China Fashion & Lifestyle Investment News: La Chabelle IPO,Menswear online subscriptionяМSecond-hand fashion platform

November 20,2017

Luxe.Co launched тLuxe.Co China Investment Weeklyт in 2016, reporting weekly updates on investment and financing in the China fashion and lifestyle industries. The updates cover fashion, beauty care, food and beverage, sports and fitness, hotel and travel, household products, culture and creativity, and other related fields.

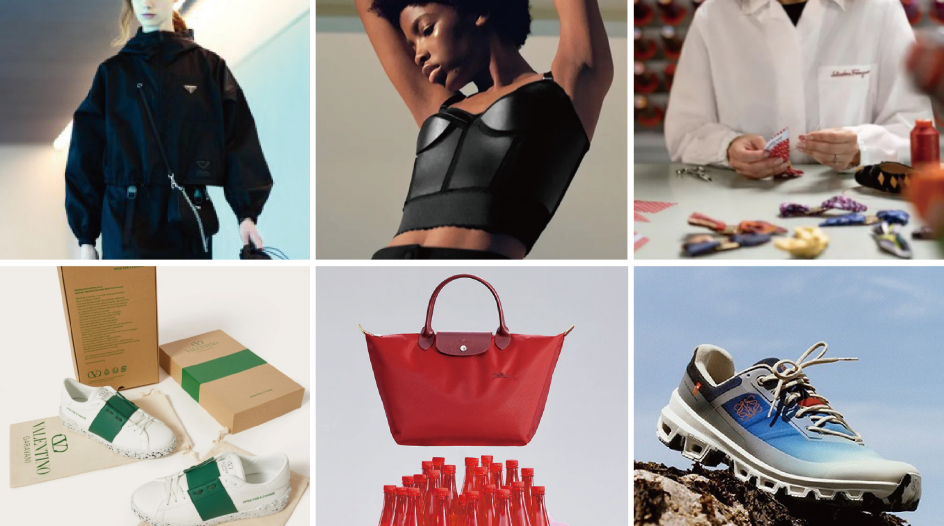

Fashion Brands

Fashion Brands

- La Chabelle (цхЄшДхА) completed IPO at Shanghai Stock Exchange

Shanghai La Chabelle Fashion Co., Ltd was listed on the main board of Shanghai Stock Exchange on September 25th (La Chabelle, 603157). La Chabelle is the first domestic garment company listed in both Hong Kong and Mainland China stock exchange. The company offers 54.77 million A-shares to the public, with the issue price of 8.41 yuan per share. The total amount raised reaches 1.64 billion yuan. La Chabelle was established in May 1998, mainly engaged in the design, marketing and distribution of women's casual wear. The company has multiple brands, including La Chapelle, Puella, Candieтs, 7.Modifier, La BabitУЉ, Vougeek, Pote and so on.

- Hemei Group (шЕЋчОщхЂ) acquired Wenzhou Chonggao Department Store Co., Ltd. (цИЉхЗхДщЋчОшДЇцщх ЌхИ)

Listed in Shenzhen Stock Exchange (002356.SZ), Hemei Groupтs wholly owned subsidiary, Hemei Commercial acquired Wenzhou Chonggao Department Store Co., Ltd. The signing ceremony was held at Hemeiтs headquarter in Shenzhen on September 28th. The chairman of Hemei Group, Lei Wang, and the executive director of Chonggao Department Store, Hongjian Sun, represented the two parties and signed the acquisition. After the completion of the acquisition, Hemei group will integrate its resources in international luxury brand operator channels, optimize its overseas procurement costs, financing costs and domestic distribution operating costs, in order to benefit domestic consumers of luxury brands. Wenzhou Chonggao Department Store Co., Ltd. is a large international luxury brand operator in China, engaged in the authorized apparel retail business of international luxury brands since 1996. It is the agent for multiple high-end brands in Wenzhou, Hangzhou, Wuxi, Changsha, Wuhan, Changchun and other regions, including 60 stores of different brand lines covering Armani stores, Hogan stores, Dolce & Gabbana stores, Boss outlet stores, Armani outlet stores, and other integrated outlet stores.

