Exclusive Report by Luxe.Co: 5 Key Trends in Luxury Industry & Luxury Stock Review 2017

February 28,2018

Since 2013, Luxe.CoяМхфИНхПяМhas been producing exclusive monthly and annual reports on global luxury stocks , tracking and analysing the financial market trends and stock price movements for leading global luxury listed companies. In 2016, Luxe.Co launched тLuxe.Co Luxury Industry Stock Indexт, monitoring the changing environment of global luxury industry in an intuitive and quantitative way.

The chart for тLuxe.Co Luxury Industry Stock Indexт (Luxe.Co Index) over the past two years is presented above. It is self-evident that global luxury industry has recovered from the downturn since the second half of 2016, and has continued the momentum as of the end of 2017.

TheТ rising trend of Luxe.Co Index in 2017 shows that global luxury industry has great growth opportunities, to a certain extent, due to the transformation made by luxury companies to adapt to market changes, and the upsurge consumption enthusiasm of Chinese consumers for luxury products.

The future growing potential of the luxury industry mainly relies on the rise of emerging markets, the accelerated development of online sales channels, and the new millennium generation rising to become the main luxury consumption force. Due to the variation in market condition, product category, positioning and development stage, every brand is exploring their own development path in changing market environment.

Through continued in-depth observation of the development trend and market feedback of leading global luxury companies, Luxe.Co has concluded five important findings:

Luxe.Coтs Top Five Observations of Global Luxury Industry in 2017

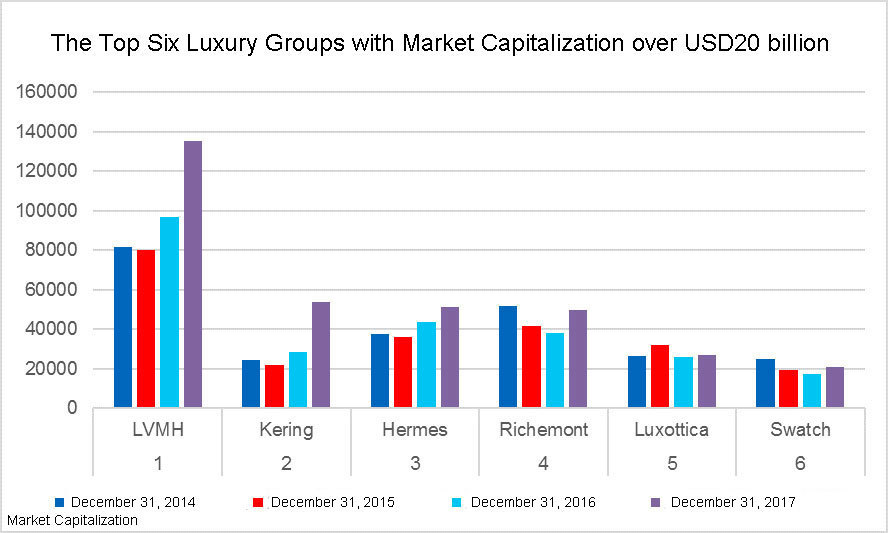

1. Multi-brand groups are more resilient

The biggest luxury group in the world, LVMH, kept its performance and stock price robust. Kering group overtook HermУЈs and Richemont to become the second largest luxury group in the world. All this demonstrated that multi-brand luxury groups featuring soft luxury goods (apparel and accessories) have better risk resistance capability and long-term growth potential in current complex and volatile market environment.

Possibly by recognizing this, non-European fashion and luxury companies and investment institutions have also joined the trend of building multi-brand groups.

Qatar Royal Investment Institution тт Mayhoola has acquired Italian luxury brand Valentino, French luxury brand Balmain and Italian high-end menswear brand Pal Zileri, and also purchased shares of Anya Hindmarch, a British accessory brand.

China Shandong Ruyi Holdings has acquired French womenswear group SMCP (including Sandro, Maje and Claudie Pierlot), British classic trench coat brand Aquascutum, and Trinity Limited, which holds multiple high-end European menswear brands. In early 2018, Shangdong Ruyi announced its acquisition of Swiss luxury brand, Bally.

American affordable luxury giant Coach acquired high-end footwear brand Stuart Weitzman and a younger affordable luxury brand Kate Spade. The other giant Michael Kors acquired British luxury brand Jimmy Choo. Both are aiming to build multi-brand groups gradually and accelerate theirТ expansion and growth, in order to hedge against concentration risk.

Unquestionably, to become тbigт is not aТ panacea. It is a huge challenge to balance the development of various brands, to make the synergy work, to understand the DNA and growth cycle of different brands of different culture background, and to control the rhythm in investment and global expansion.

2. Fashion trend is a double-edged sword

The new Gucci has gained popularity among global young fashion consumers with explosive performance growth in a short period of time. This has proved that classic luxury brands with strong leaders (e.g.,CEO Marco Bizzarri) and innovative designers (e.g., Creative Director Alessandro Michele) can have continuous vitality and unlimited possibilities. At the same time, "trendy elements" have become an important catalyst for luxury brands to attract millennium consumers.

With just one season of limited edition collaborated with American red-hot streetwear brand Supreme, Louis Vuitton has made a sales miracle of more than 100 million euros. This also indirectly helped Supreme obtain substantial investment from American top private equity firm with an evaluation of more than 1 billion US dollars. The collaboration between luxury brands and streetwear brands has become more frequent and raised discussion in the industry.

For luxury brands, fashion trend is always a double-edged sword. It can help luxury brands attract young fashion consumers. But on the other hand, it may distort the prestigious market positioning of luxury brands, damage brandsт long-term value, and even lose its core customers. Italian luxury brand Todтs has expressed that the brand will return to its tradition and focus on top luxury product line which is more stable and reliable.

3. Globalization propels niche brand

The Canadian affordable luxury winter clothing brand Canada GooseТ had successful IPO in 2017 and achieved explosive growth ever since. It demonstrated fully that a regional niche brand can grow into a global well-known brand rapidly with the help from financial institutions and capital market (Canada Goose is owned by the famous private equity firm Bain Capital). Canada Goose has gained considerable global awareness even before laying out extensive retail sales channels. This shows just how effectively the digital technology has driven the globalization in the fashion world. Niche brands and popular products can spread out and reach global consumers faster and more extensively. Although marketing inputs are still essential, the more critical point is that products need to become тextremeт and have self-broadcasting power.

