Report from Shanghai Fashion WeekяМThe Growth of Fashion Showrooms China

June 7,2017

From finalizing a design to it becoming a product for sale, the steps that lie in between are countless. Fashion trade shows and showrooms form the first round of a cruel elimination process. Meanwhile, their activity often reflects the real state of the fashion industry.

Since most Chinese designer brands are still young, they often face various problems that cannot be solved immediately on the road to market. These problems are especially apparent at the retail end, involving issues such as brand positioning, planning, defining the target audience and setting retail prices. Young brands need to be tested by the market and receive feedback in order to pinpoint their target groups and survive. The role that the showroom plays should not be underestimated.

In 2014 and 2015, a large number of showrooms emerged in China. Take the official showroom of Shanghai Fashion Week, the MODE Shanghai Fashion Trade Show, for instance, where initially only 16% of visitors to the first yearтs show were industry professionals. By the fifth MODE show, where 36 showrooms exhibited together, daily visitor numbers were exceeding 1,500, of which the percentage of industry professionals rose from 48.55% on the first day to 57.88% on the last. Out of the 57.88%, 43.31% were buyers, and 14.57% were agents.

The founder of the top Italian trade show WHITE Milano, Massimiliano Bizzi, said during an interview with Luxe.CO, that since a lot of the worldтs best buyers come to the Shanghai Fashion Show, he thought he should come to take a look himself. It has become the best window through which to view the development of independent Chinese designers.

As the top media partner of Shanghai Fashion Week, Luxe.CO offers four important observations regarding the development of the showroom:

The Entrance of More Asia-Pacific and Overseas Showrooms into China

Headquartered in Paris, the showroom Cross Mode has taken part in many fashion weeks abroad. This is their first time at MODE Shanghai. Manager Zhan Mei notes that, for many foreigners, Shanghai is an international metropolis and the centre of Chinese fashion. They know from official media and online searches that MODE Shanghai is the largest trade show, where showrooms come together to showcase their brands. Thus it could offer them opportunities to enter the Chinese market, and to get to know and discuss collaboration with other brands.

The fact that brands from abroad are choosing to enter the Chinese market via showrooms and trade shows reflects the market demand for fashion products in China. On what is already their fourth visit to MODE Shanghai, the Xin Tokyo Showroom from Japan says that at first buyers were worried about their prices being too high and Chinese consumersт acceptance of such styles. Yet after a few seasons of order placements, they have found that Japanese brands sell well. Thus Xin Tokyoтs confidence has grown, and the company feels that the Chinese market is developing. As buyersт feedback has become increasingly positive, MODE Shanghai became their preferred choice of show, as the extensive number of buyers help them to test the waters and stay abreast of developments in the Chinese market.

Т Preference for Overseas Brands

Thanks to showrooms and buyers, Chinese consumers are able to access more overseas brands at the retail end of the process. According to founder and CEO of Tudoo Showroom Zhi Fang, clothes sell best during new launches. Both brands and clients have become used to the tempo, with some of the foreign brands launching 8 to 11 collections a year.

When asked why they mainly work with brands from overseas, Zhi Fang says that the design, production and pricing of foreign brands are more mature. Boutiques can ensure that they have steady stock levels, and buyers can plan when to update each kind of product, how to coordinate in-store presentation and promotion, and which products to push during different rounds of the autumn/winter season.

On the other hand, Fang Zhi finds that Chinese designer brands have the following issues: 1) the supply is inconsistent, which creates a lag between the expected arrival date and the on-shelf date. Since products need to be photographed, entered into the inventory, and put on the shelf, this lag is an issue for retailers; 2) some designers, who think their products are good value, only take into account the final retail price, overlooking the room for profit for buyers. To buyers, the profit from selling a piece is significant. Foreign brands usually leave some room for profit, which is a very reasonable practice.

The brands that the Tudoo Showroom partners with tend to be more commercial, with items priced around 1500 to 2000 RMB. Though some domestic brands are well-designed, discounted prices are at the level of 45% of the retail price. Fang Zhi points out that such pricing leaves no profit or even creates a deficit for buyers. Though many Chinese designers cannot yet offer such discount prices, she suggests keeping order prices at around 35% of the reatail price. Manager of the Oriental Modern Centre Qu Yanyin, whose background is in design, concludes from his long experience in offline channels that since target consumers differ from those online, the price range differs as well. Eighty per cent of popular products sold offline are priced at 500 to 2500 RMB in the spring/summer and at 1200 to 3500 RMB in the autumn/winter.