Fashion Online Platforms

- Menswear subscription online platform Champzee (хшЁЃ)Т obtained 22-million-yuan Series Pre-A investment

Menswear subscription online platform Champzee announced on September 27th that they obtained 22-million-yuan Series Pre-A investment. The investment was led by Yuanjing Capital (х чшЕцЌ) and followed by Tisiwi Venture Capital (хЄЉфНПцЙОхц)Т and Guanghe Venture Capital (х ххц). Previously Champzee obtained millions of yuan angel investment from Tisiwi Venture Capital in May 2017. The new investment will be mainly used on data system optimization, team expansion and supply chain channel improvement. Customers can purchase the membershipТ at 299 yuan, and choose their personal dressing style. Afterwards, the stylists on Champzee will select ten pieces of clothing and send themТ to the customer, according to their preferences, stature data, dressing scenarios and other factors. After the customers receive the clothing, they can try and choose which ones to purchase. The rest will be sent back to the platform free of charge. The platform provides clothing of more than 100 brands currently, in which, one third of them are consignment, and two thirds are purchased by the buyer team. The platform has around 8000 paid members at present.

- Second-hand fashion online platform Plum obtained Series A investment

The second-hand fashion online platform Plum announced on September 28th that they completed Series AТ financing. The investors are IDG Capital, Matrix Partners (чЛчКЌхц)Т and K2VC (щЉхГАщПщ). The specific amount is not disclosed. Plum obtained tens of millions of yuan Series Pre-A investment from VIP.com (хЏхфМ), Unity Venture Capital (фЙххц) and Infinity Ventures in August 2017. Plum went live online in February 2017, with a C2B2C business model, providing second-hand fashion services based on WeChat shopping mall. At present, 90% of the products on the platform are from individual consignment. The platform makes profits from service commission, with the current commission ratio at 25-30%.

Food & Beverage

- Casserole rice brand Zaihuangbao (фЛчч В)Т obtained tens of millions of yuan Series A investment

Casserole rice brand Zaihuangbao announced on September 30th that they obtained tens of millions of yuan Series A investment. The investor is the Hong Kong listed company, Best Food Holdings Co., Ltd. (чОчІцЇшЁ)Т under Hony Capital (хМцЏ цшЕ). Best Food invested previously in Hehegu, Yujianxiaomian, Xishaoye, Sexy Salad, Yuexiaopin, Meinaixiaoguan, Dafulan, Seesaw Coffee and so on. The new investment will be mainly used on brand promotion, team expansion, supply chain optimization and store expansion. Zaihuangbao was established in March 2012, featuring Canton-style casserole rice and clay stewed soup. The company has developed more than 40 types of casserole rice, more than 20 types of clay stewed soup, and more than 20 types of snacks. The company has around 30 direct-managed stores in Beijing.

Sports & Fitness

- Fitness platform IMA Sports (чЎщЉЌшПхЈ)Т obtained millions of yuan angel investment

IMA Sports announced on September 29th that they obtained millions of yuan angel investment by Crystal Stream Capital (цИ цЕшЕцЌ). IMA Sports was established in November 2016, with a business model of mini gym outlets plus small studios. In residential compounds, IMA sports provides container-type gym outlets with 24~40 square meters each, equipped with treadmills and aerobic equipment. Outside the compounds, the platform provides small studios with around 200 square meters each. At present, the platform has distributed eight mini gym outlets and have signed with more than 70 residential compounds. The fitness service is charge at 1 yuan for the first half hour, and 5 yuan for the second half hour and so on. The average number of users per day is around 20 to 30 people.

Household Products

- Household online platform Quanwu Youpin (х ЈхБфМх) obtained 30-million-yuan Series A investment

Household online platform Quanwu Youpin announced on September 27th that they obtained 30-million-yuan Series A investment, led by K2VC (щЉхГАщПщ)Т and followed by Oriental Fortune Capital (фИцЙхЏцЕЗшЗц). Quanwu Youpin obtained tens of millions of yuan Pre-A investment in December 2016. The platform went officially online in March 2016, with a business model of S2B2C. In addition to selling to the customer end, through city partner franchise format, the platform has also built small business ends in 150 cities nationwide. These small business ends are supplementary to the platform, providing offline services including pre-sales, product distribution and after sales services. The platform has signed cooperation with more than 100 brands, with over 10000 SKUs.

The above information is based on the company announcement and/or online news. Luxe.Co makes reasonable efforts to obtain reliable content from third parties. Luxe.Co does not guarantee the accuracy of or endorse the views or opinions given by any third-party content provider.

| Chinese reporter: Jiaqi Wang

| Editor: Claire

Comments