A good product speaks for itself. This oldТ saying has a special practical significance in the world of social media and KOLs. With unique design, quality and function, as well as the emotional resonance with target consumers, a brand regardless of it size, has the opportunity to trigger the "tipping point". By facilitating this opportunity, the brand will quickly attract huge attention and traffic on a global scale.

4. The weight of China market is even greater, but Chinese consumers are not the same as before

Bain & Companyтs 2017 China Luxury Report showed that the total sales turnover of China's domestic luxury goods market amounted to 142 billion yuan, with a 20% increase year-on-year, which was the fastest growth rate since 2011. The global luxury market's total sales reached 262 billion euros (about 2 trillion yuan), of which 32% were contributed by Chinese consumers, which was the highest among all countries and regions. These numbers implicates that Chinese consumers purchased 650-billion-yuan luxury products in 2017, of which 78% occurred overseas.

According to the data from Deutsche Bank, the Chinese market accounts for 31% of the total demand of global luxury market, of which more than 60% of the purchases were made outside China.

However, this situation has changed gradually. More and more luxury consumption has returned to the mainland Chinese market, because major luxury brands have been narrowing the price differences between China and overseas markets, improving their Chinese stores, and enhancing customer experiences. Additionally, Chinese governmentтs lowering tariffs on luxury products and tightening the inspection on smuggling are also helping this situation.

According to тChina Fashion Consumption Survey Report 2017т produced by Luxe.Co : 71.9% of respondents chose тproduct design and identificationт as the top factors affecting their luxury purchase decision making; 67.9% of them chose "product quality" which ranked the second. In addition to brandsт own efforts, Chinese customers becoming more mature and rational is also one of the contributing factors behind the recovery of the luxury market. After the irrational exuberance faded away, luxury products become part of the regular consumption of the middle-to-high income groups. Consumers focus more on product design and quality, brand culture and services. More sophisticated Chinese consumers have raised the bar for brands, in terms of product planning, store services, integrated marketing, sales channels and so on.

5. Digitization is a MUST but one should tackle it in its own way

According to the latest studies by McKinsey, online luxury consumption amounted to 20 billion euros in 2016, accounting for 8% of total luxury consumption, including clothing, beauty and accessories. This is about three times of the number in 2009. In the next seven years, the online sales turnover of luxury products is expected to grow at an even higher rate to 74 billion euros and contributes 19% of the total luxury sales by 2025.

The report by Bain & Company shows that more than half of the top 20 brands in the Chinese market have opted to reduce the scale of their brick-and-mortar retail store network, and at the same time to enlarge existing stores. In 2017, the top 20 brands have 1119 stores in total in China, a cut of 6 stores compared to 2015. Only a few fast fashion brands chose to expand their retail network rapidly. On the digital side, all brands increased their expenses in digital marketing extensively in 2017 in China. The share of digital marketing increased from 35% in 2015 to 40~50% in 2017, in which WeChat platform occupied 30~60%.

From Amazon in the U.S. to TMall and JD in China; from Yoox Net-a-Porter to Farfetch, both full-category e-commerce platform and specialty fashion e-commerce company are trying to lure renowned luxury brands to their websites in order to attract fashionable big spenders.

The Swiss luxury giant, Richemont has always been rather conservative in digitization. But Richemont announced in January 2018 that it would acquire the remaining 51% shares of the world's largest luxury e-commerce, Yoox Net-a-porter Group SpA, for 2.77 billion euros, just to take fully control the company.

Kering group had a 70% increase in its online luxury business in 2017. Its flagship brand Gucci had the highest website visit in 2017 among all its luxury brands, which was 2.5 times the number in 2016. The group chairman Mr. Pinault said that digital strategies should not only to increase e-commerce business, but more importantly to convey brand concept to young consumers through the internet.

The world's largest luxury group, LVMH, has started developing its own luxury e-commerce platform 24 SУЈvres. As well, LVMH has been vigorously developing the official website of each portfolio brand. The majority of its brandsт online salesТ is contributed by the groupтs own e-commerce channels. The group Chairman Mr. Arnault said that if a luxury brand developed its online business too fast, it would undermine its reputation. Brands need to be cautious, and not to lower its market positioning. Online shopping also need bring consumers a luxurious experience, and maintain brandsт reputation through the overall controlling of prices and maintain an appropriate balance between online and offline channels.

Review of Luxury Stock Market Trends in 2017

1Q2017

Luxe.Co index continued its recovery tendency and startedТ growing steadily in the second half of the 2016. In the first quarter, Canada Goose had a successful IPO, which was an ice-breaker in IPOs for the luxury industry in 29 months. It also proved the recovery of the luxury market, and strengthened investorsт confidence in the industry. At the same time, the marketтs expectation increasedТ forТ M&A deals in the luxury industry. The strengthening of US dollarsТ and the declining of euros brought more attention to European luxury brands.

2Q2017

Luxe.Co index fell after a rapid growth forТ four-consecutive-months in 2017, but remaining at a relatively high level. Many industry executives and analysts expressed their caution about the sustainability of the recovery. For example, LVMH had a sales increase of 15% year-on-year in 2Q, while mainland China growing by 15%, and Japan and Europe growing by 11%. But the group chairman Mr. Arnault said that the overall prospect of the luxury industry was unclear andТ they remained cautious about the second half of the year. Mr. Rupert, the chairman of Richemont Group, which is the parent company of brands such as Cartier and VacheronТ Constantin, expressed that there were too many high-end watches in the global luxury market and one should not be dazzled by the revival of the luxury market.

3Q2017

Driven by the strong growth of the Asia market, especially in the Chinese market, Luxe.Co index has steadily risen. After a five-year slump affected by the Chinese government's anti-corruption campaign, China's luxury market resumed its steady growth. Before 2012, the luxury market surge was mainly driven by gifting and conspicuous consumption. Strong anti-corruption campaign helped remove the bubble in the luxury market in China. With the increasing purchasing power and sophistication of Chinese consumers, todayтs luxury consumption is mainly to meet the individual demand for high-quality products, as well as the personalized demand of the younger generation. From 4Q2016, Chinaтs luxury consumption has recovered, which was also benefited from the appreciation of CNY, the rise of China's housing market and securities markets, and the narrowing ofТ luxuryТ product price differences between China and overseas markets.