Т So Enter Large Department Stores and Real Estate

At MODE Shanghai, Luxe. CO met buyers from several Chinese department stores, including Xingli Department Store, Wangfujing Group, New World Department Store and Neoglory, whose attendance was also confirmed by the showrooms. Wangfujingтs buyer said that their buying department had only been established earlier this year, and that they needed rush back after attending MODE Shanghai. Clothing and Procurement Director Ting Zhou of Bailian was focused on brands that were more reasonably priced and practical. She found that Chinese designers needed to improve on these aspects, but that procurement of these brands matched Bailian Groupтs position of pursuing young brands.

Т Globalisation of Buyers, Professionalisation of Domestic Buyers, Standardisation of Boutiques

From the data from previous MODE Shanghai shows, it is clear that boutiques in second- and third-tier, and even fourth- and fifth-tier cities, continue to increase. This season, after the four-day MODE Shanghai, Manager Xiang Ma of fashion accessories showroom Creators Showroom explained to us that larger multi-brand stores have appeared in second- and third-tier cities in China, such as Shi Nan in Yinchuan. With a floor space of around 600 to 700 square metres, Shi Nan features lifestyle products in addition to apparel. Its orders are large; the percentage of on-site deals it made is higher than last year, and payment is mostly made in full.

Boutiques are on the rise in China. Among them are export sales stores trying to transition, agency stores and traditional distributors in transition, and online e-commerce platforms eyeing independent brands. Tudoo Showroom also notes that the number of orders from rental e-commerce platforms, such as YClOSET, has been steadily increasing as well. Online channels have taken up more of the market share among consumers born in the 1980s and 1990s or later. Their sales potential cannot be underestimated.

As pointed out earlier, Shanghai Fashion Week has become the top destination for those looking to tap into the Asia-Pacific market. Top buyers, including the menтs fashion buyer from Selfridgesт and the product manager/womenтs fashion buyer from Machine-A, have been seen at MODE Shanghai.

The showroom provides a glimpse into the emerging retail industry, which is very active despite its small scale. Feedback from showrooms directly depicts the reality of the Chinese consumer market. MODE Shanghai provides the most reliable support for this brand new retail industry.

Having been actively involved in MODE Shanghai since the first year of Shanghai Fashion Week, Yanyin Qu says he can see that the positioning of MODE Shanghai has become clearer, and that the eventтs promotion and impact have soared as well. Although he organizes order sessions in different cities throughout the year, MODE Shanghai is an event he makes sure to attend. A lot of showrooms also agree that the size of exhibition space, the professional promotion, the thorough service and the precisely targeted audience of MODE Shanghai significantly influence the entire showroom industry. The soil of the fashion industry, he says, is still barren. Thus he calls for showrooms to first serve designers well, rather than focusing on commission. Only by helping designers and supporting new talents in the Chinese fashion industry, can rich fruits be borne.

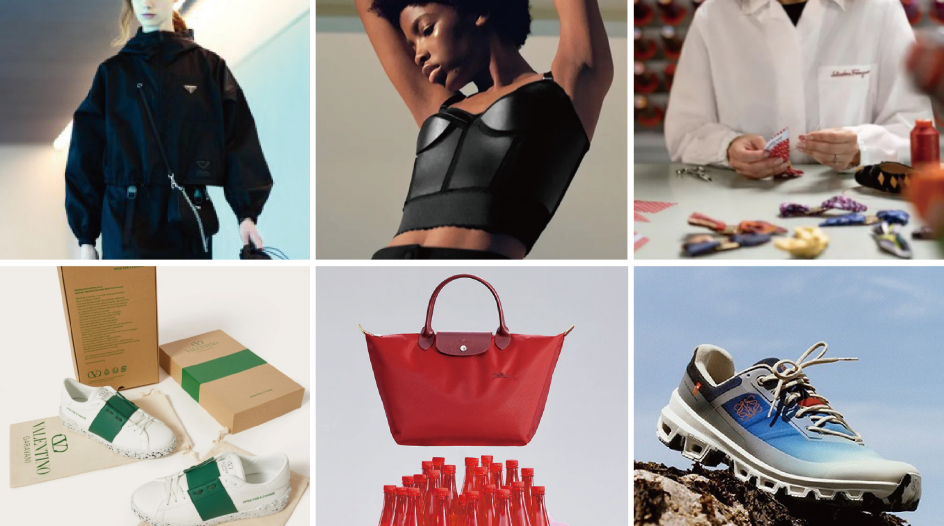

Images courtesy of MODE Shanghai, Luxe.CO

Comments