously NEIWAI raised 70 million yuan from investors led by Vertex Ventures in Series B financing in November 2017. NEIWAI was established by the couple, Jiang Li and Xiaolu Liu in 2012. Featuring wireless bra, NEIWAIТ entered the market and emphasized on тextreme comfortт.Т Currently, NEIWAI has evolved to include home wear, activewear, menswear. The focus of this year isТ NEIWAI Studio, featuring high-end market. NEIWAIтs channels have also expanded from online to offline gradually with five offline stores in Shanghai, Nanjing, Chongqing and so on. Neiwai had an annual sales amount of 30 million yuan in 2016 and 150 million yuan in 2017, respectively.

Fashion e-Commerce Platform

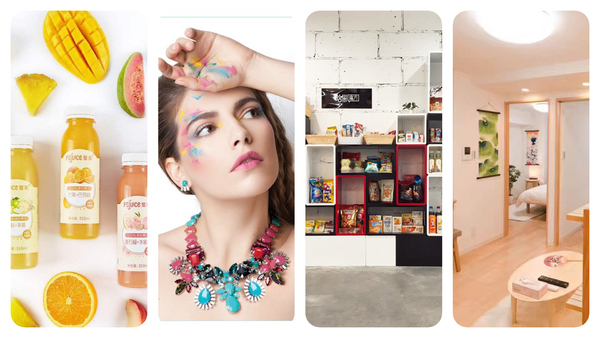

- O2O cross-border retailer KK Guan (KKщІ) raised 70 million in Series B financing

Featuring тonline APP + offline storeт, the imported-goods integrated store KK Guan announced on April 9th that they raised 70 million yuan in Series B financing. The financing arrangement was led by Matrix Partners China and followed by Bright Venture Capital. Previously, KK Guan raised hundreds of millions of yuan from Bright Venture Capital and Shenzhen Capital Group in July 2017. KK Guan was established in 2015, with more than ten thousand SKUs covering eight product categories including snacks, personal care, beauty, household products, stationary, and so on. KK Guan has more than 50 offline stores in Guangzhou, Shenzhen, Dongguan, Foshan and other cities, with a monthly sales amount of 4,000 yuan per square meter.

Food and Dining

- Tea drink brand TEASURE (ч Ўш) raised tens of millions of yuan in Series Pre-A financing

TEASURE, the neo Chinese tea drink brand, announced on April 12th that they raised tens of millions of yuan from Fortune Venture Capital in Series Pre-A financing. The financing will be mainly used to expand new stores. TEASURE was established in 2015 with products featuring tea drinks and tea meals (dessert), supplemented by tea related products, including tea and tea accessories. TEASURE has five stores, in whichТ four areТ in Beijing and one in Xiтan. Currently TEASURE has an average monthly income of about 400,000 yuan per store, among which supplementing tea related products accounts for 10-15% of the total income.

- Healthy drink brand FS Juice (цчД ) raised millions of US dollars in Series A+ financing

Healthy drink brand FS Juice announced on April 12th that they raised millions of US dollars in Series A+ financing, from Qianshu Capital under JD Finance. Previously FS Juice raised millions of US dollars in Series A financing in August 2017. The new financing will be mainly used for regional expansion and online channel investment. FS Juice features high-end vegetable and fruit juice. Each bottle of FS Juice is a mixture of at least three fruits. There are two product lines. One is NFC Juice with 10 SKUs and a price of 17.8 yuan per bottle with more than 4,000 offline retailers. The other product line is fruit tea, with 4 SKUs and a price of 8.8 yuan per bottle, sold in convenient stores in Eastern China. FS Juice had annual income of tens of million of yuan in 2017, in which offline sales accounted for 80%.

Household Products

- Lifestyle household brand NOME raised 230-million-yuan financing

Lifestyle household brand NOME announced on April 13th that they raised 230-million-yuan financing from Capital Today with a post-money evaluation of 1.5 billion yuan. NOMEтs products feature affordability and design, including nine product categories covering womenswear, menswear, fashion accessories, digital accessories, snacks, beauty care and so on with over 3000 SKUs. Currently NOME has 50 stores in Guangzhou and Shenzhen with a monthly income of 1.5 to 3.5 million yuan.

Hotel & Travel

- Hotel operator FILM HOTEL (ццчЕхНБщ хК) raised 100 million yuan in Series A financing

The boutique hotel operator Film Hotel announced on April 11th that they raised 100 million yuan in Series A financing. The financing arrangement was led by IDG Capital and followed by Buhuo Venture Capital and theТ founding team (over 30 million yuan). Previously Film Hotel raised 8-million-yuan angel financing from Zhenshun Capital in 2016. The new financing will be mainly used for store expansion, R&D and talent recruitment. Film Hotel was established in 2014, featuring a business model of тmovie + accommodationт. Hotel rooms are decorated with cinema scenes while providing high-resolution movies, TV shows and online stream services. Currently Film Hotel has nearly 30 hotels with an annual income of 10 million yuan per store and a net profit margin of 40-50%.

- City shared accommodation brand ISLANDS (ххБП) raised tens of millions of yuan in Series A financing

Islands, the city shared accommodation brand announced on April 10th that they raised tens of millions of yuan in Series A financing in March 2018. The financing arrangement was led by Banyan China and followed by Plum Ventures. Previously Island raised 10 million yuan in angel round from Zhen Fund, China Growth Capital, Prophet Capital and 01VC in August 2017. Island was established in July 2017, with rooms transformed to a third space featuring travel and lifestyle. Users can pay by time and receive discounts for sharing the idle time of reserved rooms. Currently, Islands has over 1,000 rooms in over 10 cities in China, including Beijing, Xiтan, Chengdu, Wuhan, Shanghai, Dalian, Nanjing and Hangzhou. Users can reserve rooms through Islands WeChat programs, major OTA and online short-term rental platforms.

Others

- Convenience store Magic House (чЅхЅхБ) raised nearly ten million yuan in Series Pre-A financing

Convenience store Magic House announced on April 8th that they raised nearly ten million yuan in Series Pre-A financing from Shenzhen Glory Harvest Group. The financing will be mainly used on store expansion and equipment R&D. Magic House was established at the end of 2016, featuring тcompounded convenience storeт concept with a light refreshment and tea area and self-serve vending machines with тairт storage. Two staff are in charge of the light refreshment and tea area, operating from 11am to 11pm, selling over 20 SKUs including fruit drinks, bakery and fruits. Vending machines operates 24 hours, selling over 800 standard labels. The warehouse of Magic House is located at the storeТ roof. After customers select products on self-served screens and completed digital payment, warehouse will deliver the products to the pick-up port with transmission equipment. Currently, Magic House has 4 stores in Shenzhen with a daily income of 6,000 to 7,000 yuan per store. The unit customer spending is from 12 to 15 yuan, with a repeated purchase rate of 30%.

Т

The above information is based on the company announcement and/or online news. Luxe.Co makes reasonable efforts to obtain reliable content from third parties. Luxe.Co does not guarantee the accuracy of or endorse the views or opinions given by any third-party content provider.

| Chinese reporter: Jiaqi Wang

Т

Comments