4Q2017

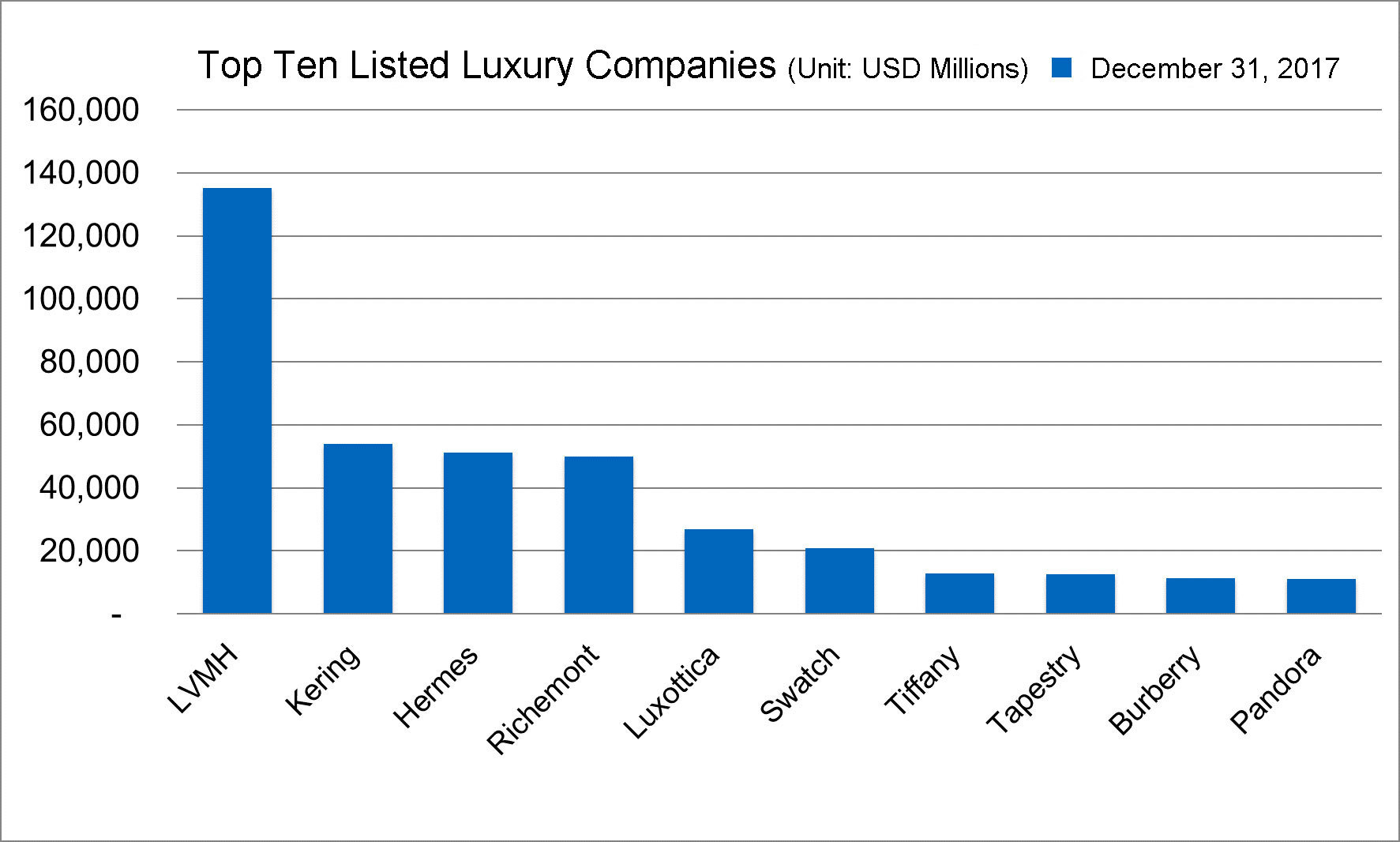

Luxe.Co index rose in volatility. In 4Q2017, LVMH, Richemont, Kering and other luxury giants performed very well and their stock prices had substantial growth, which drove Luxe.Co Index toТ continue rising and to reach a record high in December. With balanced product portfolio and solid product pricing, LVMH maintained a strong growth momentum. The jewelry business of Richemont recovered, and the group's management team was restructured. Driven by the phenomenal popularity of its flagship brand Gucci, Kering Group entered fast lane of growth. Kering's market capitalization overtook HermУЈs and Richemont and became the second-largest luxury group in the world, only after LVMH.

Individual Luxury Stock Performance in 2017

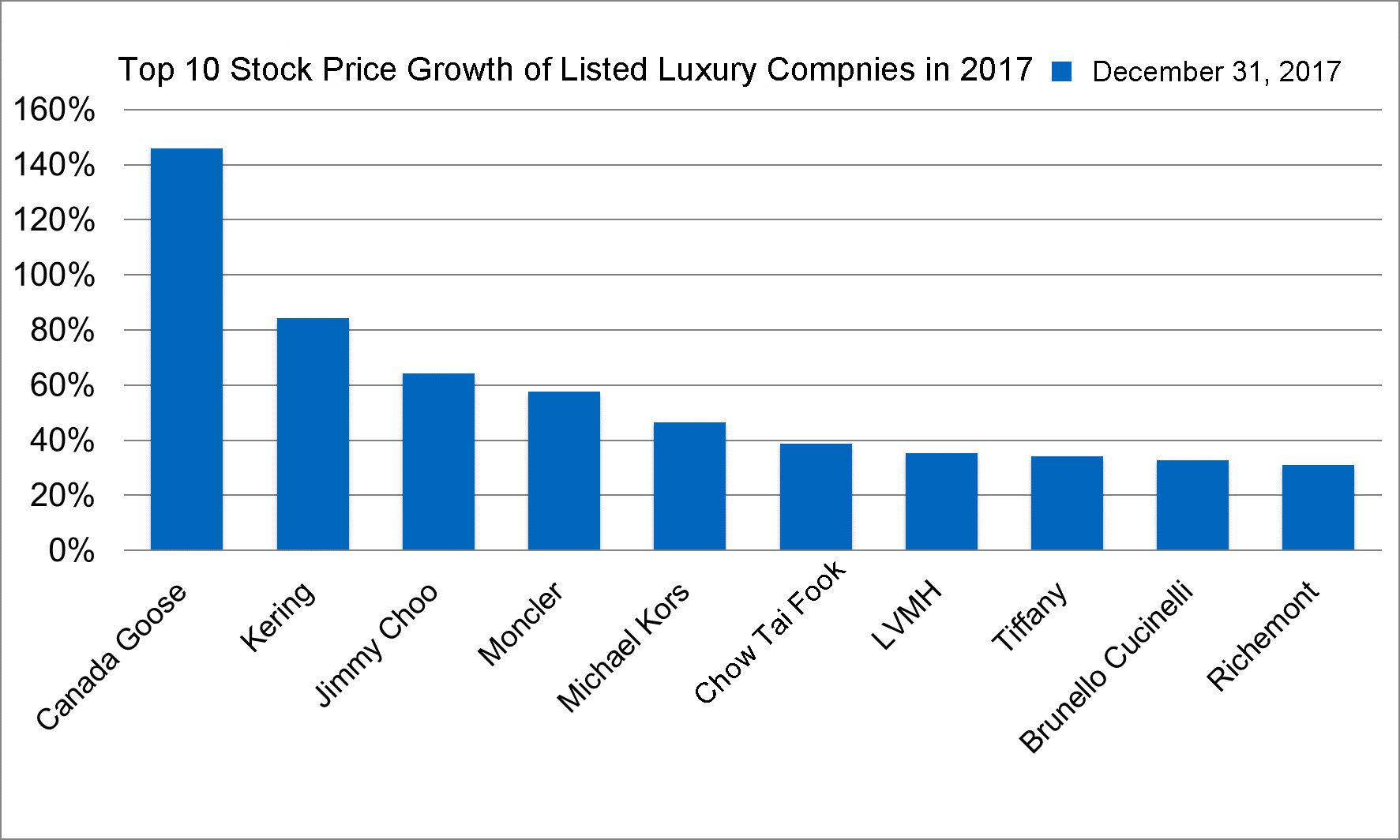

Top 10 Stock Price Growth in 2017

Canada GooseяМ

In mid-March 2017, Canada Goose went listed on the NYSE and Toronto Stock Exchange, with an opening price of 18 US dollars, which was much higher than its IPO offering price of 17 Canadian DollarsТ (=12.79 US dollars). Dani Reiss, the group CEOТ stated in September 2017 that in addition to open certain number of flagship stores, the group will speed up the growth of e-commerce, which would in turn, help Canada Goose benefit from a profit margin premium of 15% compared to peer luxury brands. The direct sales strategy would help reduce its dependence on retailers. In the past three years, almost all sales were from retailers. He also said that China would be the next target marketТ forТ the groupтs global expansion and the group's China strategy was taking shape.

KeringяМ

Driven by its flagship brand Gucci, Kering Group had an annual sales growth of 25% to 15.478 billion euros in 2017. The overall performance was outstanding andТ exceededТ analyst expectations. Mr. Pinault, the Group Chairman and CEO, said that the group would continue focusing on luxury brandsт development. Currently Kering group has three top brands worth over 1 billion euros (Gucci, Bottega Veneta and YSL). The group aims to grow 1 to 2 more brands to this scale in the next 10 years. In addition, the group aims to transform to a pure luxury group. In January 2018, the group announced that it would distribute a majority shares of Puma, a German sports brand previously under the group to its shareholders.

Jimmy ChooяМ

Jimmy Choo announced in April 2017 that in order to maximize shareholder value, the company was exploring strategic options, including an overall sale, which gained supports from its majority shareholder, JAB Holdings, the European investment giant. In July 2017, Michael Kors, the U.S. affordable luxury group agreed to acquire Jimmy Choo forТ 896 million poundsТ (aboutТ 1.2 billion US dollars), which was 17.5 times of the adjusted EBITDA, and 2.46 times of the sales turnover of Jimmy Choo in 2016. After the completion of the deal, Jimmy Choo was delisted from London Stock Exchange from October 30 onwards.

MonclerяМ

The groupтs sales exceededТ 1 billion eurosТ for the first time in 2016. This momentum continued in 2017. According to its quarterly financial data announced in July 2017, MonclerТ has had double-digit sales growth for 14 consecutive quarters. Mr. Ruffini, The group Chairman and CEO, said that the group would stick to its very own clear growth strategy in future development plans, while maintaining transparency and take the shareholders' opinion into consideration. In the long term, Moncler aims to build a strong, unique, steady growth and uncompromising company.

Michael KorsяМ

Michael Kors acquired Jimmy Choo, the British luxury footwear brand in July. This complemented Michael Kors, which was positioned at the entry luxury market. In addition, Michael Korsт "Runway 2020" strategy progressed smoothly with many sales figures better than analyst expectations. "Runway 2020" focuses on three aspects, that is, product innovation, brand interaction and customer services. As part of the program, Michael Kors will raise the proportion of new products and high-end accessories to 40%, reduce discounted sales and increase full price handbag sales, and close underperforming stores.

Michael Kors used to be popular in the entry luxury market. But more and more consumers went online whichТ resulted in continued decline in store sales. As well, the excessive distribution and reliance on promotions increased sales but diluted its brand value and attractiveness. In order to recover from the downturn in the past two years, Michael Kors has retracted heavily depreciated inventories sunk in stores and discounted channels, revived the handbag product line, closed underperforming stores and set out to create a multi-brand group through acquisitions.

Chow Tai Fook яМCTFяМ

The group's share price fell sharply in 2016. Benefited from the recovery of the overall jewelry industry in Hong Kong, CTF had a rebound in share prices in 2017. According to theТ interim data of the fiscal year of 2017, released in November 2017, the demand growth in gold accessories helped the company achieve a second consecutive half-year profit growth. The data from CTK showed that China's luxury marketТ started recovering after the downturn in the past two years affected by the anti-corruption policy.

The group expressed that the fiscal year of 2017 would be an important turning point in the revival of the CTK jewelry business. Although it is a long and gradual recovering process, the company believed that the jewelry industry would return to a stable and steady growth in the future. As of September 30, 2017, CTK group had 2358 sales outlets in mainland China. With the increasing consumer sentiment, and the booming of shopping centers in mainland China, CTK will further expand sales network to meet demand. Regarding to Hong Kong and Macau, the company will focus on building stores in tourist areas and selectively increasing stores in some residential areas.

LVMHяМ

LVMH group had an outstanding performance with a sales growth of 13% year-on-year to 42.6 billion euros in the fiscal year of 2017. Mr. Arnault, the group Chairman, said that the group had a strong performance in China in 2017. The North America market did well too. This growing trend is expected to remain in global market in 2018. The flagship brand Louis Vuitton had an excellent performance, which was the main reason for the rapid growth of theТ fashion and leather goods sector. The collaboration collection with the streetwear brand Supreme is an important driver for the sales growth. The cosmetics series Fenty Beauty, collaborated with pop music diva, Rihanna, is the main factor for the growth in the perfume and beauty sector.

In addition, LVMH acquired the majority stake of Maison Francis Kurkdjian, an independent French perfume artisan brand in March 2017, to accelerate its expansion into the fast-growing niche market of luxury perfume. In order to simplify the ownership structure, LVMH announced in April 2017, to acquire its largest shareholder, Christian Dior Group. By doing this, all of Christian Diorтs assets are integrated into LVMH, adding onto Dior's perfume and beauty business already under LVMH. At the same time, Christian Dior Groupтs actual controller, the Arnault family, would acquire its remaining shares and achieve 100% ownership.

TiffanyяМ

Bogliolo took over as the CEO of Tiffany in October 2017. With his leadership, Tiffany has gradually turned around the performance. In the first nine month of 2017, Tiffanyтs sales declined by 2% year-on-year. In November and December, both figures in net salesТ and same-store sales increased again. In addition, all categories, regions and distribution channels have seen growth. The sales in the fashion jewelry sector continued growing and the sales in the high-end jewelry sector began to rebound as well. After Bogliolo took over, Tiffany adopted a diversified-product strategy, introduced a variety of price points and more affordable low-to-mid end jewelry (including silver bracelets) to attract more price-sensitive millennium consumers.

Brunello CucinelliяМ

The group's sales exceeded the threshold of 500 million euros for the first time in 2017, in which the sales in Greater China rose by 36.2%. Brunello Cucinelli, the group Chairman and CEO, expressed that the group performance was outstanding with booming sales andТ excellent profitability in 2017. According to the orders placed for the Spring collection, the performance in 2018 will continue with expected double-digit growth in both sales and profits.

In addition, the collaboration between the brand and high-end department stores is one of the highlights of the performance in 2017. Investments in strengthening store staffтs performance and attitude also helped sales growth substantially. Cucinelli said in the statement that the group cherish and protect the exclusivity of the brand in Greater China. Limited distribution channels facilitate the brandтs attractiveness. The brand is sold through 18 boutiques in Greater China, of which only one new was opened in 2017.

RichemontяМ

According to the group's core financial data, the sales increased by 7% year-on-year to 8.72 billion euros in the first 9 months of the fiscal year of 2017, which was a substantial recovery. The economic downturn in previous two yearsТ forced Richemont, the group with hard luxury (watches and jewelry) as the core business,Т to clear excess stock at retailers, offer cheaper products and develop online channels. Burkhart Grund, the group CFO stated in November that the group would focus on few key cooperative distributors in the future. Small-scale independent watch distributors will fade away gradually. The traditional sales model of wholesale distribution will change drastically especially in the watch industry.

In March 2017, Richemont investedТ 30% shares in Kering Eyewear, a new eyewear company set by its competitor Kering Group in March 2017. As well Richemont delegated the R&D, production and distribution of its flagship brand Cartier Eyewear to Kering Eyewear. In July, Richemont sold тShanghai Tangт, the luxury brand featuring Chinese style, which it had owned for 19 years, to Alessandro Bastagli, an Italian entrepreneur backed by two private equity funds.

In order to strengthen the group's ability to deal with market changes, especially to be more flexible in the development of digital marketing and e-commerce, Richemont carried out a restructure in the management team in 2017 and abolished the position of CEO. Johann Rupert, the Chairman of the Board and the group's largest shareholder, oversees the overall management and decision making. As well 9 young members from different fields were introduced to the board. Rupert said that he would expect fewer old-generation French male members, more female members, and more diversified members including Asian and American faces on the board.

Top 5 Stock Price Drops in 2017

SafiloяМ

The company continues to take a big hit from the termination ofТ licensing agreement with Gucci brand. In the first quarter, both the IT system crash in distribution centers and the hurricane in the U.S. had negative impact and led to a group sales decline of 15.5% year-on-year in the fiscal year of 2017, which failed to meet analyst expectations. In addition, the group's top competitor and the world's largest eyewear group, Luxottica had outstanding performance. Safilo faces further intensifiedТ market competition.

The outlook of Safilo is not optimistic. The licensing agreement between Safilo and Celine (under LVMH), expired recently. LVMH acquired 10% shares of Marcolin, an Italian eyewear manufacturer. This means Safilo is very likely to lose the licensing agreement with LVMH's other brands (including Dior). The agreement between Safilo and Dior will expire in 2020. After years of growth, the sales of Dior eyewear fell in 2017.

PandoraяМ

The group's annual sales increased by 12% year-on-year to 22.781 billion Danish Krona in 2017. However, affected by unfavorable foreign exchange rate and higher tax burden, its net profit fell by 4% year-on-year to 5.768 billion Danish Krona. Over the past decade, Pandora has enjoyed phenomenal growth. The bespoke bracelets and chains are popular among young consumers. The stock price increased 8 times from 2013 to 2016. Due to the declining growth rates in recent seasons (partly due to the sales slump in the U.S.), the stock price of Pandora fell sharply in 2017. Regarding to the brandтs future development plan, CEO Anders colding Friis mentionedТ several key measures this year,Т including increasing product categories, continuing shortening the delivery cycle of new collections, reducing promotional activities and so on.

MulberryяМ

According to the first half financial report of the group in 2017 released at the end of 2017, the sales turnover remained flat at 74.6 million pounds compared to the same period last year. However, the pre-tax loss was 600,000 pounds, slightly higher than the 500,000 pounds in the same period last year. Although the overall economy (Brexit) in the UK remains unclear, the growth of tourismТ consumption in London is critical. Mulberry said that the group will further increase its investment to enhanceТ customer experiences in major international markets and strengthen the "British Design" and "made in the UK" features.

In addition, Mulberry is implementing the development strategy as a "global luxury brand". Developing international market is the primary goal for Mulberry. At present, the domestic retail sales accounted for 60% of Mulberryтs total retail sales. Mulberry and its major shareholder, Challice Limited, established a new company, Mulberry (Asia) Limited in April 2017, which is responsible for the brand's operations in the greater China area. This means that Mulberry controls its Asian operation directly. In July 2017, Mulberry and Onward Global Fashion signed an agreement to develop business in Japan, which also had a positive impact on Mulberryтs international business.

TodтsяМ

The groupтs annual sales fell by 4.1% year-on-year to 963 million euros in 2017, slightly below 965 million euros as expected by analysts. Due to the poor performance of footwear products and the unsolved issues inТ delayed delivery of AW collection, the core brand Tod' s had a sales decline of 7.7% to 516 million euros year-on-year.

In May, Alessandra Facchinetti, the Creative Director for the past three years, resigned from the company. Della Valle, the group Chairman said that the group need no longer the position of Creative Director in traditional forms. In most cases, this position became an obstacle for the development of the company. He also expressed that Tod's group would reform the cycle of new products and adjust the new arrivals cycle from quarterly to monthly. He pointed out that the entire business model had changed. There will be a new order taking shape in the fashion system in the next few years.Т Tod's group would complete the transformation by the end of 2017.

The group CFO, Emilio Macellari, said that Tod's group would not like to continue competing with other fashion brands, and would revert to its root and focus on the high-end luxury market, which would be more stable, more reliable and more consistent with the Tod's tradition. In the short term, thereТ will be sacrifices, but the group goal is mid-to-long term. The group is expecting to reach a medium to high digit growth inТ medium term.

Salvatore FerragamoяМ

In early 2017, the group had set an optimistic growth target for overall and store floor sales. The management team also set a strategy with significant investment in IT and marketing, to update brands and optimize group business, products and logistic process. However in December 2017, the board directors of Ferragamo made a statement regarding to this strategy and said that the transformation process would be prolonged till 2018. In turn, this affected the interim target released in early 2017.

Although the Ferragamo family has repeatedly denied the rumor, many industry analysts believed that if the restructuring effort failed, the Ferragamo family might be forced to consider selling the ownership. In November, the founding family and the majority shareholder of the group, the Ferragamo family, signed a new agreement on corporate governance. This agreement defined the general principles and requirements of the ability and qualification for the new generation family members to enter the company, which ensured the smooth transition from generation to generation. The Ferragamo family have many members, including 23 grandchildren and 40 great-grandchildren.

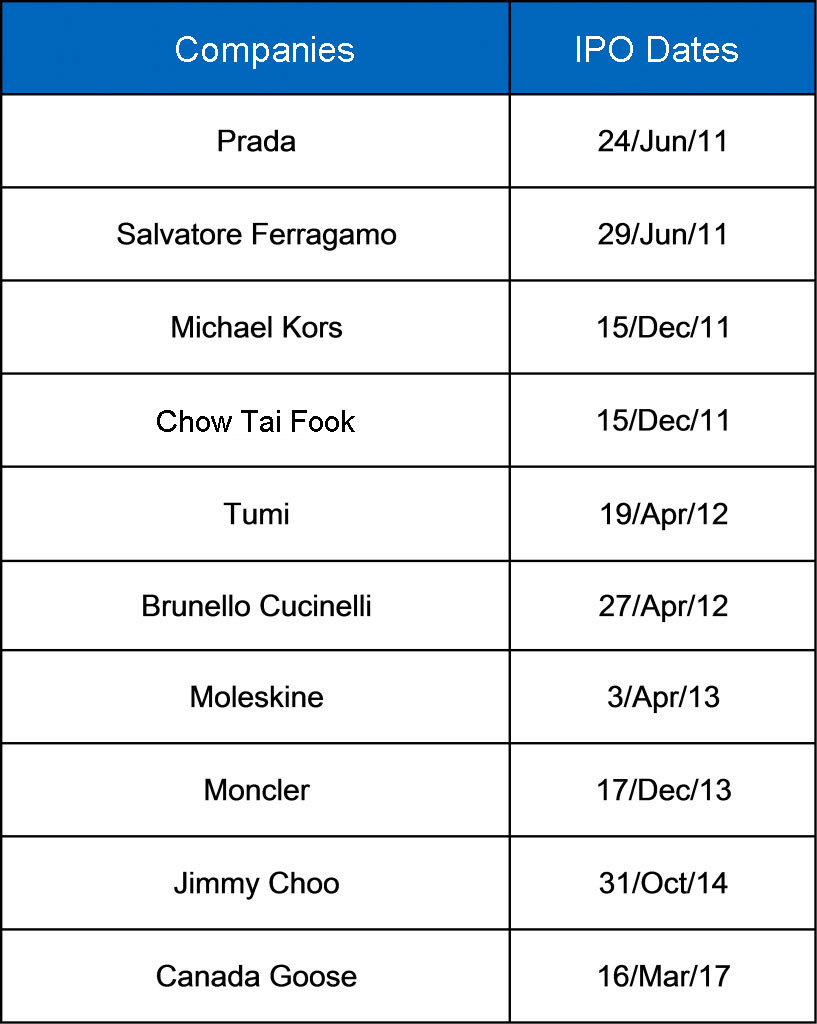

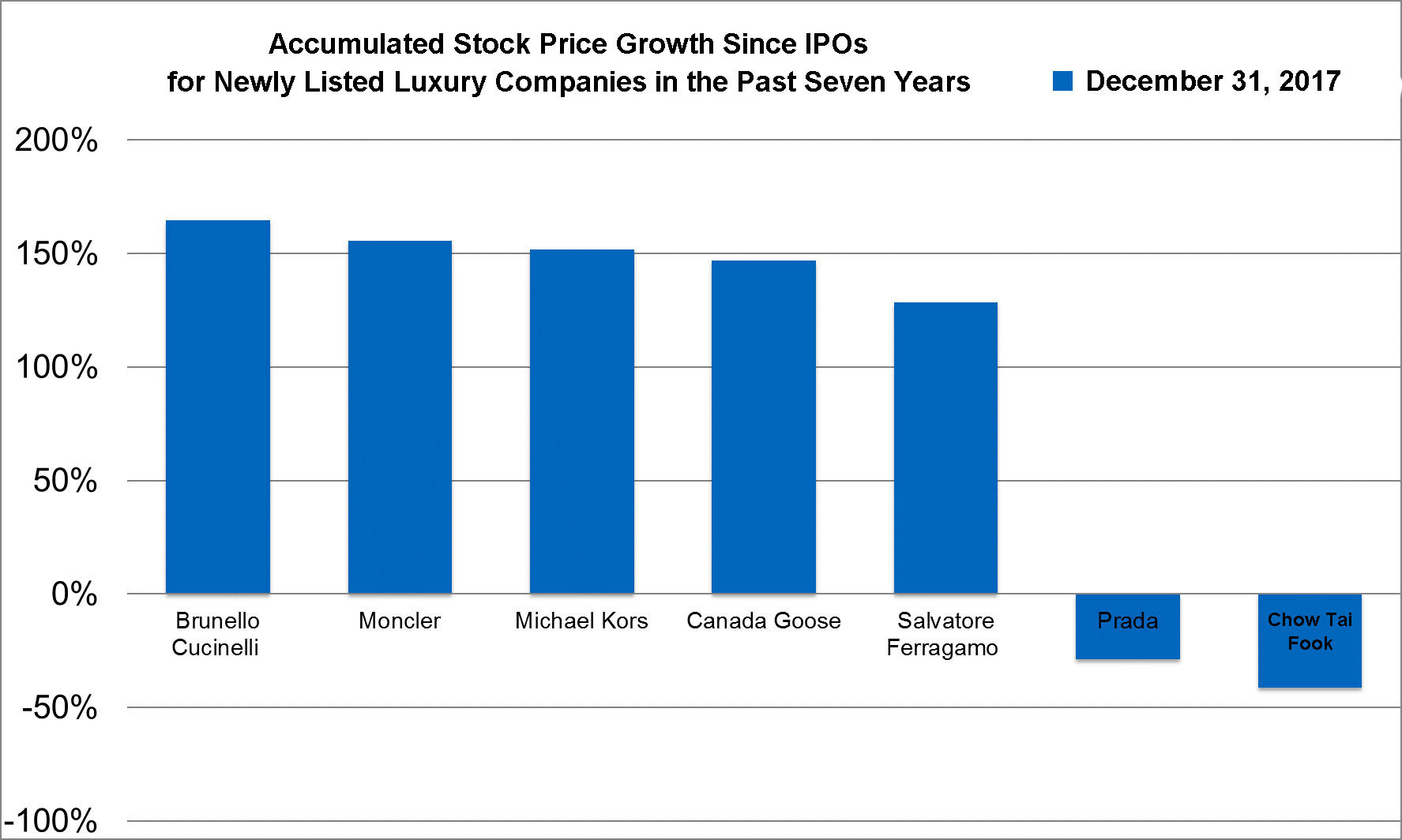

Performance Review on Luxury Stocks after IPOs in the Past Seven Years

In the past seven years, a total of 10 luxury brands have been listed publicly in the world. There were no luxury brands completing IPOs in 2015 and 2016. In mid-March 2017, Canada Goose went listed in NYSE and Toronto Stock Exchange. It was the first successful IPO in the luxury world after 29 months.

The stock performance of these ten luxury brands varied significantly. The graph below provides only a quick view of such performance, which must also take into account the different IPO dates and initial pricing level. Following the IPO, Tumi was acquired by Samsonite. Moleskine was acquired by Belgian luxury automobile importer D'Ieteren. Jimmy Choo was acquired by Michael Korsттall have been delisted after completion of the acquisition. According to the stock prices as of December 31 2017, 5 of the remaining listed companies had higher stock prices than their IPO prices; 2 of them went below.

The best performing luxury stock after IPO in the past 7 years: Brunello CucinelliТ

Brunello Cucinelli was successfully listed in Milan in April 2012, with the IPO price of 7.75 euros, which was the highest in the price range. Brunello Cucinelli's stock price rose relatively steadily in 2013, despite a general downturn in the global luxury market due to recession. In 2017, the group's sales exceeded the threshold of 500 million euros for the first time in history. According to the orders placed for Spring collection, the group's performance in 2018 will continue the positive trend and expect to achieve double-digit increase in both sales and profits.

The least performing luxury stock after IPO in 7 years: Chow Tai Fook

Affected by the fluctuation of gold prices and the continued downturn in Hong Kongтs retail sector, the sales and profits of Chow Tai Fook had fell markedly by 10% in 2014 and 51.9% in 2015, respectively. The stock price of Chow Tai Fook began to rebound in 2016. Following the recovery of the jewelry industry in 2017, many securities companies have adjusted its rating. Chow Tai Fookтs stock price increased significantly, although it is still below its IPO price.

The fastest growing luxury stock after IPO in 7 years: Canada Goose

In mid-March 2017, Canada Goose went listed in NYSE and Toronto Stock Exchange with an opening price ofТ 18 US dollars, which was much higher than its IPO offering price of 17 Canadian dollars (about 12.79 US dollars). It was the first successful luxury brand IPO in the past two years in the world. This also verified the recovery trend of the luxury industry and strengthened investorsт confidence for the industry. The company's performance continued to exceed the expectation, and the share price hit the record high at Toronto Stock Exchange currently.

Notes:

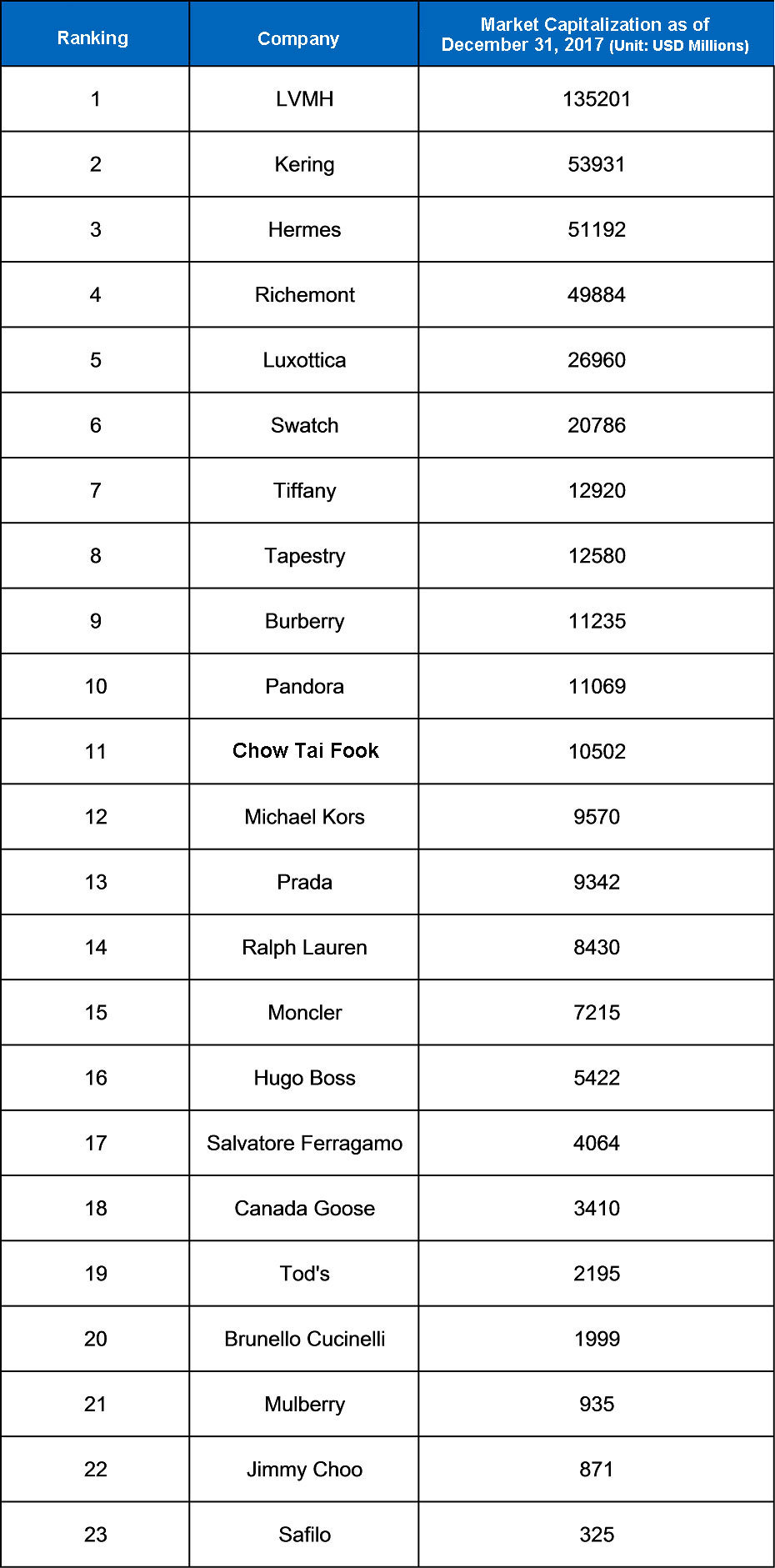

The methodology of Luxe.Co Luxury Industry Stock IndexяМ

Based on 23 of the world's most iconic luxury stocks selected by Luxe.Co, the index adopted a "market-capitalization-weighted" approach, which is to give higher weight to stocks with higher market capitalization, and vice versa. The calculation method is to add up the market capitalization of each stock in the index (prevailing stock priceТ times total number of stocks), then divide by the total market capitalization of the base period, and multiply by the index of the base period. The index of the base period is set to 100 as of January 1, 2016. In order to eliminate the impact of the fluctuations in exchange rates, the exchange rate in the base period was applied consistently.

As of the end of December 2017, there were 23 stocksТ selected into Luxe.Co Luxury Industry Stock Index:

Coach (NYSE: COH) has changed its name to Tapestry.Inc (NYSE: TPR) after acquiring Kate Spade.

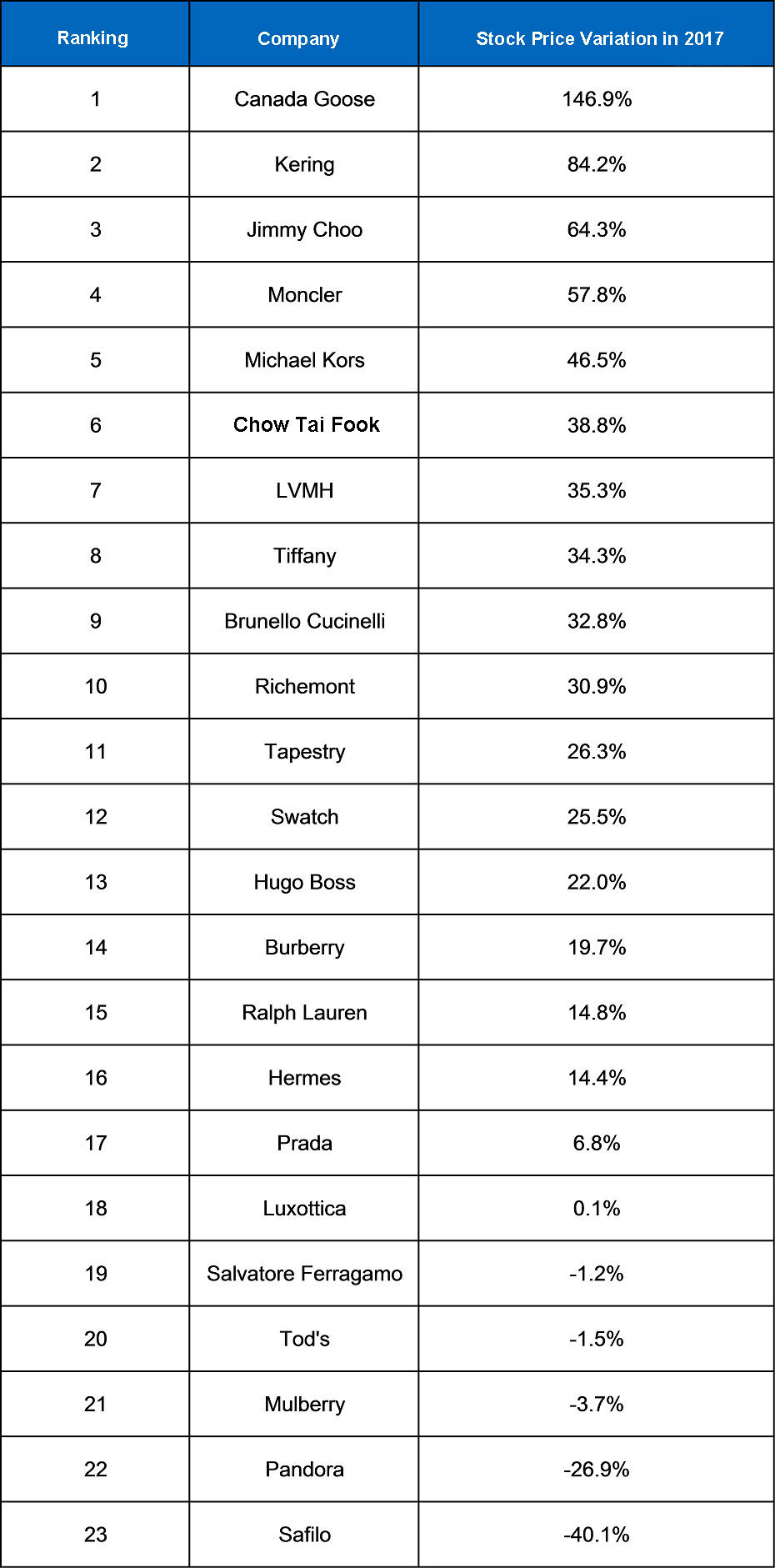

Ranking of Stock Performance in 2017:

Ranking of Market Capitalization by the end of 2017:

Ranking of Market Capitalization by the end of 2017:

Chinese Reporter: Jiaqi Wang

Comments